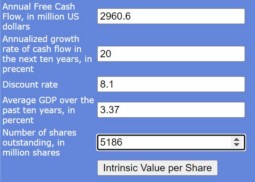

use the discounted cash flow method to estimate, What’s TSMC DCF intrinsic value?

Category: Taiwan Stock Market

TSMC negative corp culture and management style are detrimental to its future and growth

This article is intended to discuss TSMC negative corp culture and management style from the perspective of investors in TSMC in the US stock market. This is to discuss TSMC’s substantial competitiveness from the perspective of investors outside Taiwan.

Global stock markets performance comparision over the past 30 years in a table

Indian stocks performance is best among global stock markets in the past 30 years

The evil US, How did Japan, Alstom, Toshiba, HTC and Taiwan’s panel industry collapse ?

US basically does not allow any country in the world to lead it. It only allows US to set fires, but does not allow others to light lamps.

Return of market index and the market index ETF is not identical

Market index and the market index ETF is different thing.

Why are only US stocks the most valuable for long-term investment?

The factors that many investors worry about listed in this article will not cause too much harm to the long-term investment value of US stocks.

5 high-yield ETFs in Taiwan, irreversible trends, and how much do Taiwanese like it?

From the 5 high-yield ETFs in Taiwan stocks, we can find out the investment habits and obvious trends of investors in Taiwan stocks

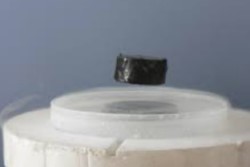

Why are superconductors important? current progress and related companies

South Korea’s LK99 claims to have discovered a superconductor at room temperature, which is hard to believe is true

Taiwan stock index and the S&P 500 index long-term return is almost equal

Although the returns of the Taiwan stock index are still relatively lower, the gap between the two is not too big in the long run.

The TSMC cost, sell price, and R&D cost of chip foundry

This post will discuss the semiconductor industry and the cost, sell price, and R&D cost of chip foundry that most Taiwan stock investors are concerned about