GE was founded in 1878 by Thomas Alva Edison, who invented the electric light and many other commodities. It is one of the few companies in the U.S. stock market that has been listed for more than a century. It can be said to be the pride of American industry and a symbol of comprehensive national strength.

Category: Stock split

Stock split is a long-term stock bullish signal with brilent outlook

Stock split is a long-term stock bullish signal with brilent outlook, My previous articles in 5-5 of the book “The Rules of Super Growth Stocks Investing” and my blog post of “Why stock split? the strong reasons and impacts” and “The valuation influence of stock liquidity and stock split on listed companies”,

How does Texas Instruments make money? Amazing long term capital reward and company net profit margin!

Take Texas Instruments (aka TI, ticker: TXN) as an example; this company was founded earlier than Intel (ticker: INTC), for Intel, I suggest you refer to my previous blog post “How Does Intel Make Money? And the Benefits of Investing in It”

Citigroup, a downward companies

Citigroup on behalf of failed companies, Citigroup’s Growth History, The growth history of Citigroup is worth understanding by investors, especially since it was set up by a commercial bank that used to be the largest commercial bank in the world.

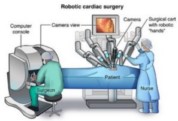

How does dominated Intuitive Surgical make money?

There should be no one who does not know about the Da Vinci medical surgical robot, right? Da Vinci Medical Surgical Robot is now more famous than this company Intuitive Surgical. I mentioned this company in the preface of my book “The Rules of Super Growth Stocks Investing”.

The valuation influence of stock liquidity and stock split on listed companies

The valuation influence of stock liquidity and stock split on listed companies. For a long time, Warren Buffett’s Berkshire company stock has been poorly rated (I didn’t write it wrong, no one should be surprised). One of the main reasons is the poor liquidity in the market, that is, very few people trade the stock.

Why stock split? the strong reasons and impacts

Why stock split? the strong reasons and impacts