In my book “The Rules of Super Growth Stocks Investing”, of section 2-4, I once listed a statistical table showing the amazing profit margin rate of TSMC (ticker: TSM), which later aroused many readers’ response. Due to the length of the book, there is not much discussion of the reasons in the book. This article intends to conduct some in-depth discussions on this topic.

When reading this article, readers can refer to the discussion on section 2-4 of my book “The Rules of Super Growth Stocks Investing”, because some of the contents of the book will not be repeated here.

TSMC discussion in my books

I have discussed the company Nvidia (ticker:NVDA) in two recent books; including:

In my book “The Rules of Super Growth Stocks Investing“:

- Sections 2-4, the entire section is dedicated to introducing the company TSMC

- Section 3-3, analyze the business development of technology companies to grasp the pulse of key industries

In my book “The Rules of 10 Baggers“:

- Section 3-2, the entire section is dedicated to introducing TSMC and the global semiconductor supply chain.

Infinite support of Taiwan

TSMC has almost obtained unconditional support from all aspects of Taiwan and the whole country; all difficulties and obstacles will automatically give way to TSMC. This is an indisputable fact. There are many reasons, but the main reason is that for more than two decades, Taiwan has not been able to produce industries that are more globally competitive than foundry and are absolutely conducive to GDP. I personally think this is the main reason. Among the more important ones are:

Government

Regardless of whether the central or local government encounters TSMC, it is as if they have been given a sword, and any obstacles will automatically give way. This gives TSMC an advantage that no one can match.

Regulations

Almost all of Taiwan’s current industrial policies are tilted towards the electronics industry where TSMC is located. Even if the regulations do not allow it, it will expand the interpretation or modify the law to meet TSMC’s needs.

The South Korean media JoongAng Ilbo reported on June 19, 2022 that the bureaucracy of the South Korean government has slowed down the construction of semiconductor factories. A professor Park Jea-Gun at Hanyang University pointed out that it only takes two to two and a half years for companies to build a chip factory in the United States and Taiwan, but it takes six to seven years in South Korea.

In February 2024, the Korean media “Donga Ilbo” pointed out that TSMC’s Kumamoto Factory 1 announced construction drawings in October 2021 and broke ground in April 2022. The entire process took only two years and four months. Considering that trial production started at the end of last year, the actual construction to completion only took 20 months, which is considered very fast for Japan, which is slow and has strict regulations. “Dong-A Ilbo” believes that South Korea Semiconductor built a semiconductor factory in just six months 41 years ago, and now it will take eight years at the fastest in South Korea.

For example, Donga Ilbo stated, SK Hynix’s SK Hynix semiconductor industry cluster in Yongin has not yet started construction since it was selected in February 2019. The project was originally supposed to start in 2022, but construction progress has been repeatedly delayed due to obstacles such as opposition from local residents, land compensation issues and water supply permits. Even if construction starts next year and operations begin in 2027, it will still take eight years. Samsung’s Pyeongtaek plant also lost five years due to the transmission tower dispute.

Human resources

As the salaries of other local companies, most of them are not at the same level as TSMC. The gap is so great that almost all Taiwanese engineering graduates take TSMC as their first consideration for their careers, because they have no better choice. It also makes it easy for TSMC to use the perspective of “company picking people” and almost monopolize the selection of most of the talents of science and engineering background who graduate from schools in Taiwan every year.

Taiwanese

The masses are short-sighted and blind, and the human nature of relying on the big watermelon. Seeing the great raising of TSMC in recent years, they are all annoyed that TSMC is the only one to follow, as if there are no other companies in Taiwan (I think Taiwan still has other good companies, and the package is not bad). I saw in the newspaper a while ago that a young Taiwanese girl bring a boy who had long planned to get married and worked in the Hsinchu Science Park home to see their parents.

At first, the girl’s parents were warmly entertained, but during the conversation, they discovered that the future son-in-law was not working for TSMC. They immediately showed an unhappy and indifferent expression. On the spot, the girl didn’t know what to do. Afterwards, the girl’s parents forced the girl to break up with the boy. ───The reason is to find a man who works at TSMC. A boy who does not work at TSMC has no future. What I want to say is, will it be like this ten years ago?

Tax and subsidy

The Korea Times quoted data from the Korea Economic Research Institute that South Korea’s corporate tax cap is 25%, while Taiwan’s is only 20% (The Yin Xiyue government pushed for a new bill to reduce the top corporate tax rate from 25% to 22%, still higher than TSMC). TSMC enjoys tax incentives of up to 15% and state subsidies for 40% of packaging costs.

The Korea Times’s report pointed out that in terms of labor costs, the average annual salary of TSMC employees is 95 million won (about 2.4 million Taiwan dollars), which is lower than Samsung’s 144 million won (about 3.6 million Taiwan dollars). In addition, there are about 10,000 people in Taiwan receiving advanced chip manufacturing training, while only about 1,400 people in South Korea. The Taiwan government also bears the training and education costs for semiconductor manufacturing professionals.

