You may surprise there is no major competitor to a company. This company was founded in 1982, and Microsoft (ticker: MSFT) was founded in 1975. This company went public successfully in 1986, and Microsoft went public in the same year, it went public in just four years after its establishment! It was a very difficult achievement in that era, and it is rare even in modern times. From this we can know how powerful this company is.

This is the second in a two-part series discussing Adobe, the first of which is “How Adobe makes money? irreplaceable undocumented standard“

Stock performance

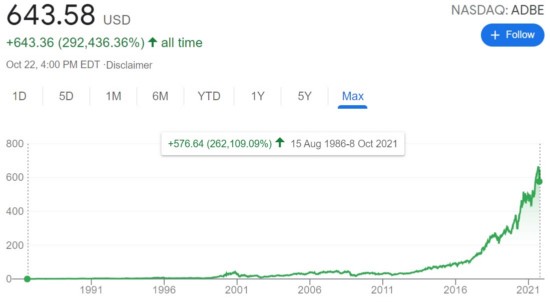

Since the company’s listing, the stock has gone through 6 splits of 2 for 1 split, a total increase of 292,436%, as shown in the figure below. Compared with Microsoft’s 9 times, 2 times were 3 for 2 split, and 7 times were 2 for 1 split; a total increase of 3,091,500%.

Adobe (ticker: ADBE) stock price trend since its listing (taken from Google Finance)

Valuation

| Market cap (US$ billion) | Annual revenue and growth rate | P/S | P/E | Dividend yield | |

| Adobe | 312.89 | 12.868(+15.19%) | 18.34 | 54.26 | 0 |

| Oracle | 255.71 | 40,479(+3.61%) | 5.74 | 19.87 | 1.37% |

| Microsoft | 2,530 | 168,088(+15.53%) | 12.83 | 37.64 | 0.74% |

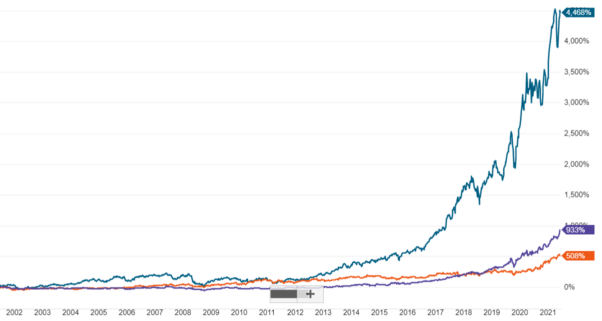

Investors should pay attention to the fact that defeating Oracle is a matter of course. But why is Adobe inferior to Microsoft in terms of revenue figures, growth rate, dividends and other traditional important indicators, but it has been better than Microsoft in terms of valuation and stock price gains (see the figure below) for a long time? Readers must think about this question-the answer is in this article.

What are its competitiveness?

According to my analysis, Adobe has at least the following moats:

- Unwritten standards: Many of Adobe’s products are almost unwritten standards in the multimedia industry.

- Monopoly: In the field of multimedia, Adobe’s products are almost the exclusive products. For decades, there hasn’t been any company that is strong enough to threaten it, none of them.

- Switching costs: No one will find it trouble-free, abandon the Adobe, which has been used for many years, and go to other vendors’ products that no one in the industry is using.

- Network effect: It is impossible people in the multimedia industry never used Adobe’s products, nor can they use niche products, because it will cause compatibility and trouble with cooperating vendors. People in the industry will automatically promote Adobe.

Expert readers will be stunned when they see these moats! Because it’s hard to have these four moats at the same time, it is almost impossible to do it in reality ─ ─ because the first two of these four moats are simply difficult to break through. The third is the moat that successful software companies have. If you have first three, and the fourth item is a matter of course.) It can be destined to have huge profits. This is why I repeatedly use Adobe as an example in my book “The Rules of Super Growth Stocks Investing”.

