This article is about an extremely important investment theme───Why do we need to concentrate investment? I once listed concentrated investment as my core allocation investment strategy in my latest two books:

- “The Rules of 10 Baggers“, Section 4-3, page 203-213

- “The Rules of Super Growth Stocks Investing“, Section 2-1, page 78

Especially since this topic is too important, I still think it is necessary to write an article specifically to clarify my views on “Why do I need to concentrate investment?”

Human capacity is limited

Humans are higher creatures of primates. We are born as groups and emotional animals. All human behaviors depend on the complex coordination and cooperation of various psychological and physical aspects of the human body. One of the characteristics of human behavior is that it is difficult to do many things at the same time, that is, unable to take care of too many goals. We only have ten fingers. Most of the company’s organizational personnel are single digits. Aircraft tower radar and flight control personnel can only guide two to three aircrafts at the same time. Under normal circumstances, we have two conversations. Reading books alone. Have you noticed, why are they all in single digits? And the more you need to concentrate, the lower the number. This is not a coincidence. This is limited by human behavior. The simplest example is─── our memory is very limited.

Just as people have to concentrate when driving, the biggest cause of car accidents is always the lack of concentration. This is also the reason why the vehicle automatic driving systems currently under development basically have more sensors than traditional cars (self-driving cars need at least four to five photographic lens). These sensors are used to play the role of human sensory environmental information collection. When investing, we bet on our own hard-earned money. Of course, we have to keep track of and follow up on the turmoil of the company we invest in. To understand that a company needs to invest a lot of effort, everyone’s time is limited; there is no difference in principle.

Number of Holdings Recommended by Investing Gurus

In section 5-5 of the book “The Rules of Super Growth Stocks Investing”, I listed the number of stocks recommended by famous investment masters to ordinary people’s investment portfolios, and they are basically within ten.

| Investing Gurus | Number of Holdings Recommended |

| Warren Buffett | 5 to 10 |

| John Maynard Keynes | 3 |

| Philip Fisher | 3 to 4 |

| Peter Lynch | 5 |

| Charlie Munger | 4 |

| Lou Simpson | 5 |

| William J. Ruane | 6 to 10 |

| Korekawa Ginzo | 3 |

| Khu Peng-lam | 5 |

| Seth Klarman | 90% fund on 10 companies |

| Mohnish Pabrai | 7 |

| Bill Ackman | 7 |

Statistics and Research Data

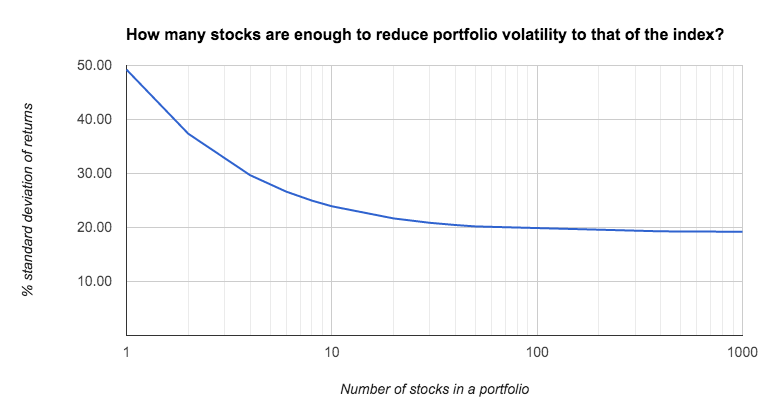

According to actual statistical investigation and research, the relationship between the number of stocks included in the portfolio and the non-systematic risk (standard deviation):

- A study by John Evans and Stephen Archer in 1968 concluded that the risk of a portfolio constructed by randomly selecting 15 stocks is not greater than the overall market risk.

- Elton and Gruber’s research report in 1977, investors only need to add 4 more stocks to the stock portfolio to reduce market volatility, you can get 71% diversification income; as shown in the figure below. Many follow-up studies and surveys similar to those in the 1980s and 1990s also reached a general consensus: 8 to 20 stocks in the portfolio are sufficient.

