Bckground

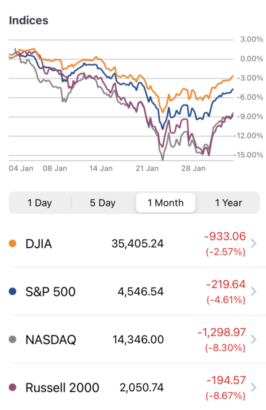

Growth stocks plunge starting last September if you are observe stock market closely. It has only been more than three months since most U.S. growth stocks reached their all-time highs in October last year to January 2022. During this period, the three major U.S. stock market indexes ended at 1/27, from the highest point in history; the Dow Jones fell 8%, the S&P 500 fell 11%, and the Nasdaq, which represents growth stocks and technology stocks fell 17%, and the Russell 2000, which represents small-cap stocks, has already fallen into a bear market (Figure 1).

The series will be divided into two articles. This article is the first part, which mainly discusses the number one reason for the slump in U.S. growth stocks—monetary policy. In the next article part two, “Why growth stocks plunge, part two“, we will discuss another big reason for the plunge in U.S. growth stocks.

Major market indices are not consistent

If you only look at the three major U.S. stock market indexes, it will distort the real picture, because the decline of the growth stocks in the U.S. stock market during this period is not what the three major indexes can express, and the collapse of the growth stocks during this period is it has reached the once-in-a-decade crash standard.

40% of Nasdaq Composites have halved from their 52-week highs, more than 36% of Nasdaq stocks have halved, and more than 68% of 2021 IPOs have fallen below the closing price on the first day of listing. Add that to the fact that many of the famous growth stocks that have led U.S. stocks with ferocious gains in the past have reached the point of collapse.

Figure 1 : U.S. stocks fell sharply in January 2022, and none of the four major market indexes were spared (graphics from Yahoo Finance)

Growth stocks crash across the board

As of February 11, Peloton (ticker: PTON), a home-based fitness company, and Upstart (ticker: UPST), an online artificial intelligence automatic lending company, have both fallen by about 80%, and online video conferencing startup Zoom (ticker: ZM) ) and vaccine stock Moderna (ticker: MRNA) fell nearly 70%, the top financial startup PayPal (ticker: PYPL), the electronic signature DocuSign (tickere: DOCU), and Sea Ltd, the parent company of Shopee (ticker: SE) and Block (ticker: SQ) have both fallen by about 60%.

In the past five years, Wall Street’s favorite Shopify (ticker: SHOP), and the first listed company in cryptocurrency trading CoinBase (ticker : COIN), and the first metaverse company Roblox (ticker: RBLX) fell by more than 50%; even more frightening are top five technology stocks with stable profits Meta Platforms (ticker: META) and Netflix (ticker: NFLX) fell more than 40%. Not only that, but also affected stable growth stocks like Nvidia (ticker: NVDA) and Adobe (ticker: ADBE).

These stocks are the most well-known representatives of growth stocks, and many of them are super-large and outstanding companies that have already made profits. In this wave of growth stocks, they cannot escape the fate of collapse. This can’t help investors to think of the 2000 dot-com bubble period, whether the nightmare of Nasdaq falling by 89% at its peak will recur this year. Because of all the large-cap index or growth stocks discussed above, the collapse is still happening.

| Ticker | Lost from all-time high in past year | ost from all-time high in past 3 months |

| PTON | -77.70% | -29.54% |

| FVRR | -75.88% | -57.90% |

| UPST | -75.09% | -62.14% |

| AFRM | -73.65% | -68.76% |

| ZM | -68.74% | -44.61% |

| MRNA | -67.57% | -30.22% |

| PYPL | -62.83% | -44.65% |

| SQ | -62.70% | -52.54% |

| DOCU | -61.09% | -53.72% |

| ASAN | -57.78% | -56.54% |

| SE | -57.53% | -53.62% |

| COIN | -54.71% | -43.28% |

| RBLX | -52.82% | -37.90% |

| SHOP | -51.56% | -48.85% |

| MELI | -45.63% | -31.69% |

| NFLX | -44.18% | -42.67% |

| META | -42.87% | -35.60% |

| ADBE | -32.25% | -27.92% |

| AMD | -31.18% | -23.47% |

| NVDA | -30.88% | -21.19% |

Table 1: Share price decline of major growth stocks as of February 11

So what are the factors that cause growth stocks to become hot potatoes overnight in three months? The first reason is monetary policy.

The Federal Reserve’s monetary policy

The Fed’s two major monetary policy reductions and interest rate hikes are one of the main factors behind the sharp decline in growth stocks. And behind it is the highest inflation in the United States in nearly 40 years, making the situation even more complicated.

