The origin of this article

A friend wrote to me, the original text is: “I read your blog article and mentioned that “stock prices will automatically rise with inflation”. After thinking about it for a long time, I still don’t understand it. Could you please give me a practical example to help me out? Let me explain.

I think this question deserves a blog post.

Stocks are the best bet for long-term investors

First of all, in the long run, a long-term investor will definitely face inflation many times in his investment career. This is an economic reality that no one can escape and must face.

Compared with real estate, gold, bonds and other assets, this is why stocks are the best asset choice for long-term investment. Buffett has emphasized many times and I will not repeat them.

According to the statistics of the author of “Where the Money Is” book, in the past fifty years, data from the United States shows:

- The annualized return on investment of stocks is 9%, please refer to my blog article “Querier to Annualized rate of return for S&P 500 Index“

- The annualized rate of return on investment in real estate is 4%

- The annualized rate of return on investment for a three-year certificate of deposit is 1%

- The annualized rate of return on checking accounts is 0.04%

For the annualized rate of return on investment, please refer to my blog articles “Investors should care annualized rate of return (IRR), How to calculate?” and “IRR Calculator“

The root cause

Currency devaluation

The most important factor is that after inflation, the money becomes smaller. In Taiwan, 10 eggs will cost NT$35 in 2022, and NT$70 in 2023 will not be available in Taiwan. That is to say, the money that consumers use to buy eggs has depreciated by 50%. In order to buy the same number of eggs, consumers must pay twice as much.

For manufacturers, the number of eggs sold this year is roughly the same as last year, but the money on the account is doubled!

All goods price go up

In the case of inflation, all prices will rise, and the prices of products and services of listed companies will of course also increase according to market conditions. Especially those companies with the power to increase prices, that is, companies with a wide moat, will not lose customers because of price increases.

When the prices of products and services of listed companies are raised, the revenue will increase according to the ratio of the price increase, and of course the net profit will also increase. The increase in revenue and net profit will naturally push up the stock price; because the valuation of the stock Will automatically increase with the increase in revenue and profit (see the description of the example below).

Illustrate with Valuation Example

For a listed company or a certain industry, in the stock market, the valuation of its stock price by the capital market is usually a stable value. Although it will fluctuate with many factors and market conditions, it will not go up and down.

Consider, among the following two most common and simplest ways of valuing stock prices:

- Price-to-earnings ratio (P/E): Under the condition of being a constant, E (that is, net profit) increases, and P (stock price) of course rises proportionally.

- Stock price-to-sales ratio (P/S): If it remains a constant, S (that is, revenue) increases, and P (stock price) of course rises proportionally.

It’s all simple mathematics, there’s nothing strange about it, and there’s actually no hard knowledge at all. Hope it’s easy for you to understand.

Related content in my book

In my book “The Rules of Super Growth Stocks Investing“:

In subsections 1-2, from pages 27 to 35, there are 3 reasons for the rise in stock prices: the first of which is 1. The continuous growth of corporate earnings

Proof of official data

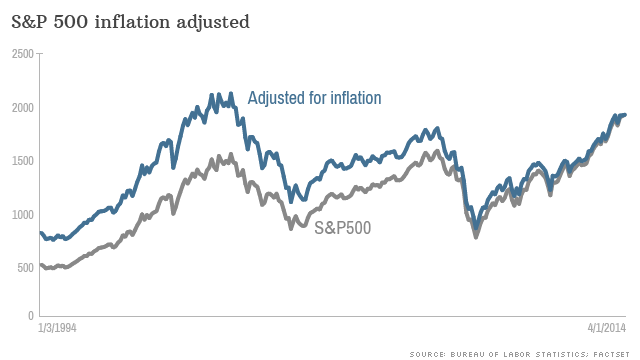

The following is the chart of the U.S. Department of Labor’s adjusted U.S. inflation rate and the S&P 500 index representing the U.S. stock market from 1994 to 2014.

Related articles

- “Querier of US Inflation Rate“

- “The impact of the Inflation Reduction Act on US stocks“

- “Inflation-proof investments“

- “Tax, inflation and rate are the top three serious killers to investors“

- “Why do stock prices automatically rise with inflation?“

- “How investors should look at economic trends and forecasts?“

- “Should investors care about currency exchange risk when investing in US stocks?“

- “Amid global recession, investor’s hard days still ahead“

- “Commercial-oriented firms perform better in recessions“

- “Querier to Annualized rate of return for S&P 500 Index“

- “Simple and compound interest calculator“

- “IRR Calculator“

- “Why long-term investment is better?“

- “Investors should care annualized rate of return (IRR), How to calculate?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.