Those who have read my book “The Rules of Super Growth Stocks Investing” know that one of the main axis of this book is ───Long-term investment (see Chapter 4 in the book for details). After publishing this book, I have the opportunity to receive interviews from TV, newspapers and magazines, radio, self-media, and Youtuber. And I find that every time I accept media interviews, there are no exceptions. Every host will ask me the same question again and again-“Why would I choose long-term investment?”

Why most people are hesitant?

After thinking about it, I guess the reason is (as an investor, if you agree with the following four myths, then it is a big problem):

Disagree from bottom of heart

First of all, most people still have myths about this kind of investment proposition, and they don’t quite agree with it. Because most people’s myth is that the stock market should be a place to make quick money, and I can’t wait that long to make money!

Wrong educatted concept

We are taught since we were young to accept it if we want to see it well, and if we make a profit, we should settle down as early as possible, so as not to have long nights and dreams. There are also many mistakes in financial management or stock market operation that we have been brainwashed, and even the financial education we received in school. Many, many, many (repeated three times are right) are wrong.

In short, we live in an environment that does not encourage long-term investment. Moreover, human behavior is easily influenced by peers. Most of the people are blind when investing. If you want to be different from crowd, just like they must resist the heart of the earth. Gravity is hard.

Hard to see around you

The successful masters of long-term investment (such as Buffett) are just lucky, too far away from us, hard to understand, there is no such example around them, and it is impossible to see and rely on them. Most people have myths and don’t believe them in their hearts.

Humanity

The last and most important humanity; as I said in the last paragraph of the “Postscript” in my book, the success story of persisting in long-term investment is too ordinary. These people are usually unknown, very low-key, and unattractive . The long-term investment method is too boring , unattractive, and most investors will not be interested.

Essential elements of successful investment

Although I have discussed the advantages of long-term investment in sections 1-4, in my book “The Rules of Super Growth Stocks Investing”, I think there is still a need to write a short essay that emphasizes some key points. First of all, if investment is to be successful, it is mainly composed of time, return on investment, and capital invested :

Time

Make good use of the time. Why is time important to investors?

Time is something everyone has, and everyone’s footing is basically equal (no one can refute this, right? Can anyone live 300 years old? If he invests in the stock market, he only needs to buy market ETFs, he will definitely become the richest man in the world). There are only two ways to improve; one is to start investing as early as possible, the other is to live longer than others, but the latter is not controllable, and the first is completely in your own hands.

Time is irreversible, nor can it regenerate precious resources, and will never go back. If you are a young person, then you will have an absolute advantage.

Return rate

Return on investment rate: The common people’s myth is always to pursue a super high return on investment that exceeds expectations. They fantasize about betting on a certain stock market and get rich overnight. People who have such idea are advised to buy lotto directly, the probability might be a bit higher. We can’t expect to have the unrealistic expectation of continuous and eye-catching return on investment every year. This is why there are so many people looking around for the touted stocks.

For this topic, you can refer to my other blog article “Investors who chase for touted stocks“. What investment should pursue is a reasonable and stable long-term annualized rate of return (or internal return rate: IRR), which is the most important: Those who are interested can refer to my other blog article “Investors should pay attention to the annualized rate of return (IRR), How to calculate?“

Fund

Too little capital invested is difficult to get rich. It is not necessary to have a lot of money at the beginning. The point is that investors must invest money in a long-term and continuous manner in order to generate considerable long-term compound interest on assets. It is a pity that most people give up investment because they are young or their salary is too low. Another mainstream myth is that rich people are born with golden spoons. But most rich man in the world was from the beginning? Most of the millionaires are self-made. If you still don’t believe it, I suggest you find time to read the statistics of the book “Millionaire Next Door“.

Time generates compounding interest

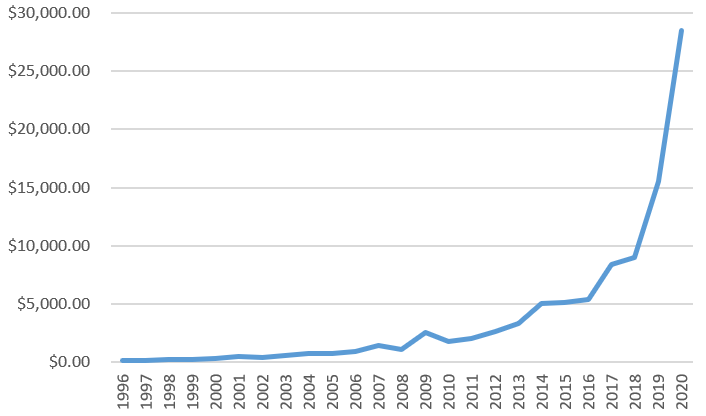

It can be seen that the main obvious advantage of long-term investment is the ability to produce “compound interest generated by time” The power of compound interest over time is powerful. As time goes by, the longer the time, the more obvious the long-term compound interest that can be produced. In terms of the trend chart of wealth accumulation, it will be a typical upward parabola; the longer the time, the greater the steep rise of the parabola (the right side of the figure below).

The benefits of long-term investment

Avoid missing the great companies

Long-term investment should not miss the long-term rewards brought about by the growth of excellent companies: excellent companies will allocate considerable funds from their profits every year, continue to invest in capital, expand the scale of operations, and bring more benefits to shareholders. The investor’s goal is to continue to make excellent companies make money for us for a long time every year, not just make money and run away!