This graph is from stockopedia.com; the horizontal axis is the number of stocks in the portfolio, and the vertical axis is the percentage of return standard deviation.

- In the 2002 edition of Investment Analysis and Portfolio Management, Frank Reilly and Keith Brown pointed out that if you hold 12 to 18 stocks in a single portfolio, you can achieve the greatest investment diversification benefits, which can reach 90%.

- According to MorningStar James Xiong’s recent research:

- When the number of portfolios rises from a single stock to 5 stocks, the standard deviation will drop significantly.

- With more than 10 stocks in the portfolio, the decline in standard deviation is no longer significant.

This graphics is from MorningStar, X axis: performance deviation, Y axis: number of stock holdings

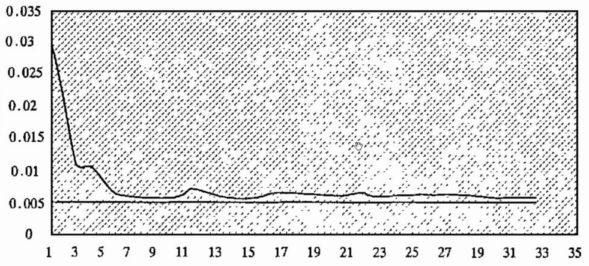

- The following is a picture of the results of research done by mainland Chinese scholars (unknown). According to this picture:

- If the portfolio contains 3 gears, you can start to significantly reduce the risk.

- There are more than 6 stocks in the portfolio, and the risk reduction effect of holding 20 or 30 stocks is almost the same.

X axis: performance deviation, Y axis: number of stock holdings

The main reasons from the opponent

The main reason most people would oppose is that there is no risk awareness of the investment portfolio. If a stock changes drastically, it may lead to extinction. Therefore, investors must diversify their investment and increase the number of shares or assets they hold. Spread to multiple category, which can dilute the risk of individual stocks or specific asset classes in the portfolio. But these opinions are really specious:

- For investment, the real risk comes from ignorance of the investment target.

- Too many holdings will increase risks:

- Everyone has a limited ability circle, and it is impossible to be familiar with too many industries or asset classes at the same time. This is the basic logic. It is impossible to understand the investment targets that are not in the circle of competence, and it is impossible to make better investment judgments at critical moments, which will ultimately affect the confidence and lower the rewards of holding shares.

- In the world of investment, simplicity is always better than complexity. Increasing the number of holdings, diversifying investments in different industries or asset classes will definitely complicate matters──the more complicated the investment decision-making process you need, and the time required also longer. The greater the number of investment stocks, the higher the research cost.

- This conflicts with human behavior. We cannot take care of many industries or asset classes at the same time. Even too many companies in the same industry cannot always pay attention to them. What’s more, to invest in different asset categories, it is basically impossible to be familiar with different asset classes at the same time. If you are not familiar with your investment target, the risk of holding shares will increase, and it is destined to be impossible to be a successful investment.

- Increase the number of holdings and diversify investment in different industries or asset classes; the result is a mediocre performance, and the result will definitely approach the market. Most of time. the usual result is lower than the market because of the transaction costs. This is also the main reason why Bank of America (ticker: BAC) has been tracking data for many years and reported that 75% of fund managers in the United States will lag behind the market (of course there are other reasons). Investing is to make a lot of money. Why do we have to adopt an investment method that doom to have no possibility of excess returns?

- Increase friction costs (whether it is visible fees, commissions, transaction fee, taxes, management fees, invisible fees and your effort), increase turnover rate, and the result is that the reward disappears between the spread of each transaction . These unnecessary expenses will eventually be left to the wealth management industry, which is why the wealth management industry raises both hands and feet and does everything possible to advocate diversified investment (this is their main source of income).

- Buffett once estimated in his 1999 article that the friction cost paid by American investors was about 130 billion U.S. dollars each year; in comparison, the world’s top 500 companies only made a total of 334 billion U.S. dollars in the first year, and friction costs accounted for nearly 40%, one can imagine how big this amount is.

