The importance of GDP

The gross domestic product (GDP) is the most objective data to measure the national strength of each country. Wall Street financial experts will use this value to establish and estimate future economic data, as well as the growth of the stock market and individual companies.

Why provide this querier?

When we calculate the discounted cash flow model (DCF), we need to use the GDP data of the United States.

The features provided

It has two features:

- Entering two sets of different values, you can query the U.S. gross domestic product (GDP) between any two years; the average growth rate and compound growth rate will be provided.

- If the two years entered are the same, you can query the U.S. gross domestic product (GDP) for that year

How to use this querier?

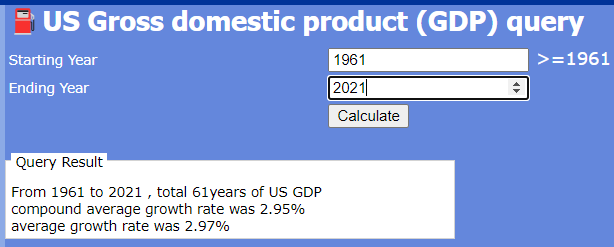

Readers can click on this link to connect and use the US gross domestic product (GDP) querier designed by me. After you onnected to the querier, you can see the following screen:

You only need to enter two fileds:

- Starting Year: For example, in the example in the screen, we enter 1961

- Ending Year: For example, in the example in the screen, we enter 2021

After the input is completed, click the “Query” button on the screen, and you can see the query results in the “Query Results” area below.

Table for stock investment toolset

Here is a list of these must-have tools for investors:

Related articles

- “The relationship between GDP and stock prices“

- “Tax, inflation and rate are the top three serious killers to investors“

- “US Gross domestic product (GDP) querier“

- “Simple and compound interest calculator“

- “IRR Calculator“

- “Investors should care annualized rate of return (IRR), How to calculate?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.