Company introduction

The origin of Domino’s

In December 1960, Thomas Mona and James, students of the University of Michigan, bought a pizzeria called DomiNick’s for $900. Five years later, it was renamed Domino’s, which is now Domino’s (ticker: DPZ).

Find the code to survive in the pizza business

In 1973, Domino’s set up a differentiated strategy for fast delivery–if the delivery time exceeds half an hour, consumers only need to pay half the price of the order. When equated with aging, Domino’s business is booming. In 1984, Domino’s stores expanded to 1,900 stores, making it the largest pizza delivery company in the United States at the time.

“Fast” is the characteristic and killer feature of Domino’s. Because the pizza is so thin that it is easy to cool down, the taste of the pizza will deteriorate if it takes more than 30 minutes after it is baked. The founder made a rule: the price of pizza will be halved if it takes more than 30 minutes for takeaway. Later, the rules are more stringent. If it takes more than 30 minutes, consumers get a free pizza.

Continuously Improve Operations

Although this 30-minute guarantee was abolished in the United States in 1993, it does not affect the status and service guarantee that has been deeply rooted in the minds of consumers. In 2007, the company launched a mobile app for ordering food, and in the following year, it launched a app service for tracking orders.

The innovative take-out initiative won the favor of consumers, and then Domino’s opened up the franchise. Through the “takeaway + supply chain + franchisee” model, Domino’s has entered the road of rapid global expansion.

IPO

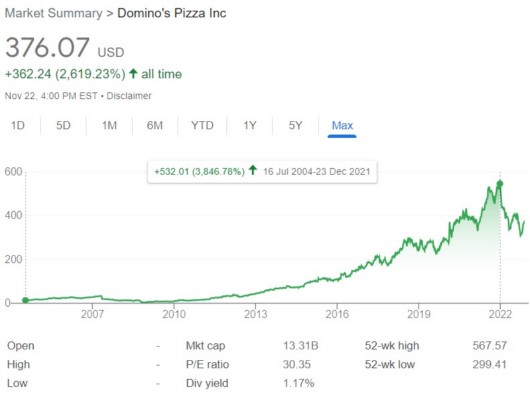

In 2004, Domino’s was listed on the New York Stock Exchange. Its return on stock investment exceeded that of Alphabet (tickers: GOOGL and GOOG), which was listed in the same year.

Crisis

However, in order to achieve fast delivery due to optimization, simplified raw materials are used, and frozen food is used to shorten the production time. After years of continuous optimization, negative effects have emerged; resulting in a substantial simplification of production procedures and ingredients, leading to the disappearance of differences with competitors, and the taste of each pizza shop is similar.

In 2006, the company’s revenue began to decline significantly. For this reason, the CEO publicly stated that the company’s past products were terrible and very unpalatable. Domino’s has taken a series of measures to admit mistakes to customers, redesign and improve their pizza ingredients, require each pizza to be handmade, and the finished product must be liked by consumers. After the company admitted its mistakes and implemented a series of successful transformation measures, the same-store sales ratio finally increased, and it set a double-digit sales revenue record in 2015. This is a great deal for an already large food retailer. A very rare achievement.

Operation and Market Performance

World’s largest pizza company

Domino’s is the world’s largest pizza company by 2020 global retail sales. As of January 2, 2022, Domino’s has more than 18,800 stores in more than 90 markets around the world, and has topped the pizza rankings in 38 countries and regions. In 2017, Domino’s global revenue surpassed that of Pizza Hut and became the largest pizza restaurant in the world. Among them, the US region’s revenue accounted for 88% of the total revenue, and the profit accounted for 73%.

Revenue sources

In 2021, the overview of the proportion of each revenue sub-item is as follows:

| 2021 | Revenue (US$) vs. year 2019 |

| U.S. direct store | 485,569 +0.00002% |

| U.S. Franchise | 503,196 +17.43% |

| Supply chain | 2,416,651 +14.81% |

| International direct store | 249,757 +3.65% |

| U.S. Franchise advertisement | 462,238 +18.28% |

| Total revenue | 4,117,411 +13.78% |

Changing the delivery policy

Domino’s has reversed its past position of not cooperating with food delivery companies, and announced on July 12, 2023 that it will open Uber Eats (ticker: UBER) to order meals. The major corporate policy change spurred shares to soar 11.1 percent to $390.38 by closing the next day, the highest level since November 2022.