- Michael Lewis, in his 2014 book “Flash Boys: A Wall Street Revolt“, he pointed out that Wall Street made $11 billion transaction fee, from investors alone annually. Please note that friction costs include visible fees, commissions, transaction fee, taxes, management fees, and invisible fees and your effort. Buffett’s 130 billion US dollars refers to friction costs.

- Those who emphasize that the portfolio must diversify risks and increase the number of shares or asset classes; in terms of actual returns, it is better to invest in ETFs that track the market.

Data speaks

Everyone has forgotten a very important thing. Long-term investigations by several well-known financial institutions:

- Consistent long-term research by many institutions, including Bank of America (ticker: BAC), indicates that only 25% of equity fund managers outperform the broader market.

- According to the statistics of Morningstar Direct under Morningstar (ticker: MORN) in 2021, the performance of active US stock funds lagged the market by more than 85%.

- The latest report from S&P Dow Jones Indices (ticker: SPGI) shows that more than 79% of active mutual fund managers will perform worse than the S&P 500 and Dow in 2021.

- The S&P Indices Versus Active (SPIVA) scorecard, which tracks the performance of active funds, with year 2023’s data showing that 79% of fund managers will underperform U.S. stocks in 2022, up from 42% a decade ago.

Investment methods and rewards of concentrated shareholders

I know that many opponents will certainly refute: how can a centralized shareholder ensure that the total return of the portfolio will be higher than the market?

- The words “guarantee” or “sure” will never exist in the stock market, and the person who raised this question is ignorant indeed.

- There is no “high return and safe” investment product existing in the world.

- As I have repeatedly emphasized, “It is impossible to generate excess returns from diversified investment, but concentrated investment is possible.”

- If you are unsure or have any doubts about your active stock selection (such as those who raise such questions), but you want to accumulate wealth on the stock market, you should face the facts (human nature is often unwilling to face reality) and buy tracking the ETF tracking the market. If you are not able to choose stocks that can generate excess returns, you do not need to doubt the possibility of generating excess returns. I sincerely advise anyone who really has high doubts about the investment method and remuneration of concentrated shareholding should obediently buy ETFs that track the market.

- Almost all successful investors are concentrated investors. Peter Lynch is the only well-known successful investor adopted diversification, because he is a fund manager, so it must be so (for the reason, please refer to my previous blog article “The advantages of retail investors“). But don’t forget Peter Lynch also suggests that retail investors should concentrate their investments (see the first table in this article). Because there are usually not many stocks that can pass the screening criteria of successful investors, this can increase the hit rate. Of course, he will also miss some excellent stocks, but the very limited targets he finally decides to buy, the rate of return will generally be very high. This is why Charlie Munger would say “You should remember that good ideas are rare—when the odds are greatly in your favor, bet heavily.”

- The delusion of diversified investment wins by quantity. The problem is that in the stock market and in the history of business, companies that can be called excellent are inherently “very rare”. For this part, please refer to my other article, “Good companies are rare, two or three will make you very rich“. Most companies are unlikely to bring you excess remuneration, and without excess remuneration, it is impossible for you to make a lot of money. A portfolio that wins by quantity cannot include the “very rare” companies in the market, because there are simply not so many “very rare” companies for you to choose from; this is the basic logic that elementary school students understand. Even if you select a few “very rare” companies in your portfolio that wins by volume, the return of your portfolio will be drastically lowered by most of the mediocre companies in the portfolio. I listed the survival rate statistics and trends of U.S. listed companies in history in sections 1-5 my book “The Rules of Super Growth Stocks Investing”. The survival rate trend of companies is getting shorter and shorter. If the company can’t survive, how do company make money for investors?

How Diversification Inventor Invested?

