For the analysis of Sea’s recent stock price turmoil, I suggest you refer to my other blog post “Why did Sea’s (Sea) share price drop by 70% in three months?”

For these major e-commerce businesses, I suggest you refer to my blog post below:

- “Shopify, the only rival admitted by the founder of Amazon, how does it make money?“

- “Amazon vs. Alibaba“

- “Latin America’s e-commerce dominant MercadoLibre“

A company worth studying

In Chapter 3, Sections 3-6 of my book “The Rules of Super Growth Stocks Investing”, taking Shopee from Sea Ltd (ticker: SE) as an example to illustrate how I decide a startup worth investing in. And in Chapter 5, Section 5-1, take it as an example to illustrate the valuation of a startup. There is no other reason, this is an enterprise worth studying.

The most valuable company in Southeast Asia

At the beginning of the fourth quarter of 2020, Sea Ltd set three records in one fell swoop:

- The company with the highest market value in Southeast Asia.

- Except Tencent (ticker: TCEHY) and Alibaba (ticker: BABA), it is the third-highest listed internet company in Asia by market capitalization.

- The founder Forest Li became the richest man in Singapore.

Capital market stock price valuation

Stock performance

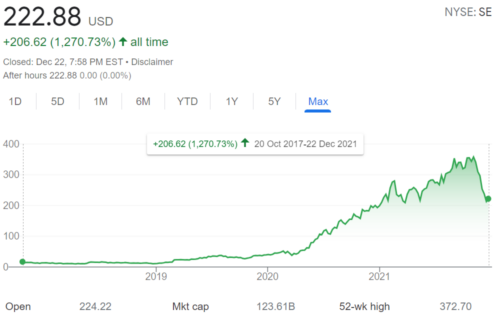

It has only been 4 years since its listing in October 2017, and the stock price has risen by 1,270% (as of 12/22/2021). The stock price chart of Google Finance is shown below. In 2020 alone, the pandemic year, has risen by 406% within one year! As far as I know, this increase should be the first place among all listed companies with a market capitalization of more than US$ 100 billion in U.S. stock market. On October 18, its stock price reached its historical high of $372.7, with a compound annual growth rate of 119% (from any point of view, this is an extremely staggering number).

Current valuation

However, by the end of December, because:

- All growth stocks in the U.S. stock market have fallen sharply.

- Investors are worried that Sea’s amazing triple-digit revenue growth over the past two years will slow down.

- The third quarter’s EBIDTA has increased 37.5% from the same period in the past year.

These unfavorable factors combined together, the stock has fallen 40.42% from it’s all time high in October 2021! Please note that all this happened within two months, and the magnitude is shocking. The following are the main valuation data (up to 12/24/2021):

| Valuation metric | Mercadolibre | Shopify | Sea Ltd | Amazon.com | Alibaba |

| Stock price | 1,262.73 | 1,439.33 | 222.05 | 3,421.37 | 118.66 |

| Market value ($ billion) | 63.72 | 180.74 | 123.15 | 1.74 trillion | 322.54 |

| P/S | 10.09 | 43.05 | 14.96 | 3.76 | 2.48 |

| EPS | 1.59 | 26.82 | -3.59 | 51.14 | 7.1 |

| P/E | 793.45 | 53.66 | N/A | 66.9 | 16.73 |

| Stock price drop from all- time high | -47% | -18.36% | -40.42% | -9.32% | -60.37% |

Company introduction

Company bio and founders

The English company name of Sea Ltd is the abbreviation of South East Asia. It is the name that the founder of the company came up with to pay tribute to where the company is based. Forest Li, a Chinese born in Tianjin China, was founded in Singapore in 2009.

In 2005, during his university studies in Singapore, Chen Ou relied on a laptop to establish the online game battle platform GGgame, which was the predecessor of Sea Ltd. In 2006, Chen Ou went to Stanford University to study for an MBA. Chen Ou was introduced to and met Forest Li, who then joined GGgame. Chen Ou chose to leave GGgame for unknown reasons later. In 2008, he sold his equity in GGgame for only US$700,000.

Later, Forest Li adjusted the company’s business, turned to game development and operation business, and renamed GGgame to Garena. Due to his outstanding performance, Forest Li got the franchise of Tencent’s most popular game “League of Legends” in Southeast Asia. Tencent noticed the performance of this game operating company in Singapore. Since 2013, Tencent has invested in Garena many times. When the company went public, Tencent had 34% of the voting rights and 39.7% of the shares; but currently, Tencent’s share only accounts for about 22.9%.

