3 major credit rating companies in corp and consumer sectors

As I introduced in section 2-2 of the book “The Rules of Super Growth Stocks Investing”, the well-known S&P Global (ticker: SPGI), Moody’s (ticker: MCO), and Fitch (unlisted) are well-known in the corporate world and the capital market. In addition to the three major corporate credit rating companies, in the field of consumers, there are also three major consumer credit rating companies in the United States. Their main business is to compare personal credit ratings, and their status is similar to Joint Credit Information Center in Taiwan, Baihang Credit and Zhima Credit under Ant Group.

Their business scope

Equifax, Experian, and Trans Union, these three are all publicly listed companies in the United States. Their main business is to provide consumer’s personal credit score and the consumer’s detailed past consumption, borrowing, and credit history. It is conceivable that all financial lending, insurance companies, and credit card issuing companies need the information they provide to filter their customers and reduce losses rate; even general companies will use it as a reference for whether to hire a new employees. Equifax and Experian not only operate consumer credit ratings, but also get involved in corporate credit ratings, providing services similar to Dun & Bradstreet (ticker: DNB).

The three major consumer credit rating companies are:

- Equifax (ticker: EFX)

- Experian (ticker: EXPN, and EXPGY)

- TransUnion (ticker: TRU)

Stock price performance

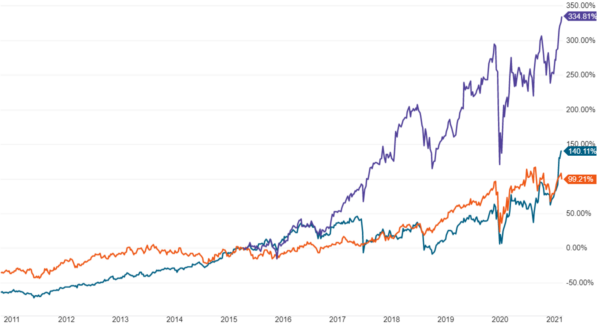

The three curves in the figure below are the stock price charts of EFX, EXPGY, and TRU from top to bottom (from 2011 to May 2021)

Corp credit rate companies are better

Corp credit rate companies are better than personal credit rating companies, because the former has a wider moat and there is currently no possibility of a breakthrough; the latter is slightly worse, because the competition is too fierce, and there are already many potential replacement companies that want to share. This once again confirms the view I hold in section 3-2 of my book “The Rules of Super Growth Stocks Investing”; companies that operate enterprise-type products are better than consumer-type companies.

Current competitor

The most important of these potential competitors in personal credit ratings is Fair Isaac (ticker: FICO). (For Fair Isaac introduction, please see my blog article “Fair Isaac, one of the most important listed companies in the US consumer finance industry“) Fair Isaac mainly uses its own unique algorithm to calculate consumer credit scores. The market for score providers has surpassed the traditional three personal credit rating companies.

However, the three traditional personal credit review companies can also provide consumers with detailed past consumption, borrowing, and credit history records. This is also a major advantage of the three traditional personal credit review companies over Fair Isaac. In order to compete with Fair Isaac, Equifax, Experian, and TransUnion jointly established a company called VantageScore Solutions to provide personal credit score services similar to Fair Isaac.

Emerging rivals

In addition, with the ubiquity of technology, technology giants have mastered the ubiquitous consumption patterns of modern people and various private information, providing consumers with various digital credit scores; this will certainly threaten the business of these three traditional personal credit rating companies in the long run. Such digital credit scores are most often used by e-commerce companies for marketing, and they have also begun to be used by emerging online lending companies in various countries to determine whether to approve loans.

Application scenarios are spreading to various fields along with commercial forces. Insurance companies determine the basis for calculating premiums by analyzing Facebook and Twitter accounts, and even matchmaker websites use the evaluation results for reference in marriage and dating.

Related articles

- “Three major consumer credit rating companies Equifax, Experian, and TransUnion“

- “Fair Isaac, one of the most important listed companies in the US consumer finance industry

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.