Avoid mistakes

Reduce the chances of making mistakes and regrets: The chance of making mistakes is one of the key factors that determine the success of an investment. Through long-term investment, select stocks strictly and cautiously, and then sell when there is a certainty and the probability of success, reducing the number of buys and sells. This can reduce the probability of investment mistakes (that is, the possibility of losing money), and thus reduce the unnecessarily frequent turnover rate of the investment portfolio.

Frictional cost

Short-term entry and exit is also the main culprit for the long-term return of retail investors lagging behind the broad market. Chasing high and killing low turnover rate is too high, frequent entry and exit will increase friction costs, including handling fees, commissions, taxes, time, effort, etc., and increase the cost of holding. Although most of the online transactions of the United States have zero commissions, there are still many hidden commissions that investors cannot see. In short, investment transactions can never be zero commission; otherwise, the exchange would have all collapsed.

According to a research report by Dalbar, the return on investment of mutual funds is 13.8%, but the actual return on investment of mutual fund investors is only 7%. why? This cannot blame others, but the investors themselves. This is because most investors like to rush to invest in funds when the fund is performing well, but run away to withdraw funds when the fund is performing poorly.

Peter Lynch said “The stock market is a long-term investment. If you need to use the money anytime soon, you should not invest in stocks. This is the money you are willing to put in the market and leave it there for 5, 10, 20, 30 years.

That is the kind of money you can do well with. If you are worried about it, don’t invest it.” also, he stated “Absent a lot of surprises, stocks are relatively predictable over 10-20 years. As to whether they’re going to be higher or lower in two or three years, you might as well flip a coin to decide.” The goal of every investor is to build a portfolio that can generate the highest overall surplus in the next ten years.

In the end, just choosing two or three stocks in your life can make you very rich; you don’t need to hold too many stocks, but the premise is to hold them for a long time, otherwise any stocks will always be what you once (owned).

Keynes said: “I believe now that successful investment depends on (among other things) a steadfast holding of fairly large units through thick and thin, perhaps for several years,” he told a Cambridge University committee in 1938.

Time is a necessary condition for wealth rise

“All investment targets, without exception, will surely rise after a long period of time.” This is common sense that no one needs to ask from a university. Buffett said more clearly, “No matter how great the talent or efforts, some things just take time. You can’t produce a baby in one month by getting nine women pregnant.”

In the end, just choosing the right two or three stocks in your life can make you very rich; you don’t need to hold too many stocks, but the premise is to hold them for a long time, otherwise any stocks will always be what you once owned.

Time can eliminate price volatility

Most investors will always refute that stocks fluctuate from time to time. If you don’t sell while you still make a small profit, you can still make some money. Maybe the holdings will fall, or the stock market will crash. Instead, has it changed from making money to losing money? Yes, if you can’t stand the short-term fluctuations in the stock market and can’t even sleep well, I suggest you hide your money under your bed. Why do most people make more money buying real estate? Unless you are a speculator, few people who buy a house will sell it in a few months or two or three years, especially for self-occupied buyers, usually it will be many years after changing the house, and it is very Few people will lose money. Why? In fact, real estate will still fluctuate, but no one will check the daily market price of their own house every day; but most people will check the price of the stocks they hold every day──this is the biggest difference between holding these two types of assets. This difference is why most people make money by holding self-occupied real estate, but lose money by buying stocks. You may also want to refute that real estate is an asset type that can almost always make money, because the cases around me are like this; but stocks are a speculative asset type, and few people can make money. No, it has nothing to do with the type of assets you hold. The key to success or failure lies in the mentality of the holder, that is, the holding time. Now in reverse, if you buy real estate, it is the same as most people invest in stocks; you check the house price every day with anxiety, and get out as soon as you see the house price fluctuating sharply. I can safely say that your mentality of buying and selling real estate is the same as investing in stocks. In most cases, it is impossible to make money. Why? Because (whether it is stocks or real estate) the holding period is extended, such as at least ten years, preferably more than twenty years. Short-term uncertainties can be eliminated. That is to say, the holding time is prolonged, stocks and real estate are the same, except for a few extreme cases, the factor of market price fluctuations can be eliminated. And if you’re patient and hold on long enough, almost as much as your stocks, like your real estate, will appreciate in value.

Closing words

Guo Guangchang, the founder of Fosun Group, once said: “Everyone can do something that can be successful in one month; fewer people can do something that can be successful in one year; even fewer people are willing to do something that can take five years to succeed; if it can take ten years to do something successfully, basically no one will compete with you.”

Related articles

- “Stocks are the best bet for long-term investors“

- “People who are good at deferred gratification is more likely to succeed“

- “Why is portfolio rebalancing unreasonable“

- “Why concentrated Investment?“

- “Why long-term investment is better?“

- “Is Buffett no longer hold for long haul? TSMC, HP, and US Bancorp cases study“

- “Investors should pay attention to the annualized rate of return (IRR), How to calculate?“

- “Possibility of long-term holdings, Deep dive on Buffett’s case“

- “The Compound Effect“

- “The power of compound interest“

- “Simple and compound interest calculator“

- “IRR Calculator“

- “The great enviable advantages of young people investing in stock“

- “Time, discipline and patience are the three elements of successful investment“

- “Patience, an indispensable element of investment success“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.