Forest Li also became Singapore’s richest man because of Sea Ltd’s rocket-like stock price rise.

The company’s main business and performance

| 2020 revenue and growth rate | Q3 2021 revenue and growth rate | Main business | |

| Garena | US$ 2.016B(+77.46%) | US$ 1.1B(+125%) | Game, e-Sport |

| Shopee | US$ 1.777B(+116.05%) | US$ 1.31B(+167.6%) | eCommerce, Food delivery, Hotel booking, Grocery and fresh, ride hailing |

| SeaMoney | US$ 582 million(+168.74%) | US$ 279.6 million(+81.9%) | Fintech |

Q3 2021 performance

Revenue grew by 121.83% over the same period last year, reaching US$2.689 billion. The net loss was US$573 million, a decrease of 36.44% over the same period last year. The disappointing news for the quarter was that adjusted EBITDA expanded from US$120 million in the same period last year to a loss of US$165 million in the quarter, an increase of 37.5%. Although the strong EBITDA of the gaming sector continues to support the loss of e-commerce, it will certainly be difficult to sustain in the long run people will care most.

Gaming Department Garena

Garena, established in 2009, is the number one online game developer and publisher in Southeast Asia. FreeFire, the first self-developed game, has 300 million registered users and has become a phenomenon-level product. At the same time, it is also the exclusive publisher of Arena of Valor, a multiplayer online competitive game co-developed with Tencent. This game continues to rank second among the global average monthly active users. In addition, according to App Annie data, “Free Fire” was still the best-selling mobile game in Southeast Asia, Latin America and India in the third quarter.

In the third quarter of 2021, revenue was $1.1 billion, an increase of 90%. The point is that the EBITDA of this sector is US$715 million, which accounts for approximately 65% of revenue. The number of active users increased by 27% to 729 million, and paid users increased by 43%.

E-commerce department Shopee

According to App Annie’s data, Shopee ranked first in the shopping category in the third quarter on Google Play, a global mobile app store for the Android operating system, and ranked second in terms of downloads and average monthly active users based on the total application time. Shopee also continues to be the #1 app in the shopping category in Southeast Asia and Taiwan. Shopee was introduced to Brazil in mid-2020. So far, it has more than 1 million sellers in Brazil.

Revenue in the third quarter of 2021 increased by 134%, reaching $1.5 billion. It is worth noting that the EBITDA loss of the e-commerce sector is as high as US$683 million, which is higher than the US$302 million in the same period last year.

Financial Services SeaMoney

SeaMoney, established in 2014, is the only electronic payment service provider in Southeast Asia that has payment licenses in the four major markets of Southeast Asia, Indonesia, Thailand, Vietnam and Malaysia. It has a complete offline channel to serve unbanked users, and provides payment services to Shopee and Garena users in its ecosystem.

In the third quarter of 2021, mobile wallet payments totaled US$4.6 billion, an increase of 111% year-on-year. Quarterly paying users increased to 39.3 million.

Why is Sea Ltd so touted by the capital market?

The reasons for my personal analysis are as follows:

- Innate advantages: The company’s three major business sectors, including games, e-commerce, and financial technology, are the most popular industries in recent years, for stock market.

- The pandemic has fueled the flames: With the coronavirus pandemic in 2020, countries around the world are shutting down cities. People cannot go out and can only purchase online and play online games at home. This has explosively helped Sea Ltd’s three major businesses. During this year, Sea Ltd was able to deliver an amazing triple-digit percentage growth in revenue every quarter.

- It is still expanding vigorously: In addition to Taiwan and Hong Kong, it has defeated Alibaba’s Lazada and established itself as #1 position in Southeast Asia. It has also achieved what Amazon was not able to. It has already grabbed a beachhead in Brazil, the largest market in Latin America, and exerted great pressure on Mercadolibre (ticker: MELI). Starting in 2020, it has begun to enter Europe. Shopee has set up branch office in India, invited merchants and plans have been drawn up to replicate the successful experience of Southeast Asia in India.

Related articles

- “Sea, the parent company of Shopee, the most valuable company in Southeast Asia“.

- “Why did Sea’s share price drop 70% in three months?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.