Regardless of the market value, product influence, modern people’s daily life connectivity, influence on the global stock market, and the most helpful for your investment, everyone who invests in US stocks must first study these five technology stocks .

The importance of these five technology stocks in the U.S. stock market is just like the Taiwanese stock market’s TSMC (ticker: TSM). Investors who invest in Taiwan’s stocks cannot avoid it and should not skip TSMC, because the market capitalization accounts for nearly 30% of the total market capitalization of Taiwan’s stock market, it is also a constituent stock of many ETFs, which almost determines the rise and fall of Taiwan stocks. The same situation applies to Samsung Electronics of Korean stocks, or Toyota Motors of Japanese stocks (ticker: TM) and Software Bank (ticker: SFYBY).

Their importance

Market capitalization

There are five major technology stocks in U.S. stocks, which not only have the same importance to U.S. stocks, but also affect global stock markets. Please pay attention to the top five technology stocks in the U.S. stock market. The market value of any one of them is more than one trillion U.S. dollars (value at the end of August 2021).

| Company | ticker: | Market value (in US$ trillion) |

| Apple | AAPL | 2.44 |

| Microsoft | MSFT | 2.25 |

| Alphabet | GOOGL and GOOG | 1.91 |

| Amazon | AMZN | 1.68 |

| META | 1.04 |

The influence

Today:

- The total market value of these five companies is 20.05 trillion U.S. dollars. The Wilshire 5000 Total Market Index, which represents the total market value of U.S. stocks, has a market value of 46.69 trillion U.S. dollars. In the second quarter of 2021, the full-year GDP of the United States is estimated to be only 22.72 trillion US dollars, which is only twice the total market value of the five companies. The current market value of TSMC is roughly equivalent to Taiwan’s annual GDP.

- The combined market value of these five technology stocks has surpassed the overall market value of the Japanese stock market.

- Among them, the market value of Apple alone has already exceeded the total market value of all 30 leading companies included in the German Dax Index since 2019.

- According to the statistics of the fourth quarter of 2019, if the profits of these five technology stocks are excluded, the remaining S&P constituent stocks have almost no profit growth.

- The combined market value of these five technology stocks is approximately 23% of the S&P 500 constituent stocks.

- The market value of one Apple company is higher than the market value of nearly 2,000 companies in the Russell 2000 Index.

- In the past four years, with the exception of Microsoft (because it suffered the same pain 20 years ago), the four major US technology giants have been involved in hundreds of antitrust investigations, fine, and verdict.

Commonalities

The commonalities of these five companies are as follows:

- Antitrust target: This will not have an answer in the short term. But investors don’t have to panic. You can refer to my blog on the analysis of the matter, “How should investors view companies being included in the antitrust investigation list“, and “Antitrust and governance faced by Chinese and American technology giants“

- Except for Apple, these technology stockare all software behemoths (Actually, the same is true for Apple, as I mentioned in my book 3-2. All software for Apple devices is developed by itself. If there is no software, and the hardware devices are just scrap iron. Readers can imagine how big Apple’s software is). This is not a coincidence; this is also one of the main reasons why I specifically point out the importance of software in “The Rules of Super Growth Stocks Investing”, section 3-2.

- For these five technology stock, the other four companies are more or less able to operate hardware business, but they do not operate hardware business to make money (except for Apple, each hardware department is actually losing money or not the main source of revenue), their main purpose is to collect information about you and me. Even Apple owns all the operating systems and important software on its own platform, because software is the key to determining the success of the platform. Apple knows this very well. Apple is also another software behemoth to a certain extent. All software is developed by itself. In fact, this is not easy; the point is that all software is developed by itself to create Apple’s current status.

- They are all Internet behemoths, and technology stock, with powerful and multiple moats; it is unlikely that modern people can completely get rid of any of these companies, even if you are not an American. Many people will immediately argue that I am in Taiwan and does not use Amazon, but as long as you are a modern people who have watched movies or read books; in fact, you can’t escape Amazon’s system.

The big five

Below we will introduce each company one by one in a short space.

Apple

The following is Apple’s resume:

- It is currently the world’s largest company by market capitalization. It has been the world’s largest company by market capitalization since it first surpassed Exxon Mobil (ticker: XOM) ten years ago.

- iPhone shipped 2 billion units, worldwide market share 26%

- There are currently more than 1.65 billion Apple devices in use worldwide.

- There are currently more than 1 billion iPhones in use worldwide.

- There are currently more than 100 million Apple Watches in use worldwide.

- Apple is also the company that has made the most money in history, earning an average of US$ 700,000 per minute.

- Apple is the first company in history to achieve quarterly revenue of more than 100 billion U.S. dollars (revenue for the fourth quarter of 2020 is 111.43 billion U.S. dollars).

- In 2020, Apple’s profit is almost three times that of Starbucks (ticker: SBUX) sales.

Apple related articles

“How does Apple make money?“

“Apple’s upcoming products, services, and technologies“

“Steve Jobs’s Apple innovation gone with him?“

“Apple’s small privacy change caused US stocks evaporate 200 billion U.S. dollars in one day“

“Did Apple really lose the lawsuit with Epic Games?“

“The importance of the App Store legal battle between Apple and Epic Games“

“Why is Apple’s privacy policy so important?“

Microsoft

The following is Microsoft’s resume:

- The market share of personal computer operating systems has never been less than 80% in the past three decades, and Microsoft is almost synonymous with personal computers.

- It is impossible for all companies, big or small, to have never used Microsoft products.

