Investment bank research reports

Research report by TS Lombard

TS Lombard believes that it all depends on whether the economy is facing a recession. In a report to clients on August 9, 2024, he wrote that “lowering interest rates is usually in response to the economy heading into a recession.”

To emphasize this point, TS Lombard’s team tracked the performance of the S&P 500 during past Fed rate cut cycles from 1984 to 2019 (see graphics 1 below): In the days after the first rate cut, the stock market averaged rose, but within weeks of the first rate cut, stocks also began to fall as the economy slumped.

Investors are increasingly optimistic about the prospect of a rate cut from the Federal Reserve, but “stocks typically rise after the first rate cut only if a recession is avoided.”

Wells Fargo Investment Institute (WFII)

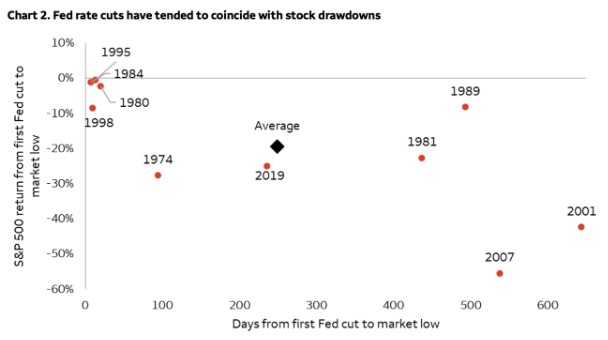

In a report dated June 18, 2024, WFII investment strategist Austin Pickle plotted the returns of the S&P 500 and the number of days between the first Fed rate cut in a cycle and the subsequent low for the index (graphics 2).

He found that since 1974, the average decline in the index in the 250 days after the Fed’s first rate cut was about 20%. He said: In other words, investors should not equate the first rate cut with a signal that the stock market is disarming.

Deutsche Bank

Analysts at Deutsche Bank have tracked interest rate cut cycles since 1955, 10 of which were associated with recessions. Two rare exceptions occurred in the late 1960s and 1980s. Deutsche Bank strategist Jim Reid wrote in a report on January 15, 2024: “Historical data shows that the Federal Reserve cuts interest rates by more than 150 basis points within one year, almost all of which are due to economic recession. If the U.S. economy does not fall into recession, Historical precedent shows that the threshold for a 150 basis point rate cut within 12 months is high.”

Strategas Securities

According to data from Strategas Securities, in the previous eight currency tightening cycles, the S&P 500 rose an average of 13% per year after the last interest rate hike, as shown in Graphics 3 below. (Please note: Annualized returns on the S&P 500 are approximately 10%!)

The Fed is embarrassed

It’s not easy to manage the timing

In fact, the Fed has been studying what happened in the 1970s, when the Fed relaxed monetary policy prematurely, causing inflation to quickly rekindle. It is not easy to time the interest rate cut. If you are not careful, you may repeat the tragedy of the 1970s.

Recession causes corporate earnings to fall

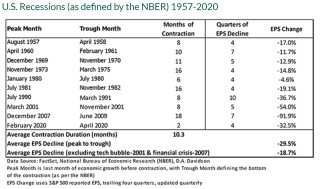

During an economic recession, corporate earnings indeed show a sharp decline, as shown in Graphics 4.

Interest rates affect corporate profits

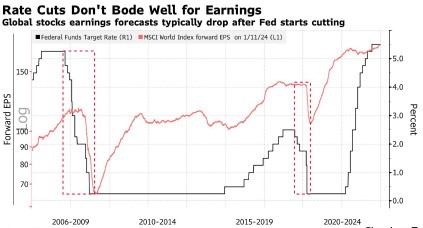

Andrew Lapthorne, quantitative strategist at Societe Generale, said: “Falling profits and falling interest rates tend to be closely related,” as shown in Graphics 5.

Conclusion

An economic recession will indeed lead to a reduction in corporate income; as a company’s revenue decreases, the stock price will of course fall accordingly. The Federal Reserve will also be forced to cut interest rates to stimulate the economy, but it will not immediately have an impact on improving economic prosperity.

In short, “cutting interest rates does not necessarily 100% make the stock market rise.”

Related articles

- “Indicators helps to interpret the direction of stock market and economic climate“

- “US credit rating downgrade by Fitch, the reasons and implications“

- “Will Fed rate cut gurantee stock market rise?“

- “Tax, inflation and rate are the top three serious killers to investors“

- “Why do stock prices automatically rise with inflation?“

- “Querier of US Inflation Rate“

- “The impact of the Inflation Reduction Act on US stocks“

- “Inflation-proof investments“

- “The impact of the Inflation Reduction Act on US stocks“

- “The relationship between GDP and stock prices“

- “US Gross domestic product (GDP) querier“

- “How investors should look at economic trends and forecasts?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.