Harry Markowitz won the Nobel Prize in Economics in 1990 for proposing modern portfolio theory. His famous theories include “Portfolio Theory” in investment science, Efficient Frontier, and Capital Market Pricing Model (CAPM) derived from later scholars. In practical applications, Markowitz’s Efficient Portfolio theory has opened up a huge market for American mutual funds industry. Through diversified investment, a portfolio can generate the highest return with the same degree of risk, they assumed.

Investors might think that Markowitz should be the richest person in the world when he retires. However, he confessed that he would simply distribute his pension equally to stocks and bonds, instead of using the complicated calculation method of modern portfolio theory that he proposed and awarded.

When quizzed about his personal asset allocation strategy, Markowitz said:

I should have computed the historical covariance and drawn an efficient frontier. Instead I visualized my grief if the stock market went way up and I wasn’t in it – or if it went way down and I was completely in it. My intention was to minimize my future regret, so I split my [retirement pot] 50/50 between bonds and equities.

What About Buffett?

As Buffett summarized in the 1993 Berkshire annual report, “We believe that a policy of portfolio concentration may well decrease risk if it raises, as it should, both the intensity with which an investor thinks about a business and the comfort level he must feel with its economic characteristics before buying into it.”, “If you are a know‐something investor, able to understand business economics and to find five to ten sensibly‐priced companies that possess important long‐term competitive advantages, conventional diversification makes no sense for you.”

Buffett said: “Risk comes from not knowing what you’re doing.” And he even said: “Dispersion is the protection of ignorance. If you know what you are doing, dispersion has no meaning.” Buffett once warned the university. Freshmen “An investor should act as though he had a lifetime decision card with just twenty punches on it.” If investors are curious about about how Buffett did, you can go to Berkshire (ticker: BRK.A and BRK.B) websites to verify his holdings at various stages of his investment. Buffett advocated concentrated investment all his life.” Buffett once warned the university. Freshmen “Investors should invest with the mentality that there are only 20 stock investment opportunities in their lifetime, so that you will be extremely cautious every time you choose stocks.” If investors are interested, they can go to Berkshire (ticker:s BRK.A and BRK.B) websites to verify his holdings at various stages of investment, Buffett advocated concentrated investment all his life.

He said: “A lot of great fortunes in the world have been made by owning a single wonderful business. If you understand the business, you don’t need to own very many of them.“

Buffett said, ““Very few people have gotten rich on their seventh best idea. But a lot of people have gotten rich with their best idea. So I would say for anyone working with normal capital who really knows the businesses they have gone into, six is plenty.”

Everyone should know that Buffett vigorously promotes investment in the ability circle, one of the main reasons is that it can increase the success rate of investment. Everyone’s ability circle will only be within a limited range. Forcing oneself to invest in the ability circle can ensure that investors can have the ability to make correct judgments better than other investors at key investment judgment time points (this point is very important), which can increase the confidence and remuneration of holding shares.

Buffett’s partner Charlie Munger put it more directly, “A lot of people think if they have 100 stocks they’re investing more professionally than they are if they have four or five”, he said. This kind of diversification is “diworsification”, with Munger saying he is “Way more comfortable owning two or three stocks which I think I know something about.” (Note: In fact, the word ” diworsification” comes from Peter Lynch’s book “One Up on Wall Street”). For this book, I also wrote a blog article for the book “One Up on Wall Street“)

However, Buffett also repeatedly emphasized almost every year that the investment method most people should adopt is to buy ETFs that track the broad market for a long time. This is because most people cannot (for many reasons; for example, incapable, unsuitable) through self-selection of stocks to obtain higher than the market rewards.

Munger’s view

Charlie Munger pointed out more directly, “An idiot can diversify a portfolio, or a computer. But the whole trick of the game is to have a few times when you know something is better than average, and invest only where you have that extra knowledge. If that gets you a few opportunities, that’s enough.”

“It is crazy to think that investing should be as diversified as possible. We do not believe that highly diversified investments will produce good results. We believe that almost all good investments are relatively low diversification. If you took away our 15 best decisions, our performance would be very mediocre. What you need is not a lot of action, but a lot of patience. You must stick to your principles and when opportunities come, you will seize them with all your strength. Over the years, Berkshire has made money by betting on sure things.”

