The Most Neglected Influence

Influence is everywhere

This article is going to talk about the thress most important things affecting investors, tax, inflation and interest rates. Buffett mentioned that investors should pay attention to inflation and interest rates. Inflation and rate, these two things have a profound impact on investment returns. Although I have written in my blog article “How investors should look at economic trends and forecasts?” and mentioned in this article, investors are powerless and can only accept the development of the overall economy; but at least investors still have to understand how destructive inflation and rate are to us.

First of all, all governments are happy to see slight annual inflation, because politicians hope that the economy can grow moderately, prices and salaries can be fine-tuned every year, so that voters can subconsciously “mistakenly believe” that life is good because of the increase in income. So people won’t voted differently in next election. But the premise is that these data must be under the control of the government and cannot get out of control.

Keep in mind: inflation and rate affect everyting around you!

Buffett’s golden words

Buffett mentioned in his letter to shareholders in 1979: “A few years ago, a business whose per-share net worth compounded at 20 percent annually would have guaranteed its owners a highly successful real investment return. Now such an outcome seems less certain. For the inflation rate, coupled with individual tax rates, will be the ultimate determinant as to whether our internal operating performance produces successful investment results — i.e., a reasonable gain in purchasing power from funds committed — for you as shareholders.”

Tax

Buffett also stated in his 1979 letter to shareholders: “The rate of inflation and the rate of income tax that shareholders must pay (usually dividends and income taxes on capital gains) before pocketing each year’s corporate profits Known as the “investor pain index”, when this index exceeds the rate of return on shareholders’ equity, it means that the purchasing power (real capital) of investors does not increase but decreases, and there is nothing we can do about this situation.”

“That combination – the inflation rate plus the percentage of capital that must be paid by the owner to transfer into his own pocket the annual earnings achieved by the business (i.e., ordinary income tax on dividends and capital gains tax on retained earnings) – can be thought of as an “investor’s misery index”. When this index exceeds the rate of return earned on equity by the business, the investor’s purchasing power (real capital) shrinks even though he consumes nothing at all. We have no corporate solution to this problem; high inflation rates will not help us earn higher rates of return on equity.”

Inflation

Where to get US historical inflation rate number?

You can use to tool I developed and introduced in my post “Querier of US Inflation Rate” to get US historical inflation rate numbers.

How should investors deal with inflation?

What should investors do?

- Stay away from companies with high capital expenditures: Inflation is not a good thing for most companies. Most companies do not have the ability to raise prices, and the increase in borrowing costs will cause profits to shrink significantly, and less competitive companies will go bankrupt.

- Invest in the stocks of companies that have the ability to increase the price of their products: Those companies that have only strong competitiveness and pricing power, such as Apple (ticker: AAPL) and Nike (ticker: NKE).

- Investors who use a lot of leverage are very dangerous: The Great Depression of the 1930s and the high inflation of the U.S. stock market in the 1970s later proved that for investors, the real danger is not stock price fluctuations, but the use of excessive leverage. Even though the regulation has been amended several times to control the limits of futures margin and borrowing investment, Wall Street has always been able to circumvent it. Buffett has always believed that average retail investors should not use leverage to invest, and regularly buy low-cost ETFs, which is the kingly way to weather the turmoil of the stock market. This is why I wrote the blog post “Investment concept not worth trying”.

As I mentioned in Sections 1-4 of “The Rules of Super Growth Stocks Investing”, Edgar Smith’s 1924 book “Long-term Investment with Common Stocks”. This book has two major influences on future generations:

- It proves that stocks are the best choice for long-term investors, and are significantly better than any investment product (the main comparison is bonds) regardless of inflation or deflation.

- He deeply influenced all the investment and economic gurus behind him, including the greatest investor Buffett, and the most famous economist and investor Keynes in history.

The performance of the stock price index during inflation is basically synchronized. From the chart below, you can see US inflation (green line), bank stock index (purple line), S&P 500 (red line), and S&P 500 bank index (gray line).

This picture comes from Wind and Zhongtai Securities

Inflation is the most lethal

In his letter to shareholders in 1980, Buffett explained the huge killing power of inflation to investors with examples:

In a world of 12% inflation a business earning 20% on equity (which very few manage consistently to do) and distributing it all to individuals in the 50% bracket is chewing up their real capital, not enhancing it. (Half of the 20% will go for income tax; the remaining 10% leaves the owners of the business with only 98% of the purchasing power they possessed at the start of the year – even though they have not spent a penny of their “earnings”). The investors in this bracket would actually be better off with a combination of stable prices and corporate earnings on equity capital of only a few per cent.