Since its inception, TSMC has enjoyed various subsidies and tax credits from the Taiwanese government. Due to the long-term disproportion between taxation and its profits, this move has also caused considerable controversy in Taiwan. Moreover, in January, 2023, Taiwan passes its Chips Act, offers 25% tax credits to chipmakers, TSMC is the biggest beneficiary.

Taiwan government once held nearly half of the shares

The Taiwan government’s official National Development Fund was also TSMC’s largest shareholder. In the early days, TSMC’s shareholding was as high as 48.3% when TSMC was in need of money, but it has dropped to 6.3% in 2020.

Geo drivers TSMC profit margin

Intel CEO Pat Gelsinger said: “building a new fab in Asia is 30% cheaper than in US and 50% cheaper in China than in US.” This also explains why 75%-80% of semiconductor factories are in Asia, less than 20% in the United States, and almost negligible in Europe. Therefore, the United States now regards this issue as a national security issue of the United States, forcing TSMC and Samsung (ticker: SSNLF) to set up factories in the United States, and it also restricts semiconductor factories with advanced manufacturing processes.

Unltra-low energy rate

TSMC’s electricity consumption accounts for 5% of Taiwan’s electricity consumption. In 2019, the electricity consumption was 14.327 billion kWh, an annual increase of 17.9%, equivalent to 91% of Taipei City’s annual electricity consumption, and the average annual growth rate in the past five years. 12.5%. This is mainly because the EUV energy conversion efficiency is only 0.02%, and the annual power consumption of the 3nm factory is 7 billion kWh.

In 2022, Bloomberg Businessweek reported that the share of electricity consumption in Taiwan rose to 6% in 2020, and is expected to reach 12.5% in 2025. Bloomberg stated in February 2024 that if electricity prices rise to the same level as South Korea in 2025, it may cause the operating profits of most chip manufacturers to fall by 8% to 18% from the current consensus level.

ASML’s (ticker: ASML) most advanced extreme ultraviolet lithography equipment is estimated to consume about 1 million watts of power each (depending on the model), and the power consumption is more than 10 times that of previous generations of equipment. But it is the only choice for the most advanced manufacturing processes. TSMC currently has more than 80 EUV units.

The point is that Taiwan is a world-renowned low-rate energy country. The government’s energy policy for decades has been to use the government’s budget to subsidize energy and absorb the increasing cost to ensure that Taiwan’s energy rates (including oil, electricity, and water) must be lowest among all Asia Pacific countries; this is a big plus for TSMC, which belongs to the ultra-high energy-intensive industry.

According to Taiwan’s Ministry of Economic Affairs, Taiwan’s industrial electricity rates are the sixth-lowest in the world, and residential electricity rates are the fourth-lowest in the world.

TSMC’s water consumption in 2019 is equivalent to the capacity of 79,000 Olympic swimming pools. The average annual rainfall in Taiwan is 2,515 mm, which is three times the average rainfall in the world. Coupled with the long-term low water bills, few Taiwanese want to save water. But for the past ten years, Taiwan has been running out of water. For the past two decades, our water policy has always been to subsidize farmers for fallow crops, and agricultural water has been forced to be used by industry.

I mentioned in the articles “Beyond your imagination of Israel’s strong venture capital and tech strength” and “Israel stock market and tech giants” that Israel’s national water-saving recycling rate is over 90%. However, the recycling rate of industrial water in Taiwan has also been too cheap for a long time. It was not until recent years that there was a shortage of water, and investment in recycling and water saving began to be made, but it is currently very, very low.

TSMC has a total of nearly 300 water trucks of its partners on standby to deal with the crisis of water shortage. In 2021, in response to the drought, it was reported that TSMC spent NT$200 million to book more than 100 water trucks. In order to cope with future droughts, TSMC will spend 2.8 billion in 2021 to save water and make zero interruptions in production. Because of the shortage of water to buy water, according to TSMC’s own estimates, it will affect 0.7-1.1% of its revenue.

Labor cost

The local personnel cost in the United States is 50% to more than two times higher than that in Taiwan (see below survey data), and the American has low productivity, poor obedience, many different opinions, high turnover rate, and the best related talents will go to Silicon Valley, will not come to TSMC wafer factory, these are labor costs.

TSMC’s high pressure and long working hours have a turnover rate of only 1/3 of that of the industry peers in Taiwan. In the past ten years, the turnover rate of employees has been below 5%; but these are all data in Taiwan. In the United States, these data are useless. Engineers have very few choices in Taiwan, but there are more in the United States. TSMC founder Morris Chang said that TSMC’s 25-year experience in setting up a factory in Oregon, USA can be proved: “We were too naive at the time. In terms of cost, the cost of manufacturing chips in the United States is 50% more expensive than that in Taiwan.”

