I spent a lot of time talking about e-commerce companies in this blog. Some companies have also used many articles to discuss in deep dive. We have already talked about Amazon (ticker: AMZN), Alibaba (ticker: BABA), and Sea Ltd (ticker: SE), and Shopify (ticker: SHOP). Today I’m going to talk about the last e-commerce company that I personally think has a larger scale, more successful business, and more worthy of study.

For these major e-commerce businesses, I suggest you refer to my blog post below:

- “Shopify, the only rival admitted by the founder of Amazon, how does it make money?“

- “Amazon vs. Alibaba“

- “Sea, the parent company of Shopee, the most valuable company in Southeast Asia“

- “Latin America’s e-commerce dominant MercadoLibre“

In my book “Super Growth Stock Investment Rules”, in subsections 3-6, and 5-1, both parts have spent some time talking about this company. Especially how the company has risen, and the valuation comparison with peers, I suggest you go back and look at it, especially the valuation comparison with Sea Ltd my book of section 5-1.

Company bio and founder

In 1999, Marcos Galperin, who graduated from the Stanford Business School, returned to his home country Argentina and founded it. While at Stanford, Galperin spent most of his time focusing on the emerging e-commerce revolution.

MercadoLibre (ticker: MELI) is a Latin American company that is rarely listed on U.S. stocks market. More specifically, it is a company from Argentina. This is even rarer because Argentina is one of the few failed countries in the world. (The details will be discussed later if there is a chance). It is also currently the largest listed company in Argentina.

In 2001, MercadoLibre acquired a subsidiary of iBazar under the EBay (ticker: EBAY). EBay did not adopt an all-cash transaction, but instead required a 19.5% stake in Galperin’s company. As part of the transaction, EBay agreed to share its experience and promised not to enter Latin America within five years.

In 2003, MercadoLibre launched Mercado Pago and began to get involved in the field of financial technology. However, the challenges posed by the number of unbanked populations in Latin America have prevented it from being used as widely as in the United States. Here, cash and checks dominate; credit cards are a rare thing. In the following years, the MercadoLibre intech sector expanded its business to include credit, point-of-sale systems, and consumer wallets, and other products, whose importance was comparable to that of the original e-commerce platform.

The internet bubble bust in 2000 caused DeRemate, the biggest competitor of the MercadoLibre to collapse, unable to make a comeback, and was finally sold to MercadoLibre in 2005. Since then, the MercadoLibre dominate the e-commerce market in Latin America.

In August 2007, MercadoLibre was listed in the United States, becoming the first Latin American company listed on NASDAQ.

In 2013, Galperin started to strengthen the logistics capabilities of MercadoLibre and launched Mercado Envíos. Although Envíos started as an order tracking solution, it has become the focus of increasing attention of Galperin, attracting a large amount of internal investment. The company also turned to mergers and acquisitions, acquiring Brazilian logistics software company Axado. By 2017, MercadoLibre has been able to provide performance services in Brazil, its largest market.

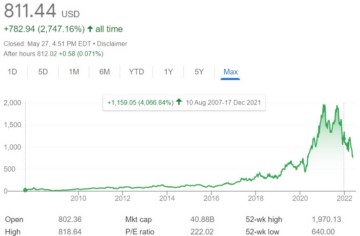

In 2020, e-commerce companies will break through the pandemic. In this fortunate industry, companies in Latin America will have the fastest growth in e-commerce sales in 2020, reaching 36.8%. This growth rate exceeds that of North America (31.8%) and Asia Pacific (26.4%). MercadoLibre’s stock price soared to a staggering $2,000 or more.

Company share price performance

As shown in the above stock price chart from Google Finance, since its listing in August 2007, its stock price has risen 4,066.84%, and most of its gains have occurred in the last three years. As the chart shows, it has gained a whopping 1,149% in the last three years.

Mercadolibre ‘s valuation

All growth stocks entered a bear market in the last quarter of 2021. The stock prices of many growth stocks have almost fallen by half from their all-time high price. The Mercadolibre is a typical example, falling 47% from its all-time high price level. Its investors are bleeding, only better than Alibaba’s investors (up to 12/24/2021):

| Valuation metric | Mercadolibre | Shopify | Sea Ltd | Amazon.com | Alibaba |

| Stock price | 1,262.73 | 1,439.33 | 222.05 | 3,421.37 | 118.66 |

| Market value ($ billion) | 63.72 | 180.74 | 123.15 | 1.74 trillion | 322.54 |

| P/S | 10.09 | 43.05 | 14.96 | 3.76 | 2.48 |

| EPS | 1.59 | 26.82 | -3.59 | 51.14 | 7.1 |

| P/E | 793.45 | 53.66 | N/A | 66.9 | 16.73 |

| Stock price drop from all- time high | -47% | -18.36% | -40.42% | -9.32% | -60.37% |

Company business peformance

| 2020 annual revenue and growth rate | Q3 2021 revenue and growth rate | |

| Service | – | $1,630.914 million (+57.03%) |

| Product | – | $226.538 million (+193.72%) |

| Total revenue | $3.9735 billion (+73%) | $1.86 billion (+61.7%) |

Related articles

- “Shopify, the only rival admitted by the founder of Amazon, how does it make money?“

- “Amazon vs. Alibaba“

- “Sea, the parent company of Shopee, the most valuable company in Southeast Asia“

- “Latin America’s e-commerce dominant MercadoLibre“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.