If Nubank meets all conditions, the company continues to operate smoothly, and the overall environment in Latin America improves, perhaps Nubank “has a chance (but it may not happen)” to become Latin America’s version of Block (formerly known as Square, ticker: SQ) Or the potential of PayPal (ticker: PYPL ).

Tag: PYPL

Fintech’s valuation plummeted and current dilemma

Fintech is no longer a super new blue ocean in the technology and financial circles ten years ago.

Cryptocurrency ETFs drive surge in related companies

But the current situation has changed a lot. People in the financial industry, Wall Street, and most issuers themselves judge that the SEC is likely to approve the listing of multiple cryptocurrency ETFs at the same time before January 10, 2024.

Excluding top tech behemoths, US market grew almost zero in 2023

the U.S. stock market will have zero growth in 2023 excluding the tech behemoth. Among them, the magnificent 7 is the most critical and are also the protagonists of this article.

How do Coinbase and Binance make money? Advantages comparison

Coinbase and Binance are respectively the second and largest cryptocurrency platforms in the world.

Several possible threats to the Visa and Mastercard credit card networks

Visa and Mastercard Credit Card Network are subject to antitrust investigations by various countries almost every year around the world, but they always escape safely.

PayPal’s current crisis and appeal

PayPal in my two books In my book “The Rules of Super Growth Stocks Investing“: In the book “The Rules of 10 Baggers“: How bad is it? The pandemic catalyst is no longer In the two or three years before 2021, PayPal’s stock price, like most technology stocks, has repeatedly hit new highs. Since the … Continue reading “PayPal’s current crisis and appeal”

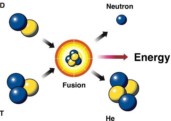

The current progress of nuclear fusion, and relevant companies

The goal of a nuclear fusion is just a few years away. The profit may reach a thousand times. As an investor, this may be a “lose your money, or earn 1000 times” investment opportunity.

Commercial-oriented firms perform better in recessions

U.S. stocks have rebounded a lot from the bottom of the bear market in June. Many investors believe that the worst time has passed; but the reality is not so optimistic. But there is another important point in this article — commercial-oriented companies are more resilient to recessions.

Why Shopify is so killing?

Readers are interested in Shopify