New engineers who graduate from top Taiwanese schools can expect to earn a starting salary of about NT$2 million (about US$67,000), according to Taiwan’s local human resources agency. But in the US, $67,000 is incredibly low for an American engineer.

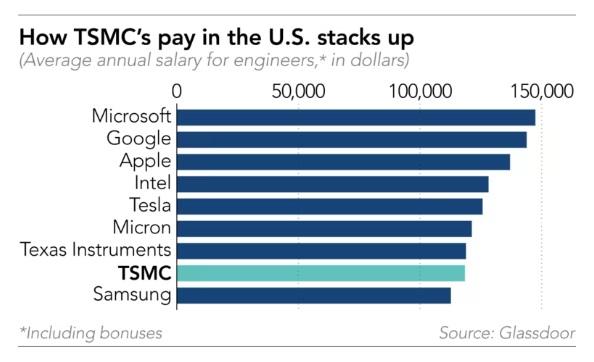

The following is the salary data of Glassdoor showing the annual salary of local workers in the United States, in US dollars. The average annual salary of engineers TSMC has hired in the United States is about $118,000. Intel engineers earned an even higher average of more than $128,000. Data will speak:

Other visible hard resource costs

Resource costs include electricity, water, land, plant, etc. Taiwan’s electricity power, and water costs have long been the lowest among Asian rival countries. If it is not in the densely populated states on the east and west coasts such as California or New York, the states in the Midwest, the land acquisition cost is considered low.

How much can TSMC save?

Wall Street’s estimation

General Wall Street semiconductor industry analysts estimate that the manufacturing cost of Intel’s (ticker: INTC) US plant is more than twice that of TSMC, mainly because the US does not have a semiconductor downstream ecosystem including packaging, testing, PCB module, and assembly industry chain. It also lacks the efficiency required for wafer substituting manufacturing.

Nikkan’s estimation

The Japanese media Nikkan has estimated that the Arizona factory of TSMC seems to be very difficult, and the “construction cost” alone is 6 times higher than that in Taiwan. Intel Chief Executive Pat Gelsinger mentioned that “compared to the United States, the cost of building a factory in Asia is 30% less, and if you build a factory in China, it will be 50% less. The cost gap between factories will reach hundreds of millions of dollars. Therefore, if American manufacturers want to gain an advantage, they will need as little as 30% to 50% of economic subsidies.

Industry experts’ estimation

A report published by Bowden Consulting (BCG) and the American Semiconductor Industry Association (SIA) in April 2021 pointed out that the total cost of owning a fab in the United States is 25% to 50% higher than in Asia.

Competitor’s estimation

Intel’s vice president of global regulatory affairs, Greg Slater, also stated that the cost of manufacturing chips in Europe will also be 30%-40% higher than in Asia. Therefore, market analysts stated that even if governments of various countries promise to provide subsidies to TSMC and other chip manufacturers, they may not be able to fill the gap of up to 40%.

Nationality

Chinese are hard-working, cheap and obedient

The Chinese are talented, obedient, smart, and diligent. They are among the best in the world. This is nationality and gift and cannot be quickly cultivated. All these make TSMC have unparalleled corporate production efficiency. Apple’s chief executive, Tim Cook, said the same thing when lamenting that Western countries cannot escape China’s supply chain. Musk also said that “Chinese workers don’t just stay up late, they work overtime until 3 a.m. and don’t even leave the factory, whereas in America, people are always trying to avoid going to work.”

Everyone, just think about why Taiwan’s ODMs companies have moved their factories to India and Southeast Asia for many years, but they still can’t get rid of mainland China. The reason is not that the governments of various countries put pressure on them to resist China and spend money to build. The factory can do it. Western countries also want to get rid of their dependence on China, but in reality it is impossible to do so. We will find time to talk about this subject when we have the opportunity.

American don’t want to work overtime

I also mentioned in the book that you need a white American with a high degree of education to work overtime for you for a long time, and you have to be on standby at any time after get off work. If you have an urgent problem, you need to get up in the middle of the night and immediately return to the factory for repair. This is impossible.

But in Taiwan, many highly educated employees take it for granted to sell livers for the company. Not only do they have no overtime pay, they may receive less than half of the salary of white Americans, and they have been doing it for decades. None of these phenomena can happen in the United States.

There are no unions in Taiwan

And don’t forget that the power and ability of American labor unions are not something we Asians can understand and imagine. Many people have been stuck on the notion that unions are organizations of American blue-collar workers. But the times have changed a long time ago.

