The parent company of Da Vinci Robots

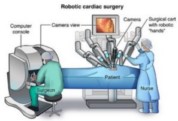

There should be no one who does not know about the Da Vinci medical surgical robot from Intuitive Surgical, right? Da Vinci Medical Surgical Robot is now more famous than this company. I mentioned this company in the preface of my book k “The Rules of Super Growth Stocks Investing“.

I mentioned this company in subsections 3-4, pages 152-153 of my book “The Rules of 10 Baggers“, when I discussed the major pharmaceutical and medical device companies in the US stock market; especially the entire subsections 5-3 , are used to introduce the company Intuitive Surgery.

It’s already subscription

The Da Vinci medical surgical robot, the cheapest one (please note that I use the word cheapest model) costs $1.5 million. This looks like a good deal, doesn’t it? But intuitive surgery find ways to make more money. After Da Vinci’s medical surgical robot is sold to you, you will be charged for follow-up training, maintenance, and consumables; this is amazing. An estimated $500,000 per year. In particular, all its consumables are designed to be used only once, and after one surgery is opened, all of them have to be replaced.

The proportion of surgical consumables (mainly instruments and accessories) revenue has increased from 29.8% in 2005 to 56.3% in 2020. Its robotic arm locks up forcefully after ten uses and needs to be replaced. Not only that, but the relevant consumables are designed to only use the original products of Intuitive Surgery (other medical surgical robots, some consumables are not mandatory to be supplied by the original factory), which cuts off the hospital’s efforts to use third-party low-cost The dream of reducing product costs is completely blocked.

As far as 2022 is concerned, Around 75% of the company’s total revenue is recurring (mainly the consumables mentioned above), 75% is a high number, largely stemming from replacement instruments and accessories. This gives Intuitive a cushion that most companies don’t have.

How is the performance?

Here’s how Intuitive Surgery performed in 2021:

| Business index | Number |

| Da Vinci medical surgical robot installed numbers | 6,730 |

| Procedures Proceeded | 1,594,000 |

2021’s annual report

| US$ million | Annual growth rate | |

| Total revenue | 5710.1 | +31.02% |

| Product revenue | 4793.9 | +33.74% |

| Service revenue | 916.2 | +26.58% |

| Gross margin rate | 69% | +300 bps |

| Net income | 1704.6 | +60.72% |

It has been listed for 22 years, and the revenue growth rate can still be 31%!

What about competitors?

It would be an overstatement to say that it has no competition. However, intuition surgery is a medical devices company that focuses on medical surgical robot only. The other major competitors are all veterans who have been in the medical field for a long time. All of them have a lot of background. They have almost unlimited resources and abundant connections in medical institutions. Everyone is eyeing the achievements of intuitive surgery. Take it for nothing.

For the market share, it took more than 80% of surgical robot market these years. Yes, it dominates.

The versatile Da Vinci robot

Medical surgical robots basically have functional limitations, or only specialize in a certain field, and there is no all-round medical surgical robot. The Da Vinci robot is no exception, but it should be the most versatile surgical robot, which means that it can perform the most types of surgical operations approved by the FDA. Officially documented in company documents, there are at least 10 major categories of approved surgeries.

The Lord of patent

Intuitive Surgery has a total of over 4,200 U.S. and foreign patents licensed in the field and has filed over 2,100 U.S. and foreign patent applications to date. This is due to the fact that when the company was founded, it was a technology-oriented company, focusing on patents. Without patent protection, products would be counterfeited immediately.

How is the valuation?

The following table shows the valuation of intuitive surgery by market as of 03/15/2022:

| number | |

| Stock price | 270 |

| Market capitalization | US$ 96.983 billion |

| P/E | 57.94 |

| P/S | 16.98 |

This valuation level is no different from that of “top” technology companies, and it is higher than that of the top five technology stocks. You might think it’s too expensive. In my own experience of tracking it for more than 20 years, the stock of this company has never been cheap, and the price-earnings ratio is rarely below 50.

For the top five tech stocks, I suggest you refer to my other blog article “Five technology stocks for better getting started in US stocks“.

How is the share price performing?

Since the beginning of 2022, the US stock market Nasdaq has entered a bear market, the broader market has entered a correction, and all stocks have plummeted across the board. Intuitive surgery is only down about 25%, and it’s one of the more resilient stocks, which is also reasonable. A recession or a stock market crash, or someone is sick, and they have to be treated with surgery.

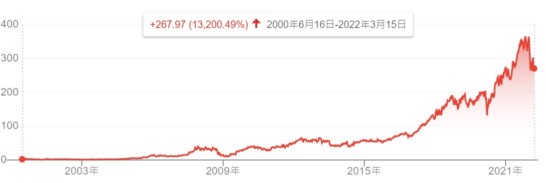

Intuitive Surgery has undergone two stock splits since it went public; in 2017 and 2021, both of them are one-for-three splits. Since its listing in 2000, the stock has rised 13,200% as shown in the chart below.

The annualized return rate for 22 years is an astonishing 24.85%! During the same period, the annualized return of the S&P 500, which represents the U.S. stock market, was only 5.49%. Let’s take a look at its stock price chart, which is almost a perfect upward curve!

Related articles

- “Abiomed acquired by Johnson & Johnson“

- “How did three listed companies make money after GE spinoff? What are the prospects?“

- “Intuitive Surgical, a company that essentially monopolizes surgical robots“

- “How the best AAA credit rating Johnson & Johnson makes money?“

- “How does dominated Intuitive Surgical make money?”

- “Abbott, the world’s most important medical device and nutritional food supplier, how does it make money?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.