Johnson & Johnson (ticker: JNJ), founded in 1886, went public in 1944, is a very important company in the US stock market, and there are many aspects that investors should explore.

I used Johnson & Johnson (ticker: JNJ) as an example when I discussed debt credit ratings in subsections 2-2 of my book “The Rules of Super Growth Stocks Investing“. In Sections 3-4, pp. 143-151, of my book “The Rules of 10 Baggers“, when discussing the major pharmaceutical and medical device companies in the U.S. stock market, I constantly use Johnson & Johnson as an example.

Simple bio

Founded by two brothers with the same surname “Johnson” in the early 20th century, Johnson & Johnson is a top healthcare company with pharmaceutical and device medical subsidiary, Ethicon, but its main business is hospital supplies. With the life expectancy of the average person and the issue of aged care. Ethicon, part of Johnson & Johnson medical devices, has contributed significantly to surgery for more than 100 years.

Important lawsuit

It has paid hundreds of millions of dollars in lawsuits over cancer-causing powders. In 2012, a court in St. Louis, Missouri, USA ordered it to pay $110 million in compensation to a Virginia woman who developed ovarian cancer due to the use of baby powder; A jury has awarded it $417 million in damages to a woman who developed ovarian cancer after using its baby powder and other powder-containing hygiene products, the largest lawsuit ever awarded.

In addition, between 2016 and 2018, it paid $761 million in damages over a baby powder cancer-causing lawsuit. it has been selling baby powder for more than 60 years, now has to pay for the medical bills for these women. My previous blog post “How serious is the problem of misappropriating client funds in Taiwan? ” took this as an example.

Baby powder has been riddled with cancer-causing lawsuits, and has faced about 38,000 lawsuits. For this reason, in October 2021, it established a new subsidiary, LTL Management LLC (“LTL” for short), as a way to “shake the pot” , transfer the liabilities to the new company, let LTL assume all liabilities related to the baby powder cancer-causing lawsuit, and declare that the company has filed for bankruptcy protection and the new entity will assume legal responsibility. LTL listed assets of $ 10 billion , the debt is also 10 billion US dollars.

Johnson & Johnson remains one of the richest companies in the world, with about 31 billion in cash, with a net cash flow of 15 billion.

Johnson & Johnson to spin off consumer health division as Kenvue

Johnson & Johnson will spin off the health consumer goods company Kenvue and go public independently. The newly spun off company will have an annual revenue of US$14.635 billion in 2021, accounting for 15.6% of Johnson & Johnson’s total revenue. The new company itself could be ranked 207th on the 2021 Fortune 500 list, and Johnson & Johnson itself is ranked 36th. From this data , you know how big the size of Johnson & Johnson and the other new company it spun off. The separation is expected to be completed within 18 to 24 months from November 2021.

As mentioned earlier: Compared with the other two businesses (medical equipment and pharmaceuticals), the company size and growth rate of the consumer goods business are slightly lower, and both medical equipment and pharmaceuticals will achieve double-digit growth in 2021.

One of the world’s only AAA credit ratings

Moody’s (ticker: MCO) only grants the highest AAA credit rating to three listed companies in the world, Johnson & Johnson, Microsoft (ticker: MSFT), and Apple (ticker: AAPL); the reason is simple, these three companies It is impossible to go out of debt, because there is too much money and the ability to continuously generate cash is so strong that creditors need not worry.

How is the performance vs. peers?

business performance comparison

In 2021, Johnson’s and Johnson’s, Abbvie, Merck and Pfizer’s business performance are shown in below table, respectively.

| Index | JNJ | PFE | ABBV | MRK |

| 2021 total revenue ($ billion) | 93.775 +13.55% | 81.288 +95% | 56.197 +22.69% | 48.704 +17.31% |

| Pharmaceuticals | 52.08 +14.28% | 79.557+95% | 56.197 +22.69% | 48.704 +17.31% |

| Medical devices / Pfizer is CDMO | 27.06 +17.86% | 1.731 +87% | 0 | 0 |

| Nutrition | 14.645 +4.1% | 0 | Spin off as Abbott | Spin off as Organon |

| Gross margin | 68.27% | 62.28% | 69.65% | 72.81% |

| Operating margin | 26.92% | 33.02% | 35.29% | 32.56% |

| Net margin | 22.26% | 27.04% | 22% | 26.79% |

Stock price comparison

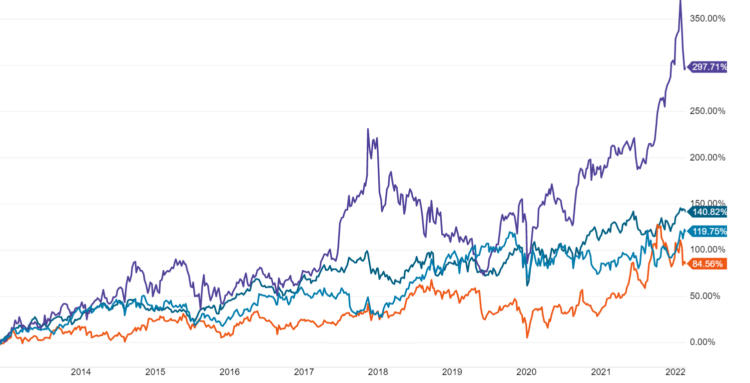

In the past 10 years, the stock prices of Johnson & Johnson, Pfizer, Merck, and AbbVie, as shown in the chart below, have risen by 119.75%, 46.11%, 84.56%, 140.82%, and 297.71%, respectively.

Stock performance comparision

| | JNJ | PFE | ABBV | MRK |

| Market captalization (billion) | 474.54 | 277.14 | 259.43 | 221.61 |

| Share price | 180.46 | 49.07 | 146.88 | 87.65 |

| P/E | 24.31 | 12.5 | 22.76 | 15.68 |

| P/S | 5.08 | 3.51 | 4.91 | 4.1 |

| Dividend yield | 2.5% | 3.26% | 3.84% | 3.15% |

Related articles

- “Weight loss is the future golden goose of the drug market “

- “Alzheimer, the only major disease yet to be conquered, current progress and related companies“

- “Why Eli Lilly become global pharmaceutical market value king?“

- “Big pharma spin-offs, and advantages to invest them“

- “Eli Lilly, a big pharma with astonishing valuation“

- “Pfizer, the world’s largest pharmaceutical company“

- “Novo Nordisk’s new diabetes drug Semaglutide,Ozempic,Wegovy and Mounjaro found to have surprising weight-loss effects“

- “The next No. 1 pharmaceutical leader AbbVie“

- “Stable Dow Component Merck, how does it make money?“

- “The ex-largest pharma Merck“

- “Abbott, the world’s most important medical device and nutritional food supplier, how does it make money?“

- “Roche, the king of anti-cancer“

- “How the best AAA credit rating Johnson & Johnson makes money?“

- “How does dominated Intuitive Surgical make money?”

- “How did three listed companies make money after GE spinoff? What are the prospects?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.