Introducing Disney

Company Profile

Disney created The Disney Company by connecting a group of cartoon characters to Hollywood. While cartoons are still the main product, Disney is now a diversified entertainment company with a wide range of content, big enough to buy Capital Cities, the owner of the ABC Network, to provide the broadcast pipeline for that content. Buffett played an important financing role in the original Capital Cities acquisition of ABC and was behind the sale of Capital Cities to Disney; In any case, Disney, Capital Cities, and ABC are all companies Buffett has invested in before in the 1960s and 1970s. Disney and Coca-Cola, McDonald’s, and Starbucks are all symbols of American culture.

Note: Buffett took an 8.6% stake in Disney shortly after Disney acquired Capital Cities and ABC, but did not hold it long-term. For more details, please see my other blog post “Mistakes of omission and mistakes of commission“

Disney in my book

In my book “The Rules of Super Growth Stocks Investing“:

- Sections 2-3, pages 111-113

Streaming video

Business update

The streaming video business is now the focus of all investors on this company, and here is a list of its performance.

| Q1, 2022 | Disney | Netflix |

| Subscribers (million) | 137.7 | 221.64 |

| Market share | 4.6% | 6.4% |

Competitors

Disney has a large business scope, and of course there are many competitors. The larger ones include Paramount Global (ticker: PARA), Comcast (ticker: CMCSA), Sony Group (ticker: SONY) ), AT&T (ticker: T), Netflix (ticker: NFLX), Apple (ticker: AAPL), and Amazon (ticker: AMZN).

Business performance and stock valuation

Business performance

| 2021 | Disney | Netflix |

| Annual revenue and growth ($ million) | 67,418 +3.1% | 29,697.8 +18.8% |

| Gross income and growth ($ million) | 22,287 +3.62% | 12,365.2 +27.22% |

| Operating income and growth ($ million) | 3,492 -7.64% | 6,194.5 +35.09% |

| Net income and growth ($ million) | 1,995 +169.66% | 5,116.2 +85.28% |

| Gross margin | 33.06% | 41.64% |

| Operating margin | 5.18% | 20.86% |

| Net margin | 2.96% | 17.23% |

Stock valuation

| 6/9/2022 | Disney | Netflix |

| Market capitalization ($ billion) | 188.159 | 85.643 |

| Share price | 103.3 | 192.77 |

| P/E | 71.24 | 17.5 |

| Dividend yield | 0% | 0% |

| Past 5 years stock performance (S&P 500 was+65.13%) | -2.09% | +26.51% |

Details of Disney’s business units

New divisional approach

Starting in the first quarter of fiscal 2021, Disney reorganized the company’s business units. The company now operates in two main business segments as follows:

- Disney Media and Entertainment Distribution (DMED): The first segment consists of Disney’s media and entertainment business, which can be further divided into three segments:

- Linear network

- direct-to-consumer

- Content sales/licensing and others

- Disney Parks, Experiences, and Products (DPEP): Mainly includes Disney’s parks, experiences, and products.

Operational performance of each department

Financial performance for the first quarter of fiscal 2022 (ended January 1, 2022) is:

- Net profit was US$1.2 billion, an annual increase of 64 times.

- Revenue was $21.8 billion, an annual increase of 34.3%.

- Operating profit was US$3.3 billion, an annual increase of 144.6%.

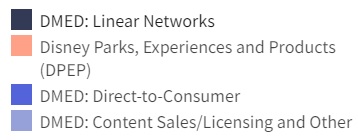

The graph below is a legend representation of the graphs and colors by sector for the first quarter of fiscal 2022 (ending January 1, 2022).

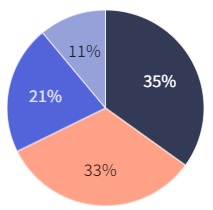

The first big pie chart is the revenue share of each segment in the first quarter of fiscal 2022.

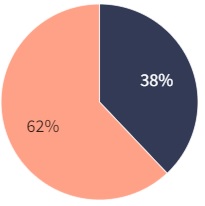

The second large pie chart is the percentage of operating profit by segment for the first quarter of fiscal 2022 (ending January 1, 2022).