“This worshiping at the altar of diversification, I think is really crazy.”

“We don’t believe that widespread diversification will yield a good result. We believe almost all good investments will involve relatively low diversification.“

“If you took our top fifteen decisions out, we’d have a pretty average record. It wasn’t hyperactivity, but a hell of a lot of patience.”

How Many Holdings Should I Have?

According to statistics from UK brokers in 2013, the average number of stocks owned by investors in the portfolio was 4 holdings. Based on the above discussion, actual research reports, and my own personal experience (I have only 3 holdings in my portfolio within 3 to 5 years after the 2008 financial tsunami). If you are confident and know what you are doing (that is, you have a good understanding of your holdings). For most retail investors, having 3 to 10 holdings in the portfolio is enough to lower the risk. Too much is useless, on the contrary, it will lower the return, increase investment risk, effort, and cost. As for how many holdings are required:

- Senior investors: 10 to 12 gears, no more than 15 gears at most, and the main funds should be concentrated in 3 to 5 gears.

- Average investors: 5 to 7 gears.

- New to the stock market: 3 gears.

- It is not recommended for anyone to bet on one file at any time.

The above is the recommendation I give to investors. Please note that this number is the number of all holdings in the investor’s portfolio, even if you hold 1 share, it is counted one holding. Personally, I still think:

- It is not recommended that investors hold too many gears. Suggestion is that the fewer the gears, the better.

- Regardless of how many stocks you hold, focus your funds on a few stocks as much as possible.

No excess returns possibility from diversified investment

Just like what I said in section 2-1 of my book “The Rules of Super Growth Stocks Investing”, Diversified investment is just a means to prevent ignorance. Knowing what you are doing, there is no need to diversify investment.

Keynes said something similar: “For those who don’t know the stock market in particular, the wisest plan may be to diversify their investments in multiple different areas.” and “Invest in one stock that can fully grasp the information and make judgments, and don’t invest in ten stocks that you don’t know or even know nothing about.” Another investment celebrity Gerald Loeb, In his book “The Battle for Investment Survival”, he wrote: “Diversification is a necessity

for the beginner…an admission of not knowing what to do and an effort to strike on average, the real great fortunes.”

There can be no excess returns in diversified investment, because when you decide to adopt diversified investment, you have “automatically gave up” the possibility of making big money. Both theory and practice are impossible, because the basic logic is irrational; it is just as absurd as most people want to have both a safe and stable investment target and a high-return investment target (the Taiwan regulation stated that any investment products claim can be with guaranteed returns are illegal). Unless you just want mediocre rewards from the beginning, it’s better to buy ETFs that track the broad market and ensure good returns (please always remember that most investors have far lower returns than market ETF) and save a lot of trouble. Because you cannot guarantee that the average return of the basket of stocks you choose in your portfolio after diversification will outperform the market ── this is the most important point. Keep it!

Buffett emphasized “Diversification may preserve wealth, but concentration builds wealth.”

Need Long-term investment to make it work

Concentrated investment must be a long-term investment, otherwise it will not be effective. The reason is that without long-term investment, there is no time to compound interest; even if you find a rare and excellent company in your investment career, you can only hold it for a short period of time, and you can’t get considerable rewards. The reason can’t be simpler. In short, when investors concentrate their investments, they must:

- The lower the turnover rate of the investment portfolio, the better, otherwise it will lose the meaning of concentrated shareholding.

- Only by concentrate and long-term investment in “very rare” companies can investors continue to make big money.

John Maynard Keynes said: “One good share is safer than ten bad ones.” Have you ever heard that buying a mutual fund or ETF makes a person a millionaire?

Related articles

- “Why is portfolio rebalancing unreasonable“

- “Why concentrated Investment?“

- “Why long-term investment is better?“

- “Is Buffett no longer hold for long haul? TSMC, HP, and US Bancorp cases study“

- “Investors should pay attention to the annualized rate of return (IRR), How to calculate?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.