Viking is developing VK2735 for weight control and VK2809 for MASH

Category: US Stock Market

How does the resurrected Dell make money?

Dell is involved in almost all device products in the electronics industry, personal computers, servers, data storage devices, network switches, mobile phones, software, enterprise information services, printers and computer peripherals.

FDA approved first ever MASH drug

Madrigal’s Resmetirom was approved by the FDA on March 14, 2024, becoming the first new NASH hepatitis drug to be regulatory approved in history

Supermicro valuation is not justified and unsustanable, no worth for long-term holding at current level

Supermicro has absolutely no autonomy in its business. It is a typical manufacturer that relies on others, that is, it can be choked by others at any time──Intel (ticker: INTC), Nvidia and AMD (ticker:AMD) If the three major chip manufacturers find a manufacturer with higher cooperation and lower assembly prices, they may be in trouble at any time.

How does Applied Materials, lord of semiconductor equipment, make money?

Applied Materials’ main products are wafer manufacturing related products, such as atomic layer deposition, physical vapor deposition, chemical vapor deposition, electroplating, etching, ion implantation, rapid heat treatment, chemical mechanical polishing, metrology and silicon wafer inspection, etc., and include supporting software, Quality inspection services are provided to operating customers, such as various semiconductor manufacturers in wafer fabs and screen factories.

How did three listed companies make money after GE spinoff? What are the prospects?

GE was founded in 1878 by Thomas Alva Edison, who invented the electric light and many other commodities. It is one of the few companies in the U.S. stock market that has been listed for more than a century. It can be said to be the pride of American industry and a symbol of comprehensive national strength.

Four chip companies account for one-third of S&P 500 gains so far this year

As of April 8, 2024, the four chip companies in the United States accounted for a staggering one-third of the increase in the S&P 500 Index.

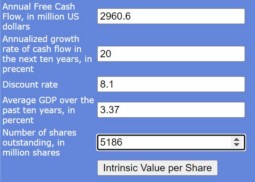

What’s TSMC DCF intrinsic value?How to calculate it quickly with a free tool?

use the discounted cash flow method to estimate, What’s TSMC DCF intrinsic value?

How does database monopoly Oracle make money? What are the prospects?

Missing out on cloud computing has created a serious disconnect between the former second-largest software company and the mainstream software market, which has also affected Oracle’s stock price performance in the past two decades.

How perform well and high growing CrowdStrike makes money?

CrowdStrike’s main competitors Palo Alto Networks and Fortinet have solutions that focus on network security protection in the old era, while Zscaler focuses on Cybersecurity in the cloud.