As I mentioned in my blog article “The future of the electric vehicle industry“, in 2018, Volkswagen (ticker: VWAGY), the world’s largest car manufacturer, stated that the last internal combustion engine car was set to leave the factory in 2026. (Volkswagen’s Audi has also announced that the last traditional car will be set in 2026). This is a very important decision, because in the automotive industry, electric vehicles are already an irreversible industry development direction.

Two different EV development directions

There are two main ways to produce electric cars in the past, one of which is designed from scratch like Tesla (ticker: TSLA) or many electric car manufacturers in the United States and mainland China. The other is based on the traditional automobile platform, which can be used to create a variety of models, such as internal combustion engines (ICE), electric vehicles (EV), or a combination of both gasoline and electricity; this category is based on Europe, Japan, Europe, and Korean car factory.

Have investors ever wondered why there is such a completely different way of development? The answer is “it is not difficult to build electric wheels, but the hard part is to profit from electric wheels.” Automakers in Europe, Japan, and South Korea are known for being conservative in terms of finances, but they have a strong auto industry and existing customer sales as the basis, and the nationality of Europe, Japan and South Korea is relatively conservative, financing is not easy, and risk-taking is not encouraged.

The United States and China are different. These two big countries have abundant resources and their own markets are enough to support their respective domestic automakers and control global automobile production. Another factor is that these two big countries have abundant venture capital, an endless stream of financial support, investment from technology giants, and policy support, resulting in surging capital investment.

Electric vehicles in European carmakers

Several major European car manufacturers include Volkswagen (ticker: VWAGY), BMW (ticker: BMWYY), Stellatis (ticker: STLA), and Daimler (ticker: DDAIF). Each of these companies has a solid financial and sales customer base; among them, the three major German car manufacturers have a long brand history, a good reputation among car fans all over the world, and they have created countless job opportunities and industrial foundations. It influences the important policies of the German government.

In addition, the EU itself is a pioneer in the green energy initiative. Not only did it take the lead in proposing a timetable for banning the sale of internal-combustion vehicles, but it has also introduced similar policies on non-fossil fuel energy sources. In addition, the EU has recently begun to advocate carbon trading taxes. The start of the levy; this kind of profitability has made European car manufacturers inherently have to take the lead in all countries in the world to set a more pragmatic electric vehicle development plan.

Volkswagen’s EV blueprint

Because of its success in the China market, Volkswagen has clearly gained the upper hand in comparison with Toyota (ticker: TM) on the throne of the world’s largest car sales in the past ten years. Since Volkswagen is the leader in the automotive industry, its layout on electric vehicles is particularly worthy of investors’ attention. The following is the blueprint for the development of Volkswagen’s electric vehicles that I have compiled for you:

| Schedule | Volkswagen’s goal | Tesla’s goal |

| 2040 | Global sales of EV will surpass that of traditional vehicles, and Volkswagen’s sales of EV will be the world’s first (Investment bank estimation) | |

| 2030 | More than 60-70% of Volkswagen brand new car sales in Europe will be EV, much higher than the originally set 35%. It is expected to produce 22 million EV and build a six-seat super battery factory in Europe | Annual sales of 20 million vehicles in 2030, eliminating fuel vehicles |

| 2026 | Both Volkswagen and Audi announced that 2026 will be the factory day of the company’s last internal combustion engine car | |

| 2025 | Volkswagen EV will have an annual output of 1.5 million EV, and it will become a leader in the global EV market by 2025 at the latest, achieving an operating profit margin of 7%-8% within 2025. | |

| 2024 | Volkswagen EV sales will surpass Tesla, spending 73 billion euros to develop self-driving and EV technology by 2024 | |

| 2023 | Volkswagen EV annual production will reach 1 million units | A fully self-driving electric car with a price of only US$25,000 will be launched in 2023 |

| 2022 | Volkswagen will become the world’s first car manufacturer to profitably in selling pure electric cars (Investment bank estimation) | Mass production at the Berlin plant |

| 2021 | Volkswagen aims to sell 1 million EV in 2021, including 150,000 ID.4; invest USD 15 billion each year in the development of EVs in the next 5 years | 750,000 to 800,000 vehicles (Investment bank estimation) |

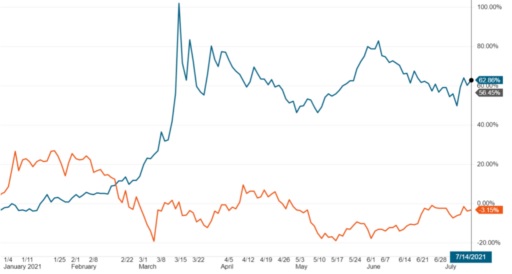

Investors are extremely shrewd, and this is also reflected in the stock price trends of Tesla (orange line) and Volkswagen (green line). The following is the chart of the two companies so far this year. The stock prices of the two companies are far different:

Related articles

- “How does Tesla make money?“

- “The bright future of the electric vehicle industry“

- “Tesla has lost edge in China“

- “The future electric vehicle giant Volkswagen“

- “How to screen potential qualifiers for electric vehicles?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.