Just look at how the unions of the Alphabet (ticker:s GOOGL and GOOG) and Microsoft (ticker: MSFT) in recent years are so powerful that they affect the company’s decision-making, and even force the company to give up the tens of billions deal company has acquired. All the way down to Starbucks (SBUX: SBUX), Amazon (AMZN: AMZN), and even Apple (AAPL: AAPL) recently. To a business person, you will shudder at the unions in the United States.

In his early days of mergers and acquisitions, Buffett had experienced many times the intangible and powerful negative influence of labor unions on business operations. The most famous one was in January 1977, when Buffett invested 32 million US dollars to acquire the Buffalo Evening News. Interested investors can refer to the description in Buffett’s biography.

What about in Taiwan? Except for Formosa Plastics Group because of founder But what about in Taiwan? Except for Formosa Plastics Group because of founder Wang Yongqing “specially ratify”, non-public or non-state-owned large-scale listed companies in Taiwan rarely have strong labor unions. In my impression, only EVA Air in recent years, I mean strong and influential in normal times The union of the company’s decision-making (not the kind that only speaks out when the company goes out of business).

Many people will say that our company has an employee welfare committee that asks me to deduct money every month. Is that a union? That should be regarded as a cheerleader for the company and the capital!

Company culture

TSMC is known for long hours, strict management, and an emphasis on discipline and hierarchy, according to Nikkei interviews with suppliers, current and former employees, and an analysis of comments on recruitment platforms.

Many TSMC employees have experienced this: at any time (even holidays) they may be called to work with unexpected problems, such as earthquakes, power outages, or any other production interruption. “You can get an emergency call at any time…if there is a major accident, you have to go back to the factory right away,” said one employee. “Most employees and suppliers don’t think it’s easy to replicate this working model in the U.S.”

Technology without competitors

Monopoly advanced process

Like my previous blog posts “Comparison of TSMC, Samsung, Intel’s Yield and Advanced Process“, “6 common wrong semiconductor investment myths” and “Comparison of TSMC, Intel, and Samsung’s new process roadmaps for future chips” explained, the foundry price of an advanced process is much higher than that of a mature process; that is, the profit is higher, which is very easy to understand. And TSMC almost covers most of the advanced process orders, of course, it makes more money than others.

Incredible yield rate

In addition to monopolizing the advanced process, what is even more rare is that the yield rate of TSMC’s advanced process is very close to the mature process. Yield equals margin rate! Take a look at Samsung’s yield in my post “Comparison of TSMC, Samsung, Intel’s Yield and Advanced Process“, you should understand.

Related articles

- “Mong-Song Liang, the hero of SMIC’s breakthrough in US blockade“

- “What’s TSMC DCF intrinsic value?How to calculate it quickly with a free tool?“

- “TSMC negative corp culture and management style are detrimental to its future and growth“

- “Four chip companies account for one-third of S&P 500 gains so far this year

- “Top five lucrative artificial lucrative intelligence listed companies“

- “What’s TSMC DCF intrinsic value?How to calculate it quickly with a free tool?“

- “How many fabs and houses does TSMC have currently and in the future?“

- “Comparison of TSMC, Samsung, Intel’s Yield and Advanced Process“

- “The TSMC cost, sell price, and R&D cost of chip foundry“

- “ASML, who dominate TSMC’s fate“

- “Comparison of TSMC, Intel, and Samsung’s new process roadmaps for future chips“

- “Two long-term threats to TSMC: US and SMIC“

- “Why is TSMC’s profit margin much greater than competitors?“

- “How does TSMC make money?“

- “Zyvex and sub-nanometer semiconductor processes, will Zyvex threat TSMC?“

- “TSMC gets emerging and serious challenges“

- “How does nVidia make money, Nvidia is changing the gaming rules“

- “The reasons for Nvidia’s monopoly and the challenges it faces“

- “Why nVidia failed to acquire ARM?“

- “Revisiting Nvidia: The Absolute Leader in Artificial Intelligence, Data Center, and Graphics“

- “How does Intel make money? and the benefits to invest in it“

- “Intel’s current difficult dilemma“

- “How does Texas Instruments make money? Amazing long term capital reward and company net profit margin!“

- “How AMD makes money? A rare case of turning defeat into victory“

- “Why is AMD’s performance so jaw-dropping?“

- “Qualcomm diversifies success, no nonger highly dependend on phone“

- “How does the ubiquitous Arm make money?“

- “Significant changes in Broadcom’s business approach“

- “Data center, a rapidly growing semiconductor field“

- “How does Applied Materials, lord of semiconductor equipment, make money?“

- “The lucrative semiconductor supply chain“

- “Global semiconductor chip market in detail, big dominators and markets“

- “6 common wrong semiconductor investment myths“

- “Gen 3 semiconductor“

- “Three EDA oligopoly vendors: Synopsys, Cadence, and Mentor Graphics“

- “How does, the EDA oligopoly, Cadence make money?“

- “How does Synopsis, the EDA oligopoly, make money?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.