Disney Media and Entertainment Distribution (DMED)

DMED: Linear Network

Disney’s Linear Networks segment operates a long list of assets, including cable networks such as Disney, ESPN and National Geographic; the ABC broadcast network and eight domestic TV stations; and a 50% equity investment in the A+E television network, and others.

The Linear Networks segment’s revenue of $7.7 billion in the first quarter of fiscal 2022 was only marginally higher than the year-ago quarter. Operating income fell 13.3% year over year to $1.5 billion. This segment accounts for approximately 35% of total revenue and 38% of total operating income.

DMED: Direct to Consumer

Disney’s direct-to-consumer (DTC) segment consists of its various streaming services, including Disney+, Disney+ Hotstar, ESPN+, Hulu, Star+.

The DTC segment reported revenue of $4.7 billion in the first quarter of fiscal 2022, up 33.8% from the three-month period in the same period last year. The segment reported an operating loss of $593 million, up from an operating loss of $466 million reported a year earlier. The DTC segment accounted for 21% of total revenue.

DMED: Content Sales/Licensing and Others

Disney’s Content Sales/Licensing and Other segment sells movie and TV content to third-party TV and subscription video-on-demand (VOD) services. The segment also includes the following businesses: distribution in movie theaters; home entertainment distribution, such as DVD and Blu-ray; music distribution; hosting and licensing of live entertainment on Broadway and around the world; post-production services through Industrial Light & Magic and Skywalker Sound; and 30% ownership interest in Tata Sky Ltd. in India.

The Content Sales/Licensing and Other segment generated revenue of $2.4 billion in the first quarter of fiscal 2022, an increase of 42.9% over the same period last year. The segment reported an operating loss of $98 million, a marked deterioration from operating income of $188 million a year earlier. Content sales/licensing and other segments accounted for 11% of total revenue.

Disney Parks, Experiences and Products (DPEP)

Disney’s Parks, Experiences and Products segment consists of theme parks and resorts in Florida, California, Hawaii, Paris, Hong Kong and Shanghai. It also includes cruise ships and vacation clubs. Revenue is primarily derived from the sale of theme park tickets, food, beverages, various merchandise, resorts and vacation accommodations, and royalties from licensed intellectual property.

The Parks, Experiences and Products segment reported revenue of $7.2 billion in the first quarter of fiscal 2022, an increase of 101.6% over the same period last year. The segment reported an operating profit of $2.5 billion, a marked improvement from an operating loss of $119 million in the first quarter of fiscal 2021. The segment accounts for about 33% of Disney’s total revenue and about 62% of total operating income.

The Pros of Investing in Disney

Intellectual property rights

I take Disney as an example in Sections 2-3 of my book “The Rules of Super Growth Stocks Investing” to illustrate the importance of intellectual property, the so-called intellectual property rights, to a business. Disney is one of the few listed companies in the world, almost all of which make money from the invisible intellectual property rights owned by the company.

I personally think that’s where Disney’s greatest value lies, and why it’s so overvalued, because investors give it a premium. Americans nicknamed the Disney Company as the house of Mickey Mouse because the company was originally developed from the cartoon Mickey Mouse.

Brand Value

Disney (ticker: DIS), Coca-Cola (ticker: KO), McDonald’s (tickere: MCD), Starbucks (ticker: SBUX) are all symbols representing American culture.

Diverse business

In the previous section on Disney’s business department, I described in great detail the scope of Disney’s current business. If most people study this company for the first time, they will have an unbelievable look at the diversity of its business. If you plan to invest in this company, I suggest that you must understand all of them. The best manual is of course the latest annual report of Disney.

Also, please refer to my previous article, “The significant valuation impact of diversity to listed companies“. Business Diversity is very important for large listed companies. It is not only related to the sustainable development of the company, but also affects the stock market valuation of the company.

Related articles

- “How does Netflix make money? what’s great about“

- “How does Disney make money? How is the future?“

- “Disney is currently facing its biggest crisis since its inception“

- “Disney’s ESPN enters sports betting, and US listed gambling companies“

- “Why Amazon acquired MGM?“

- “Warner Bros. Discovery, a new media giant“

- “The global streaming video throne is replaced“

- “Decisive factor for AT&T and Verizon stocks valuation“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.