Explicit income taxes alone, unaccompanied by any implicit inflation tax, never can turn a positive corporate return into a negative owner return. (Even if there were 90% personal income tax rates on both dividends and capital gains, some real income would be left for the owner at a zero inflation rate.) But the inflation tax is not limited by reported income. Inflation rates not far from those recently experienced can turn the level of positive returns achieved by a majority of corporations into negative returns for all owners, including those not required to pay explicit taxes. (For example, if inflation reached 16%, owners of the 60% plus of corporate America earning less than this rate of return would be realizing a negative real return – even if income taxes on dividends and capital gains were eliminated.)

For inflation, Buffett’s advice to investors

In a 1981 letter to Berkshire shareholders, Buffett highlighted two characteristics that make a business well adapted to an inflationary environment:

- An ability to increase prices easily

- An ability to take on more business without having to spend too much in order to do it.

Interest Rate

Interest rates will affect the market and all business activities; and as soon as the adjustment is announced, the effect will be reflected immediately, and there is nowhere to escape. Its importance is as follows:

- The most important weapon in the hands of central banks around the world is interest rates.

- There is an inseparable causal relationship between interest rates and inflation. As long as inflation goes together, market interest rates must go up, and as a result, prices will rise rapidly and the profits of average companies will be compressed. But the sad thing is that, in order to curb inflation at this time, the central bank will definitely increase market interest rates; the result will immediately cause the stock market to fall sharply. But this is the main rule of the economic cycle, and investors cannot escape.

- The main reason for the failure of a business is that the cash inflow is not enough to make ends meet, so it has to borrow money. I mentioned in section 4-2 of “The Rules of Super Growth Stocks Investing”: When the economy is good, there is nothing wrong, companies can borrow money everywhere, as long as the economy reverses, the bank will start to close the umbrella and become the last straw that crushes the camel.

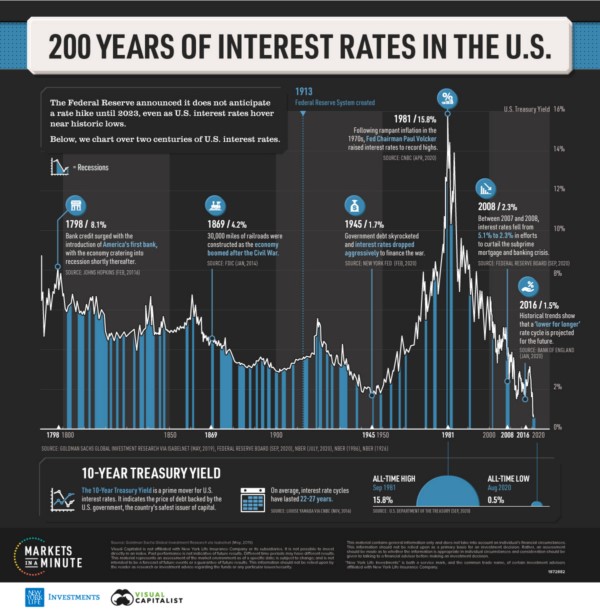

Below is the U.S. interest rate in the past 200 years:

Figure credit: New York Life Investment and Visual Capitalist

Actual impact

Actual numbers

According to actual calculation:

- Since 1913, the inflation rate in the United States has been 2663.3%, which means that the dollar has depreciated 27.63 times in 109 years.

- Since 2001, the inflation rate in the United States is 54.6%, which means that the U.S. dollar has depreciated 1.55 times in the past 20 years. The US$ 100 in 2001, 20 years later, should now only be worth US$ 54.6 (I calculated based on the actual inflation rate in the United States)

Compared with S&P 500, the return on investment during the same period:

- Since 1913, the remuneration excluding dividends is 52169.402%, and the remuneration including dividends is 3938542.680%. Taking into account the purchasing power of inflation, the remuneration excluding dividends is only 1807.782%%, and the remuneration including dividends is only 143656.576%.

- Since 2001, the remuneration excluding dividends is 326.805%, and the remuneration including dividends is 525.361%. Taking into account the purchasing power of inflation, only 177.755% of the remuneration excluding dividends remain, and only 306.971% of the remuneration including dividends.

For the numbers shown above:

- The real value feeling of most people is much more serious than these numbers.

- It proves that investing in stocks can effectively resist inflation.

