For the deep dive topics on these two major Chinese stocks, I suggest you refer to the description of my other blog article “Tencent vs. Alibaba, part two“.

What do western investors think of these two companies

These two stocks, Tencent vs. Alibaba, are of indescribable importance in terms of index (representing China’s economy and technology) or substantive (real shareholding purchase). Most Western investors (including retail investors and institutional investors), except there are other special reasons to invest others, most Western investors will invest in these two stocks first among 250 Chinese listing companies in US stock market.

Even though the former and the current chairmen of SEC have repeatedly publicly asked Americans don’t buy Chinese stocks, Trump also ordered that the U.S. official pensions or organizations shall not hold Chinese stocks. Please don’t forget Tencent is not listed on the US stocks, but there are still many US stock investors doing everything possible to trade it (Tencent’s daily trading is more popular than many Dow Jones constituent stocks).

For example, the Government Pension Fund of Norway, the world’s largest sovereign fund, holds shares in Alibaba (ticker: BABA) and Tencent (ticker: TCEHY), which are its 10th and 11th largest holdings in 2020, respectively. In 2021, the fund hold 742 Chinese companies, and the stock market value increase by 35.75% annually, and the scale exceed RMB 320.5 billion.

Response from Chinese authorities

Of course, mainland China has a clear understanding of the impact of US investors’ supervision of the Chinese government on stock prices. American investors have complained a lot about this, because it has caused a year-long irrational decline, hurting the pockets of Western investors. These two stocks are the Chinese stocks with the highest holdings by Western investors. The competent authorities have “repeatedly” sought out American heavyweight Wall Street corners for coffee, emphasizing support for private enterprises, and the opening-up policy remains unchanged.

Analysis of operating indicators and competitiveness

The areas Tencent beat Alibaba

The areas where Tencent has advantages are as follows:

- Tencent has the upper hand in product diversity: Both companies have broad product lines. Alibaba is mainly focused on e-commerce, cloud, and financial technology; Tencent also has these three parts (although none of them close tp Alibaba’s scale, Alibaba ranks first, and Tencent around ranks third), but Tencent has a few more items that Alibaba can’t get involved at all. It has reached a full monopoly on the WeChat social network. Streaming music accounts for 75% of market share, as well as streaming video that is far ahead of Alibaba, and it is also the world’s largest gaming company. Please refer to my other blog post “The valuation impact of diversity to listed companies“

- In terms of investments outside of its own business, Tencent is more successful and has many achievements: For details, please refer to the detailed statistics for readers in Section 5-1 of the book “The Rules of Super Growth Stocks Investing”.

- Tencent seems to have better government relations: In terms of this wave of comprehensive supervision, the intensity of antitrust investigations, and the known fines, Tencent outperforms Alibaba. For example, Alibaba was fined RMB 18.2 billion, and Tencent was fined RMB 10 billion. In addition, Alibaba’s own market value has fallen by US$344 billion in the past year since Ant Group’s delisting alone. This does not include Ant Group’s valuation, which has already dropped 2/3 (according to Fidelity Investment’s estimates, it’s value from 461 billion U.S. dollars to the current 144 billion U.S. dollars). Please refer to my other blog article “Antitrust and governance faced by Chinese and American technology giants“.

The areas Alibaba beat Tencent

The areas where Alibaba has advantages are as follows:

- The attractiveness of the stock price: This is obvious, Alibaba’s stock price is more attractive.

| Companu | P/S | P/E |

| Tencent | 7.51 | 21.32 |

| Alibaba | 4.01 | 21.3 |

- Degree of internationalization: Alibaba’s three main core business areas, namely e-commerce, cloud, and financial technology, have basically been internationalized (except for the United States and Western Europe, which are banned from anti-China access). However, Tencent’s business is basically limited to China, except for a small number of foreign cloud services.

- Revenue and profit scale and growth: The performance of the two in fiscal year 2020 is as follows (numbers are in US$ millions), and Alibaba is obviously better.

| Company | Annual revenue | Annual revenue growth rate | Annual net income | Net income growth rate |

| Alibaba | 109,468 | +52.12% | 22,980.2 | +9.06% |

| Tencent | 73,847.9 | +36.29% | 24,487.1 | +82.72% |

Areas on par

The part where the two are tied:

- Alibaba’s main platform e-commerce users: In the second quarter of 2021, Alibaba’s global annual active buyers were 1.13 billion; its subgroup, Ant’s Alipay, had 1 billion annual active users in the second quarter of 2020.

- Tencent’s main platform WeChat users: In the second quarter of 2021, WeChat’s global annual active users were 1.25 billion.

Stock performance

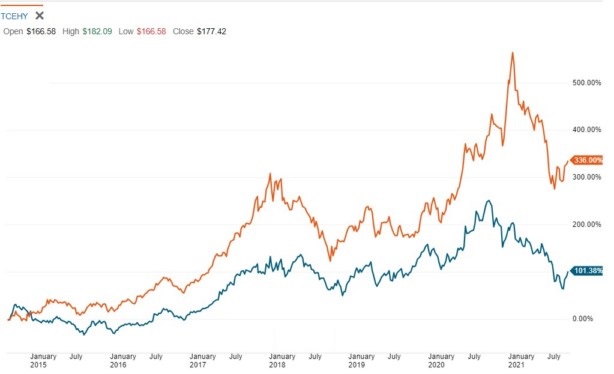

Investors are smart, and these factors are reflected in the stock price performance of the two companies; the orange line is Tencent, Alibaba is green, and the stock price graphs are all from Charles Schwab.

The following chart is a comparison chart of the performance of the two companies’ stock prices since Alibaba’s listing (September 2014) to 10/21/2021; Tencent’s total return is 336%, and Alibaba’s total return is 101.38%:

The following chart shows the performance of the stock prices of the two companies since the past year and 10/21/2021; Tencent’s total return is negative 10.61%, and Alibaba’s total return is negative 42.73%:

Which is better?

If you can only choose one, based on all the above facts and analysis; obviously:

- In the short term, Alibaba’s stock price undoubtedly has a higher upside potential.

- For long-term investors, Tencent would be a better choice.

Related articles

- “The gap between China and US, is all China-made software and hardware possible?“

- “Why is Alibaba spin-off unanimously optimistic?“

- “How does Pinduoduo make money, why it surpass Alibaba and become No. valuable listed Chinese companies in US?“

- “Tencent vs. Alibaba, part one“

- “Tencent vs. Alibaba, part two“

- “The biggest risk to hold Chinese stocks, taking Alibaba and Tencent as examples“

- Why do many Chinese companies want to go public in the United States?“

- “Are Chinese stocks suitable for long-term investment?“

- “Chinese stocks is not a wise choice“

- “Possibility of long-term holdings, Deep dive on Buffett’s case“

- “Antitrust and governance faced by Chinese and American technology giants“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.