Regarding the importance of inflation and interest rates, I suggest you refer to my other blog post, “Tax, inflation and rate are the top three serious killers to investors“.

Shrinking the balance sheet ends throwing money

At the press conference on 1/27, the US Federal Reserve has officially announced that it will begin to reduce the $9 trillion on the balance sheet that has been increased by quantitative easing in recent years to $4 trillion; the decrease is as high as 55.56%.

It means that 55.56% of the hot money in the market will disappear. In 2020, in order to avoid the global stock market crash due to the COVID-19 pandemic, the unlimited quantitative easing released by the US Federal Reserve has released money to the world after piling up the global stock market (don’t forget, the purpose of the US Federal Reserve was to push up the global stock market in 2020).

Now that the US Federal Reserve will take the money back, most of the money invested in the US stock market will also be withdrawn from the stock market in large quantities. Of course, the fastest way is to sell the stock and realize it, and the price paid is to accelerate the US stock market fell. Investors knew that the money released into the market by the Fed’s quantitative easing would be recovered sooner or later.

But why are growth stocks crashing? Because of these short-term so-called smart money, most of them will be invested in growth stocks with more volatility and higher return probability. These smart money have no interest at all in large-cap stocks with tepid gains, suitable for long-term stable investments, or mature blue-chip stocks with stable earnings.

Most of the bailout cash is poured into the stock market

Since 2020, the U.S. government has issued multiple rounds of personal grants to bail out cash, but it is surprising that many people use the money to buy stocks, especially for white-collar office workers who are not short of money. According to the interview results of Deutsche Bank in January 2021, it was found that the average proportion of the plan to put the bailout money into the stock market is 37%.

After conversion, it is estimated that 170 billion US dollars will flow directly into the stock market. For the young people without family aged 25 to 34, the proportion is as high as 53%.

Interest-hiking

The second monetary policy that caused the stock market tumble was raising interest rates. In the United States, the inflation rate in December 2021 was 7%, approaching the highest point in 40 years; the annual growth rate of core prices in December was 4.9%, a record high in nearly 40 years. If interest rates are not raised, rising prices will be unable to be suppressed, and the consequences of unchecked inflation will lead to currency devaluation, which will cause irreparable serious damage to the economy.

And if there is another recession that requires a rate cut in a few years, the Fed will have no weapons at its disposal. However, raising interest rates will cause a parity effect of financial assets. Investors will fully adjust the allocation of assets. Some funds will be withdrawn from the stock market to low-risk treasury bonds, corporate bonds, or money market hedging. Of course, this will cause investors to sell Stocks weighed down on the stock market.

What’s more deadly is that the cost of borrowing for companies will rise, limiting their profits. Growth stocks, on the other hand, are companies that have just been listed and are not yet on their feet; they are still in the stage of business expansion, and most of them have no surplus, that is, free cash flow is negative. This is the fundamental reason why growth stocks tumble when interest rates are raised.

Impact on business

Small and growth stocks will take immediate hit from monetary policy

However, large companies or mature companies can survive without borrowing because of their abundant cash flow. They can also regularly issue dividends to investors, or repurchase company’s stock; this also explains why the five major technology stocks And the Dow Jones components fell much less than growth stocks. As a result, these technology giants, who represent 22% of the S&P 500 stocks in the U.S. stock market, have indeed distorted the real market decline during this period of decline. Investors cannot see the real situation of the sharp collapse of thousands of growth stocks.

Industries that benefit from higher interest rates

Bank stocks are one of the few industries that has traditionally benefited from every rate hike. Since the market has been speculating on when the Fed will raise interest rates since last year, the policy and schedule are now clear. For the stock market, it will be all negative, and it will help the stock market to sweep away the Fed currency since the fourth quarter of this year.

A destabilizing factor in policy speculation. But once the Fed decides to raise rates, it will continue to do so multiple times until the next economic downturn calls for a rate cut. Therefore, raising interest rates is a long-term factor, which should be paid special attention to.

I am the author of the original text, the abridged version of this article was originally published in Smart monthly magazine.

Related articles

- “Why I prefer growth stocks instead of value stocks?”

- “Growth vs. Value Investing, Buffett’s view“

- “Tax, inflation and rate are the top three serious killers to investors“

- “Why growth stocks plunge, part two“

- “Why growth stocks plunge, part one“

- “How does Nike make money? The role model of growth stocks in non-tech industry“

- “Discover the possibility of super growth stocks in the civilian production industry“

- “The past and present of value investing“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.