- According to Flexera’s research, in the 2021 ranking of corporate information expenditure procurement, the first place is Microsoft with 84%, and the second is Amazon’s AWS with 43%. After the third place is Oracle (ticker: ORCL), Salesforce.com (ticker: CRM), IBM (ticker: IBM), Alphabet, ServiceNow (ticker: NOW), Adobe (ticker: ADBE).

Microsoft related articles

- “Microsoft, the real overlord of cloud computing“

- “Microsoft buys the game master of the PC era, Active Vision Blizzard“

- “How Microsoft makes money? Where is the future?“

- “Is Microsoft’s personal computer computing department a tasteless one?“

Alphabet

The following is Alphabet’s resume:

- It has a total of 12 products or services with more than 1 billion registered users worldwide. The closest Facebook is only 5, Microsoft has only 2, Apple has two, Amazon has only one, Tencent has one, and Alibaba has two; the total of these six is only 13!

- The long-term debt ratio is an exaggerated 0.07 (long-term debt is almost zero); there is a total of 135.104 billion U.S. dollars in the account, which is more than Apple’s 69.834 billion or Microsoft’s 125.407 billion. It is the company with the most cash on the account of listed companies in the United States.

- Its degree of monopoly has reached the level of public utilities necessary for Americans’ lives.

- The StatCounter survey pointed out that Google search accounts for 89% of the market in the United States, 92% in Canada, 93% in Europe, and 99% in India.

Alphabet’s related articles

Amazon

The following is Amazon.com’s resume:

- 64% of Americans have an Amazon account.

- The e-commerce market in North America accounts for 40%.

- The global retail market accounts for 1%, and the North American retail market accounts for 4%.

- AWS cloud computing platform accounts for more than 35% of the market, ranking first in the world.

- Prime Video streaming accounts for 65% of the North American market, second only to Netflix (ticker: NFLX) with 81%.

- Amazon Music streaming market accounts for 15%, second only to Spotify (ticker: SPOT) with 35% and Apple Music with 19%.

Amazon related articles

- “Why Amazon acquired MGM?“

- “Amazon vs. Alibaba“

- “Amazon’s dominance by its economic scale, impact share price of PayPal, Affirm, Fair Isaac, Visa, and Mastercard“

Meta Platforms

The following is Facebook’s resume:

- 60% of Americans have a Facebook account.

- Facebook has five products with more than 1 billion users each, including four major products Facebook, WhatsApp, Messenger and Instagram.

- The number of monthly active users of Facebook family products is 3.51 billion, and the number of daily active users is 2.76 billion.

Meta related articles

- “Meta, the modern evil empire, a hard day“

- “Why did Meta Platform (Facebook) become a copycat empire?“

Why all US stock investors need to know about them?

Reasons for newbies in U.S. stocks

If you are a new investor in U.S. stocks and may not be very familiar with other U.S. companies, then you can consider starting with these five major technology companies. Because modern people deal with these five major companies almost every day, their products and services, because:

- Everyone uses it every day, and it is unlikely to be able to get rid of it completely. It will be easier to understand by comparison.

- All the media around the world will report the latest developments of these companies at any time. The daily financial news of the media, these the five related news accounts for most of it. Everyone has been bombarded for a long time and it is impossible to be completely ignorant; Moreover, it is easier for investors to obtain information on these five companies.

- In the visible mid-to-long term of five to ten years, these technology giants will still affect everyone in this world. The outlook will still be better than that of most companies in the US stock market. But as I said in other articles, please remember: no company is immortal. It has never happened in history, and it will never happen in the future.

Why talk about these five?

If you have “very thorough” research on TSMC individual stocks (it’s not that I want to pour cold water, in fact, most investors do not fall into this category), investing in Taiwanese stocks 0050 ETF (it’s the most popular market ETF in Taiwan, just like S&P 500 for US market) is not as good as investing in TSMC (TSMC accounts for nearly 50% the weight of 0050 ETF).

In the past 5 years, Taiwan stocks 0050 ETF returns 101.74%, while TSMC’s 245.56%. Opponents will say that it is not advisable to bet on only one gear (I am opposed to betting on only one gear at any time, I mean comparing 0050 ETF and TSMC). There is another reason for me to say this. Please see my comments in my book “The Rules of Super Growth Stocks Investing.” section 1-6.

In the same way, investing in S&P 500 ETFs (such as the most famous SPY or VOO) that represent the U.S. stock market, it is better to study these five companies carefully, so that you can have full confidence in holdings; then invest directly in these five major companies. These five companies are the most important driving force for the U.S. stock market. To make money is is the most important thing to invest in the stock market.

Return of past 5 years

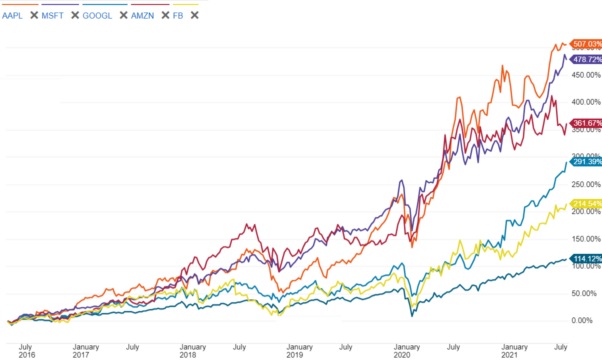

As shown in the picture above (from Charles Schwab), their return rates in the past five years are as follows:

- Apple: 507.03%

- Microsoft: 478.72%

- Amazon.com: 361.67%

- Alphabet: 291.39%

- Facebook: 214.54%

- S&P 500 ETF: 114.12%

In the past five years, even if you invest in the worst-performing Facebook, your performance will be twice that of the broad market S&P 500 ETF. Which one should you invest? the answer is clear.

Related articles

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.