With the development of the capital market in recent years, companies do not necessarily need to be listed, and there are many factors that can hinder startup companies from going public.

Category: Startup

A brief discussion on partnership

In addition to venture capital firms, accounting firms, law firms, consulting firms, private equity funds, investment banks, and wealth asset managers; these types of large companies are usually partnerships──unless they are companies To go public, it will be reorganized into a limited company.

Don Valentine, founder of Sequoia Capital, father of Silicon Valley Venture Capital

Don Valentine is the founder of Sequoia Capital. He founded Sequoia Capital in 1972.

What company is Nubank owned by Buffett? How it makes money and its advantages?

If Nubank meets all conditions, the company continues to operate smoothly, and the overall environment in Latin America improves, perhaps Nubank “has a chance (but it may not happen)” to become Latin America’s version of Block (formerly known as Square, ticker: SQ) Or the potential of PayPal (ticker: PYPL ).

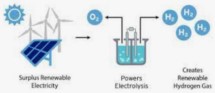

Clean Energy, Green Energy, and Renewable Energy, current development, differences, and related companies

Green energy refers to energy that is friendly to the earth’s environment and does not cause environmental harm. Clean energy refers to energy that does not pollute the environment during the production of energy. Renewable energy is energy that can be regenerated repeatedly and has an endless supply.

Exponential growth can produce excess returns

All investors want to obtain excess returns, and the best situation for so-called excess returns is when your investment can achieve exponential growth.

Duan Yongping’s investment empire and his BBK Group(Oppo, Vivo, One Plus, J&T Express, Realme)

Almost no Taiwanese have heard of Duan Yongping, but it is not an exaggeration to say that he is a household name in Chinese circles outside Taiwan, especially in the business and investment circles.

How do Coinbase and Binance make money? Advantages comparison

Coinbase and Binance are respectively the second and largest cryptocurrency platforms in the world.

Current progress of hydrogen energy and relevant companies

Since hydrogen does not emit carbon dioxide, it is also one of the strategies to reduce greenhouse gas emissions in industries such as long-distance trucking, maritime freight and air travel.

Unconventional “The Millionaire Fastlane”

Book The Millionaire Fastlane disrupted most people’s view