Norway Sovereign Wealth Fund, or Norwegian Government Pension Fund (aka Government Pension Fund: GPF) is well-known among most people with investment experience. The Norwegian sovereign wealth fund is very important. It is the most important sovereign wealth fund and pension fund in the world. If you want to know what a sovereign wealth fund is, you can refer to the article I post before “Sovereign Wealth Fund (SWF)“.

Another world-famous one is the Nobel Foundation. You can refer to my other article introducing “The investment strategy of the Nobel Foundation“.

It has a lot to worth study. I will write two articles about Norway Sovereign Wealth Fund, this is the first post. The send article will be “What investors can learn from GPF (Norway Sovereign Wealth Fund )“

Introduction to Norway Sovereign Wealth Fund

In 1990, Norway discovered that the income from North Sea oil will gradually decline in profits in the next 10 years. In order to reduce the impact of oil price fluctuations on the economy, the non-renewability of oil, and the pension problem derived from population aging, the establishment of oil fund. It mainly holds stocks of listed companies around the world, as well as bonds and real estate in Europe and the United States, which saves Norway from having to suffer from debt like other countries.

In 2006, the Norwegian Petroleum Fund and the National Insurance Plan Fund were merged and reorganized into a government pension fund, which is now known as the Norwegian Government Pension Fund or Norway Sovereign Wealth Fund (Government Pension Fund: GPF), which is currently the largest national sovereign fund in the world. Because of its outstanding long-term investment performance, it can be said to be a model student for all sovereign funds and pension funds in the world; its portfolio management, principles, strategies, allocation, supervision, and transparency are all worthy of investors to follow.

Key achievements of the Fund so far in 2020

Fund NAV

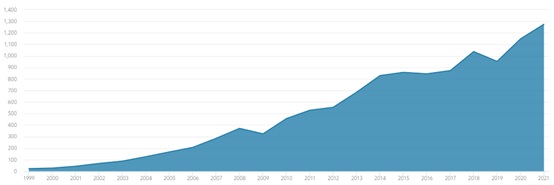

As shown in figure 1 below, from 1999 to the end of 2020, the net value of the Norway Sovereign Wealth Fund is USD 1.275 trillion.

Figure 1: Changes in the net value of Norwegian sovereign funds from 1999 to the end of 2020

Annual rate of return

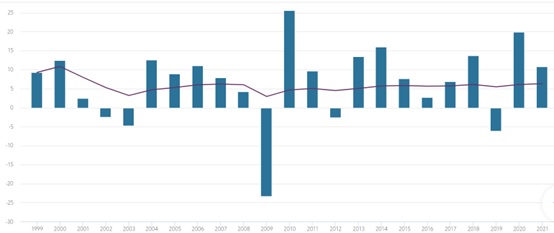

Figure 2: Annual returns of the Norwegian sovereign wealth fund from 1999 to 2020 (in percentages)

Annualized rate of return

From 1998 to the end of 2020, the annualized return of the fund was 6.3%.

Investment areas

The fund mainly invests in three areas. Table 1: The main investment fields and proportions of the fund:

| Fund percentage | Investment area |

| 72.8% | Shares in 9,123 companies in 69 countries |

| 24.7% | 70% invested in government bonds, 30% corporate bonds; includes 1,245 different bonds in 45 countries |

| 2.5% | 867 real estate transactions in 14 developed countries |

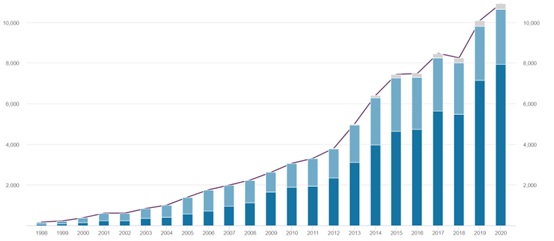

Changes in the investment landscape

The following is the trend chart of investment in the three major areas:

Three types of asset investment

Equity investment

Appropriate adjustments are made to account for the sale of shares to fund investments in real estate based on the equity component of the benchmark index. For 2020, financial, technology, and healthcare equity investment contributed the largest relative returns, while consumer services contributed slightly negatively. As far as investment destination countries are concerned, China, the United States, and the United Kingdom are the top three contributors to the growth in equity investment. The fund’s equity investment accounts for up to 1.4% of all listed companies in the world.

Table 2: This is the list of the fund’s top 12 holdings.

| Company | Country | Net value (in millions of NOK) |

| Apple | US | 185,339 |

| Microsoft | US | 147,893 |

| Amazon | US | 124,334 |

| Alphabet | US | 97,343 |

| Nestlé | Switzerland | 77,028 |

| Meta | US | 67,424 |

| TSMC | Taiwan | 66,089 |

| Roche Holding | Switzerland | 59,125 |

| Samsung Electronics | South Korea | 56,598 |

| Alibaba | China | 55,559 |

| Tencent | China | 49,657 |

| Tesla | US | 45,802 |

Fixed Income Investments

The performance of fixed income management is compared to the bond component of the benchmark index, adjusted for bond sales, and to fund real estate investments.

Table 3: This is the percentage distribution of bonds held by the fund.

| AAA | AA | A | BBB | non-inventment grade bond | Total | |

| Government bond | 29.8% | 6.6% | 12.8% | 3.2% | 0.8% | 53.2% |

| Government-grade bond | 4.4% | 4.6% | 1.5% | 0.4% | 0% | 10.9% |

| Inflation-linked bonds | 4% | 1.2% | 0.3% | 0.4% | 0% | 5.9% |

| Corp bond | 0.2% | 1.7% | 10% | 12.2% | 0.3% | 24.5% |

| Securitized bonds | 4.6% | 0.8% | 0% | 0% | 0% | 5.4% |

| Total | 43.1% | 14.9% | 24.7% | 16.1% | 1.2% | 100% |

Real estate investment

Table 4: Real estate category share of bonds held by the fund.

| Real estate category | Net value (in millions of NOK) |

| Unlisted real estate | 273,109 |

| Listed real estate | 146,677 |

| Total | 419,786 |

I am the author of the original text, the abridged version of this article was originally published in Smart monthly magazine.

Related articles

- “What investors can learn from GPF (Norway Sovereign Wealth Fund )“

- “How great Norway Sovereign Wealth Fund (GPF) is“

- “Sovereign Wealth Fund (SWF)“

- “The investment strategy of the Nobel Foundation“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.