Company insider and institution shareholding is a wide-ranging topic. You can read another blog post of mine, “Why successful manager usually not a good investor?“, and “Should investors buy stocks in the companies they serve?“

Insider ownership

First of all, the proportion of shares held by corporate insiders is relatively high. Of course, comparably, it will have a bonus effect on confidence to the investors hold the company’s stock. Unless it is a company with a smaller market capitalization (I’m talking about it in general, with exceptions of course), in terms of large technology stocks that are well known to you and I and account for a large market value, the founders are almost no longer the CEOs, that is, most of them are run by professional managers or non-founders.

These professional managers are salaried people, and at best they are just giving them more incentive stocks, so they cannot have a huge shareholding ratio or voting power (this is very different from Taiwan stocks).

Institution ownership

However, the holding logic and operating ideas of ordinary equity fund or hedge fund are quite different from those of pension funds or non-profit organizations; instead, they will chase high-volatility growth stocks and technology stocks in order to seek excess return. The investment and exit of their holdings will be very fast, and they will not hold them for a long time.

Therefore, if you don’t want to go deep into the cause or effect, and don’t want to know the reason (after all, the above is just my personal opinion), and if you are a conservative investor and cannot withstand large fluctuations, you can take institutions’ holding ratio into your buying consideration, to determine whether it can become a member of your conservative and safe investment portfolio.

As a reference, not a guide

Investors don’t need to regard the proportion of shares held by insiders of a company as important consideration to buy, however, as a reference to buy the stock. The reason is that I think that institutional and insiders stock holding ratio and optimistic degrees are the “results” rather than “causes”; the word consequence is more accurate. It means that individual stocks will not be a long-term long signal because there are more institutions holding them.

Two types of institutions, pension funds or non-profit organizations, usually prefer stocks with lower volatility, such as the Johnson & Johnson (ticker: JNJ), Procter & Gamble (ticker: PG), Colgate-Palmolive (ticker: CL), Coca-Cola (ticker: KO). They will hold for a long time, the change is not big, and these blue chip stocks will have high dividends, which is another reason for their holdings.

Let me cite another stock as an example. The institutional shareholding ratio of Visa (ticker: V) is as high as around 90%, and this is always the case long time; this means that the holders are all super-large pension funds. As far as I know, in terms of holding ration, Visa should be the most popular mega stock held by a institutional shareholders.

Insiders are not necessarily accurate

Two famouse examples

Regarding corporate insider holdings, we only need to pay attention to when insiders buy in large quantities. Use it as a basis for judgment when necessary; for example, I have done my homework and observed it for a long time, and I want to buy it at a certain time; it just happens to be pulled back by a large margin. But there is no need to dance with it, because there are hundreds of reasons for selling, but there is only one reason for buying: to be optimistic about the company’s business development.

I still want to emphasize that I don’t mean that you should spend time watching insiders’ dynamics and holdings every day, because unless it is a company with a small market value and no one pays attention, it will be reported by financial news.

In addition, there are too many factors involved in the rise and fall of stock prices, and sometimes the buying points of insiders are not necessarily right.

Intel

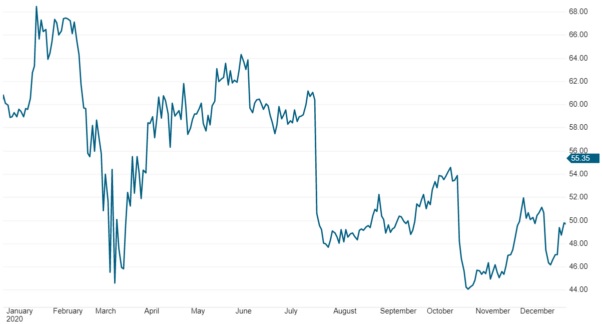

For example, in 2020, the stock price of Intel (ticker: INTC) fell 19% for the whole year (see the chart below), which was almost the worst performer among all large technology stocks. The news conference reported that the core management team under SEC supervised bought in a lot, but at least it seems that they have not made a lot of money. To enhance investors’ view of long-term holding of Intel stock should be their purpose.

Figure 1: Intel’s stock price trend chart for the whole year of 2020

TSMC

TSMC’s performance and stock price have been on the rise in recent years, and the stock price has climbed to the highest point in the second half of 2021. In addition to attracting Taiwanese stockholders to buy in a big way, it has almost become the most-held stock by Taiwanese investors. Of course, the senior managers within TSMC did not fall behind and increased their stakes one after another; through declarations and transfer announcements, three of them are the most famous:

- TSMC’s 7 deputy chief executives all increased their own stocks in February, increasing their holdings by more than 28 shares (3/20/2022)

- CEO Wei transferred thousands of TSMC shares on October 6 to his wife Niu Qingrong (10/27/2021)

- TSMC senior executives bought 278 shares of their own stocks in 2 years in February (3/15/2021)

However, since the beginning of 2022, the global stock market has entered the bear market, TSMC’s utilization has greatly reduced, and customers have reduced placed orders. End up the share price has fallen by more than 43% as of 10/24/2022. If investors just read the media reports, followed the TSMC senior manager, and then bought in the footsteps of these insiders, the above three waves of overweight players will lose a lot.

I have always been against short-term in and out, and I cite these two examples not to encourage short-term success or failure. Just taking these two well-known listed companies in the US and Taiwan stock markets to illustrate, the purpose is to remind investors that the purchase of insiders should be used as a reference, and it is not necessarily accurate.

Should care shorting ration

In contrast, investors had better pay special attention to the shorting ratio of individual stocks. Shorting is the biggest difference between a hedge fund legal entity and a general stock fund.

Related articles

- “Changes in company insider and institution shareholding ratio“

- “Pros and cons of employee stock options as compensation“

- “Insider trading and regulations on U.S. stocks“

- “The pros and cons of CEO returning, Boomerang CEO“

- “The more shares CEO owns, the higher stock return

- “Founder-CEO firms stock shown better performance“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.