How big is the impact of inflation and rate

These two factors, inflation and rate, have far-reaching influence on the stock market, and they are not short-term factors; at least they will continue until the end of the economic cycle, and even in some years, along with other factors, it will affect the global economy, stock market, prosperity, and geopolitics have had an impact that lasted more than ten years-the most famous example is the Great Inflation in the United States in the 1970s, the two oil crises, and the Vietnam War; the threatening nightmare that caused people throughout the generation to continue to live in inflation down.

For the stock market, inflation and rate do matter and destroy stock market indeed, dividends are the biggest source of interest for small shareholders, and these two reasons are the “most important factors” that affect dividends. Readers who are interested in this topic, please refer to my other blog article “Why do more and more U.S. technology stock companies tend not to pay dividends? 》

Investors’ response

This is why I advocate investing in growth stocks (see my blog post “Why I prefer growth stocks instead of value stocks?“). Let me give another famous example. In the past ten years, if you invested in Coca-Cola stocks, your real return will be negative. Please refer to my blog post “Coca Cola has been inferior to Pepsi in and even return rate is negative in past 10 years!” for detail analysis.

Buffett reminds investors of inflation and rate almost every year; his words and occasions may be different, but the meaning he wants to convey has not changed over the years:

- Stocks are the best choice for long-term investors. They are good investment targets regardless of inflation or deflation.

- The average person (that is, the vast majority of people) should buy ETFs tracking the broad market.

- If you are really not at ease, then use 10% of your wealth to buy treasure bonds and the other 90% to buy ETFs tracking the broad market.

If you are really a very conservative investor, you can buy anti-inflation bonds (TIPS, Treasury Inflation-Protected Securities), or directly purchase investment anti-inflation bonds (TIPS, Treasury Inflation-Protected Securities) At least ETFs can keep your money from shrinking too severely.

The actual situation in Taiwan and Japan

What about Taiwan?

4-5 years ago, I had a meal with an American colleague who came to Taiwan on a business trip. He was very curious about the standard of living and daily life in Taiwan. I mentioned the following things to him, which left him speechless in his seat for ten seconds in shock:

- I pointed to the twenty-storey (at Nankang, Taipei city) new elevator building not far from the window, and I told him that the most basic apartment would cost US$ 1 million.

- I then told him that the starting salary of most office workers in Taiwan is the same as 15-20 years ago (Most people may not know that Japanese wages have stagnated for 30 years), but prices have not stopped rising during this period. He thought how our society would allow this situation to continue for so long, far worse than he thought the salary level.

- I told him that 20 years ago, Taiwanese could save money and start buying houses and cars and plan marriage, et., life events after five years of being out of society. I use the term “American Dream” to explain to him, then he understand what I mean.

Lessons from the past

The salary level in Japan has stayed the same in the past 30 years, only 4% higher than in 1990, and about 50% in the United States and 40% in the United Kingdom. The average annual salary in South Korea, Europe and the United States both increased significantly during the same period, Japan has been becoming the latter part of the rich countries of the Organization for Economic Co-operation and Development (OECD).

The reason is that the Japanese economy fell into period of deflation after the asset bubble burst, and companies were depressed to increase their profits, falling into the “lost 20 years.” In terms of the purchase price parity method (PPP), the average annual salary in 2020 is 38,514 U.S. dollars, ranking 22 out of 35 member states, and the U.S. is 69,000 U.S. dollars. In addition, Japan’s salary level was surpassed by South Korea in 2015.

Recommended article on Inflation and rate

In May 1977, Buffett wrote an article for Fortune magazine “How Inflation Swindles the Equity Investor“, which was later included in the book “

Tap Dancing to Work”. To learn more about the impact of interest rates and inflation on investors, this is a must-read article.

Related articles

- “Querier of US Inflation Rate“

- “The impact of the Inflation Reduction Act on US stocks“

- “Inflation-proof investments“

- “Tax, inflation and rate are the top three serious killers to investors“

- “Why do stock prices automatically rise with inflation?“

- “The impact of the Inflation Reduction Act on US stocks“

- “The relationship between GDP and stock prices“

- “Tax, inflation and rate are the top three serious killers to investors“

- “US Gross domestic product (GDP) querier“

- “How investors should look at economic trends and forecasts?“

- “Dividend-rich industries and 6 big differences from Taiwan”

- “Considerations as a dividends investor“

- “Why dividends disappeared suddenly these years?“

- “Pros and cons of investing in Coca-Cola“

- “Coca-Cola has been inferior to Pepsi in and even return rate is negative in past 10 years!“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.