650 Group estimates that the data center customized chip market will grow to $10 billion this year and double by 2025, while Needham analyst Charles Shi said that by 2023, broader customization ASIC market is worth approximately US$30 billion, accounting for approximately 5% of global annual chip sales.

Tag: TSLA

How does Starlink, which monopolizes low-orbit satellites, make money?

The number of Starlink satellites in orbit is expected to double that of all other satellites by 2024. In fact, he had stated earlier in 2023 that the payloads launched in 2023 may already account for 80% of the world’s total.

Capital operations are the root cause General Motors’ 30% rise so far this year

Stock repurchase is the most typical and most effective method of capital operation. The total stock repurchase amount of US$16 billion accounts for approximately 50% of the company’s total market value when GM announces this plan in November 2023.

How does BYD make money? Why it beat Tesla? Sweeping the global EV market

Due to geopolitical risks and the United States’ anti-China policy and decoupling from China in various fields, BYD may become another target of embargo, retaliation, or containment by the United States after Huawei.

How does the all-powerful Huawei make money?

No company in modern corporate history has ever won this honor. You can imagine the importance of this enterprise. The United States has discovered the signs of Huawei’s development. For the first time in history, the Department of Defense replaced the Department of Commerce to supervise Huawei.

Why is AMD’s performance so jaw-dropping?

The market has strong demand for artificial intelligence chips, and AMD’s newly released artificial intelligence chip MI 300 series products are regarded as another option to break Nvidia’s monopoly in this area, and have won immediate purchase order from several of the largest customers in the market.

Excluding top tech behemoths, US market grew almost zero in 2023

the U.S. stock market will have zero growth in 2023 excluding the tech behemoth. Among them, the magnificent 7 is the most critical and are also the protagonists of this article.

Low-orbit satellites (LOS) progress, relevant companies

Low-orbit satellite (LOS) launches are represented by projects such as Starlink and OneWeb

How does BlackRock, the world’s largest index and asset management company, make money?

BlackRock’s AUM like index trackers and ETFs top $9 trillion by mid-2023

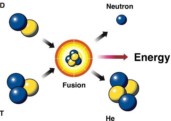

The current progress of nuclear fusion, and relevant companies

The goal of a nuclear fusion is just a few years away. The profit may reach a thousand times. As an investor, this may be a “lose your money, or earn 1000 times” investment opportunity.