Investment Philosophy, Principles, and Strategy looks similar, however, they play different roles in investment.

Investment Philosophy (the why)

- Definition: Your belief system about how markets work and how value is created.

- Nature: Broad, timeless, and often rooted in personal worldview.

- Example:

- “Markets are not always efficient, so patient investors can exploit mispricing.”

- “Long-term compounding matters more than short-term gains.”

- Role: Provides the foundation and “North Star” that guides every decision.

Investment Principles (the rules)

- Definition: The guidelines or core rules derived from your philosophy.

- Nature: Practical, but still fairly general. They shape behavior and discipline.

- Example:

- “Always maintain a margin of safety.”

- “Do not invest in businesses you don’t understand.”

- “Diversify across industries and geographies.”

- Role: Translate philosophy into rules of conduct that keep you consistent.

Investment Strategy (the how)

- Definition: The action plan you implement using your principles, to pursue returns.

- Nature: Specific, tactical, and adaptable depending on market conditions.

- Example:

- Value investing in small-cap companies with P/E < 15.

- Growth investing in AI-related tech stocks.

- Dollar-cost averaging into the S&P 500.

- Role: The playbook — how you actually invest day to day.

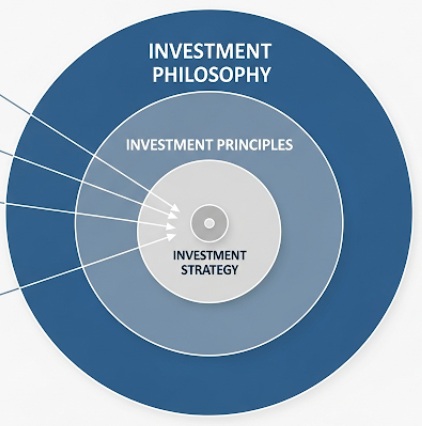

Hierarchy

- Philosophy → the beliefs that shape…

- Principles → the rules that guide…

- Strategy → the actions you take.

Related articles

- “What is investment philosophy?“

- “What should a great investment philosophy include?“

- “What is an investment strategy?“

- “The key points of Andy Lin investment style“

- “Andy Lin’s long-term investment experience sharing“

- “In the crowd, it’s impossible to think independently or keep sane“

- “The crowd tend to lose their judgment and get lost“

- “How difficult to be out of the ordinary“

- “Investing is not voting“

- “In the crowd, it’s impossible to think independently or keep sane“

- “Why is the efficient market hypothesis unreasonable?“

- “Thinking cannot be outsourced“

- “Investors need to think different“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.