Financial and share price performance

Main financial figures

| 11/23/2022 | Domino’s | Yum (Pizza Hut) | Starbucks | McDonald’s |

| Revenue (US$) | 4,357.4 +5.83% | 6,5484 +16.49% | 29,060.6 +23.6% | 23,222.9 +20.9% |

| Gross margin | 27.74% | 48.08% | 32.47% | 54.17% |

| Operating margin | 17.91% | 32.46% | 16.18% | 42.51% |

| Net margin | 11.72% | 23.92% | 14.45% | 32.49% |

Stock price valuation

| 11/23/2022 | Domino’s | Yum (Pizza Hut) | Starbucks | McDonald’s |

| Market value (US$ billion) | 13.45 | 35.31 | 86.7 | 182.42 |

| Share price | 379.71 | 125.35 | 75.37 | 246.64 |

| P/E | 30.64 | 28.56 | 20.33 | 26.06 |

| P/S | 3.05 | 5.44 | 2.93 | 7.83 |

| Dividend yield | 1.15% | 1.825 | 2.6% | 2.24% |

Amazing annualized return on share price

From its listing in 2004 to the end of 2021, its share price has risen by a total of 3846.78%. The annualized rate of return on investment in 18 years is as high as 22.48%. Such a stock rate of return is rare among listed companies in the US stock market.

Domino’s China

Enter China

In terms of revenue in 2021, Domino’s China is the third largest pizza company in China, second only to Pizza Hut (ticker: YUM) under Yum China (ticker: YUMC) and the local brand Zumbo Pizza.

In 1997, Domino’s officially entered China. In 2010, Dashi (達勢) acquired the franchisees of Domino’s Pizza in Beijing, Tianjin, Shanghai, Jiangsu and Zhejiang.

In 2017, it signed a franchise agreement with Domino’s headquarters, and obtained Domino’s 10-year franchise rights in mainland China, Hong Kong and Macau. According to the agreement, Dashi’s franchise can be extended to 30 years at most.

In 2021, the number of stores increased from 188 to 468.

Business model is different from US

The main body of Domino’s China that applied for listing on the Hong Kong stock market this time is Dashi, which is different from Domino’s international market environment, even the business model is different, and the performance is even more varied. As can be seen from the financial data of Domino’s Pizza, a large part of its profits come from the supply chain and franchisees. Domino’s produces almost all its raw materials by itself, and has also signed a benefit-sharing agreement with franchise stores.

However, Domino’s stores in China are all directly-operated stores, and Dashi shares, as the operator, only have franchise rights and cannot open franchises. Pizza Hut and Zumbo have both directly-operated stores and franchise stores.

In addition, Dashi shares have to pay a certain amount of fees to the brand authorization to US HQ every year, including franchise fees, royalties, software licensing fees, and annual upgrade fees. In 2021, this part of the cost will be 114.6 million yuan.

In 2021 and 2022, 95% of Domino’s China’s delivery, take-out and dine-in orders will be placed online, which is higher than the industry average. The industry average is below 70%.

30 minutes delivery

And it is the only pizza delivery company in China that can deliver pizza within 30 minutes. Domino’s is the only pizza company that promises consumers that it will be delivered within 30 minutes among all sales channels in China. In 2021, more than 91% of the company’s pizza delivery orders will be delivered within 30 minutes, and the average order time is 23 minutes, especially the pizza delivery service markets in Beijing and Shanghai rank first. The key is to have a large number of direct-hired exclusive rider teams, but it has brought side effects of employee salary pressure, resulting in unsolved losses so far.

IPO in Hong Kong Stock Market

According to the IPO prospectus, from 2019 to 2021 and the first half of 2022, Domino’s China achieved revenues of 836 million yuan, 1.104 billion yuan, 1.611 billion yuan, and 909 million yuan respectively.

During the same period, the company’s net losses were 182 million yuan, 274 million yuan, 471 million yuan, and 96 million yuan, respectively, with a cumulative loss of 1.022 billion yuan in three and a half years. The adjusted net losses were RMB 168 million, RMB 200 million, RMB 143 million, and RMB 83 million.

Related articles

- “How does Domino’s make money? its stock reward beat down Alphabet“

- “How does ubiquitous Yum! Brands make money?“

- “Chipotle Mexican Grill, a new generation of fast-casual food that performed surprisingly well“

- “How does Starbucks make money? and the current predicament“

- “Discover the possibility of super growth stocks in the civilian production industry”

- “Coca-Cola has been inferior to Pepsi in and even return rate is negative in past 10 years!“

- “Pros and cons of investing in Coca-Cola“

- “Monster Beverage’s monster level stock returns“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.