Accurately grasp several major software trends

With the enviable moat above, it is difficult to break through, but Adobe is not complacent with it. It keeps pace with the times. In the past more than ten years, it has adopted the following successful transformations:

- Business Diversity: In addition to the company’s already strong digital media and publishing business; digital experience, advertising, and digital signatures are new and expanded businesses, and these two sources of revenue were the focus of business development in the past two decades, and the proportion of revenue and products have been increasing (the digital experience alone has accounted for about 23% of revenue in 2020). Fully demonstrated the ambition of the new leadership team and the transcripts handed over. This is also what I mentioned in the article “The valuation impact of diversity to listed companies“. Adobe is one of the few large companies in the U.S. stock market that has successfully conducted business diversification. This is also one of the many reasons why market investors have been optimistic about its prospects.

- Cloudization (SaaS): When it comes to Adobe, one cannot fail to mention that this company has been transforming in the cloud successfully. Adobe has turned all its main products into the cloud, and has embraced the new direction of the software industry more than ten years ago. At that time, there was a lot of attention; but time proved it to be a highly visionary approach. You only need to look at the performance of the stock price of Oracle (ticker: ORCL), which was once the second largest in the software industry by market capitalization, during the same period, to know how important cloudification is to a software vendor (see details in my book “The Rules of Super Growth Stocks Investing” Chapter 3, section 3-3).

Figure 1: Stock prices trending of Adobe (green line), Microsoft (purple line), and Oracle (orange line) in the past 20 years: data from Charles Schwab

Please pay special attention to, regardless of the time period, Adobe’s stock price is significantly ahead of Microsoft.

- Subscription: Adobe has changed all its software products license model from the one-time buyout to subscription. The overall success of this policy has been the main driving force for the company’s revenue growth for more than a decade. During this period, Adobe also experienced two years of customer resistance and pain, which caused the revenue to shrink. Looking at it now, this proved to be one of the most critical factors for the success of the company’s business transformation.

What is rare is that with such a large company as Adobe, it has adopted these changes, almost all of them Adobe is the first to take the lead, and it all very successful. Being able to lead the times and lead the trend and accurately capture all major trends in the software industry makes it difficult for the company to fail.

Flaws in the fly

These moats possessed by the company listed in this article are the competitiveness that all software companies expect to have. To be honest, I think that as far as a software company is concerned, these moats owned by Adobe are stronger than the software company Microsoft. Someone began to refute, but its market value is still much worse than Microsoft! This is true. The main reason for this is that Adobe’s business is not a function that “everyone” needs (but Microsoft’s software is a tool that everyone needs), so the market is much smaller than that of Microsoft, of course.

This influences its market value. It is also why I mentioned at the beginning in Sections 3-4 of my book “The Rules of Super Growth Stocks Investing”. The first of the 3 criteria for initial filtering of super growth stocks: “What we are looking for is an industry that is needed by everyone”, please pay attention to the words “everyone”. This is the flaw in the fly in the ointment. However, life cannot be perfect, and it is impossible for everything in the world to be fair, but it does not affect the greatness of this company.

Related articles

- Related article

- “Three EDA oligopoly vendors: Synopsys, Cadence, and Mentor Graphics“

- “How does, the EDA oligopoly, Cadence make money?“

- “How does Synopsis, the EDA oligopoly, make money?“

- “How does Autodesk make money? Why is the stock price so amazing?“

- “How Adobe makes money? irreplaceable undocumented standard“

- “Adobe, a listed company with no strong competitors in its main business for a long time“

- “Why Adobe’s Figma Acquisition Caused Upheaval“

- “Vertical software is expensive, but worth the investment“

- “Why software underperforming amid the AI craze?“

- “Software PE ratio is about twice that of hardware. What is the basis?“

- “How does Salesforce make money? Why is it so successful?“

- “Veeva, the king of industry systems in the lifescience industry“

- “Fair Isaac, one of the most important listed companies in the US consumer finance industry“

- “There are indeed monopoly in this world“

- “Software PE ratio is about twice that of hardware. What is the basis?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.