In recent years, more and more U.S. listed companies have tended not to pay dividends, which is a topic worthy of study.

Traditional corporate practices

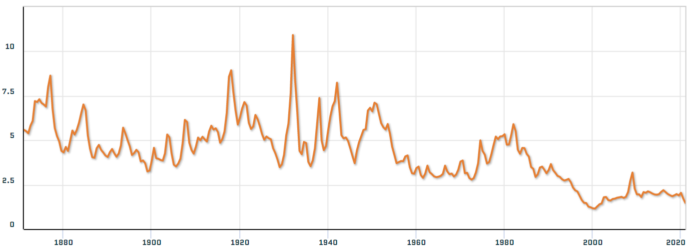

Since 1980, U.S. stock yields have been falling. I think there are two main reasons. First of all, of course, the market interest rate level (including the currency market, US Treasury bonds, and corporate bonds). These are the main reasons. Another reason is the trend of the times, a large number of dual class shares companies listed. Because compared to the pre-2000 years, market expectations and companies will almost always start allocating dividends as long as their earnings begin to stabilize.

S&P 500 dividend yield chart from 1870 to 2021 (Source: Quandl)

Significant impact of Dual Class Shares

Years later, a large number of companies with the same shares and different rights were listed, most of them are technology companies. Through the same shares and different rights (aka Dual Class Shares), the founders and management can almost permanently control the board of directors and voting rights, and resist the interests of any large and small shareholders (dividends is the most direct benefit of minority shareholders). These new generations of companies prefer to keep cash for the company’s use (for mergers and acquisitions, stock repurchases).

The usefulness of these funds is in the name of saving taxes for shareholders, repurchasing stocks, and reinvesting capital. Enterprise managers will also repeatedly brainwash shareholders, claiming that dividends will be taxed repeatedly, but stock repurchases are tax-free (this is true). However, the meaning of dividends received by shareholders is not only measurable by the money received-see my explanation in section 5-6 of my book “The Rules of Super Growth Stocks Investing” for details.

Weapons are not equal

But stock repurchase is not entirely beneficial to minority shareholders, and it is also one of the ways for the management team to profit themselves. The main reason is that the management team receives a large number of low-priced company stock options every year. The management team can legally control the stock repurchase to drive the stock price up, and when it rises to the segment high point they think, it will take profit accordingly. This is a right that small shareholders have no rights at all, and it is simply take advantage of shareholders; but as far as the current law is concerned, it is legal.

Institutional Imperative

But this is only part of the facts. The main reason is that any management class is guilty of what Buffett calls “Institutional imperative“. They like to compare each other and spend a lot of money on inefficient mergers and acquisitions. Just like what Buffet wrote in his 2005 shareholder letter: “But, Mom, all the other kids have one.” Alphabet(ticker:s GOOGL and GOOG) and Facebook (Facebook, ticker: META) are typical representatives.

According to the standards before 2000, the two companies have amazing cash levels, Alphabet have 135.104 billion U.S. dollars as of first quarter of 2021, Facebook has 64.219 billion U.S. dollars, dividends should have been paid long ago. However, with the current shareholding structure of the two companies, small shareholders are powerless to do this.

Please note inefficient mergers and acquisitions are monsters that eat money, depleting dividends that should have been paid to minority shareholders. And most (up to 75%) mergers and acquisitions end up failed, based on history.

Substantial profits from capital gains during the bull market

Disney (ticker: DIS) has been a huge success since the release of Disney+ streaming, which is the main reason why its stock price has been pushed up sharply in the past six months. Its corporate value is mainly intellectual property (IP), and nothing has changed. Its operating conditions (its main sources of cash flow are movies and Disneyland, because the streaming business is still losing money).

Strictly speaking, it has worsened due to the COVID-19 pandemic, this stands to reason that the stock price should go lower like Disney stock price dropped sharply, lead to dividends cut accordingly. However, the success of Disney+ offset the negative impact of the cancellation of the semi-annual dividend in July 2021 on the stock price.

If my judgment is correct, a large part of Disney’s major shareholders in the past would have been washed out as a result and bought other blue-chip stocks that continued to distribute dividends. Compared with the past, these new shareholders will be younger, and they expect capital gains rather than dividends (just like their mentality of buying technology stocks).

This is the market trend in recent years-that is, the retail stock price is determined by the company’s e-commerce level: Walmart (ticker: WMT), Costco (ticker: COST), Target Department Store (ticker: TGT) quarterly reports will announce the eCommerce comparable sale for the quarter, and that’s why.

Not only that, the stock price of the digital media industry is also determined by the company’s degree of streaming; for example, Disney, Comcast (ticker: CMCSA), AT&T (ticker: T), CBS (ticker: VIAC). The stock prices of traditional publishing and newspaper industries are determined by the company’s digitalization level, such as the New York Times (ticker: NYT). The retail and media industries are both very traditional industries. In order to boost stock prices and survive, corporate management must make such changes.

Dividend investors were washed out

After Disney’s management tasted this sweetness (the dividend was cancelled, but the stock price rose through the success of Disney+), it would be interpreted as shareholders like this change, the company’s market value has increased, and the position of the management has become stronger. So I think unless there are active shareholders or heavyweight shareholders (Disney has a well-known heavyweight shareholder, she is the granddaughter of the founder family, Abigail Disney) to give stronger and powerful protests, and is willing to chain shareholders to take action, otherwise Disney’s management will not change accordingly.

Let me cite the most famous example in technology industry. Adobe (ticker: ADBE) went public in 1986 (the same year as Microsoft, there were no listed companies with dual class shares). The company stopped dividend distribution after March 2005. The company’s long-term stock price performance in past was very well, it naturally attracts shareholders who only value capital gains, while investors who expect dividends will naturally not buy Adobe stock.

Related articles

- “Dividend-rich industries and 6 big differences from Taiwan”

- “5 high-yield ETFs in Taiwan, irreversible trends, and how much do Taiwanese like it?“

- “Why dividends disappeared suddenly these years?“

- “Considerations as a dividends investor“

- “Tax, inflation and rate are the top three serious killers to investors“

- “Coca-Cola has been inferior to Pepsi in and even return rate is negative in past 10 years!“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.