What is Modern Portfolio Theory

A simple introduction

Modern Portfolio Theory (MPT) has several key points:

- Rational investors use diversification to optimize their portfolios.

- The portfolio is a weighted combination of assets, the return of the asset is a random variable, the return of the portfolio has an expected value and a variance, and the risk is the standard deviation of the return of the portfolio.

- Use analysis of variance to maximize expected return for a given level of risk.

Modern Portfolio Theory assumes that investors are risk-averse investors. If two assets have the same expected return, investors will choose the less risky one. Investors will only take more risk on the premise of higher expected returns.

One of the three pillars of modern financial economics

Modern Portfolio Theory is one of the three pillars of modern financial economics, the other two being the Capital Asset Pricing Model (a model that explores what the equilibrium state of financial markets would look like if capital were priced according to an efficient portfolio).

Markowitz won the Nobel Prize

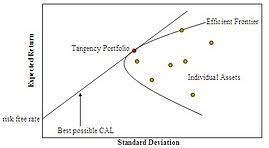

The Harry Max Markowitz Efficient Frontier is a collection of all the best portfolios (aka Efficient Portfolios). Each point on the efficiency frontier curve represents an optimal portfolio, that is, the portfolio with the lowest risk given any one of the same expected returns. Markowitz also won the 1990 Nobel Prize in Economics.

The challenge from behavioral economics

Behavioural economics, by contrast, is based on general public psychology and the actual performance of behavior, and there are countless easy-to-use cases that disprove the impracticality of modern portfolio theory. And in recent years, behavioral economics has indeed begun to receive attention. The 2017 Nobel Prize winner in economics is the father of behavioral economics, Richard Thaler.

What about the real world?

The inventor himself did not use it

When quizzed about his personal asset allocation strategy, Markowitz said:

I should have computed the historical covariance and drawn an efficient frontier. Instead I visualized my grief if the stock market went way up and I wasn’t in it – or if it went way down and I was completely in it. My intention was to minimize my future regret, so I split my [retirement pot] 50/50 between bonds and equities.

What about the performance of the biggest backers?

The fund industry is based on the largest implementer of modern portfolio theory and has attracted the capital of countless investors for decades. But what about the actual results? In 4-3 of my book “The Rule of 10 baggers“, I detailed the long-term statistical results of three well-known institutions in recent years:

- Consistent long-term research by many institutions, including Bank of America (ticker: BAC), indicates that only 25% of equity fund managers outperform the broader market.

- According to the statistics of Morningstar Direct under Morningstar (ticker: MORN) in 2021, the performance of active US stock funds lagged the market by more than 85%.

- The latest report from S&P Dow Jones Indices (ticker: SPGI) shows that more than 79% of active mutual fund managers will perform worse than the S&P 500 and Dow in 2021.

- The S&P Indices Versus Active (SPIVA) scorecard, which tracks the performance of active funds, with year 2023’s data showing that 79% of fund managers will underperform U.S. stocks in 2022, up from 42% a decade ago.

With indices ETF tracking the broader market, “Any strong reason to buy mutual fund?“. Therefore”Most investors should invest ETFs tracking broader market” and “US issued ETFs tracking US market is your best bet“

Buffett and Simmons prove that theory is just theory

Buffett and Simmons, who have amassed billions of dollars in their own way of investing, represent two completely different investing styles. And the long-term investment annualized rate of return of both of them is quite amazing, and they are the greatest investors of our time.

But theoretically and literally, the efficient market hypothesis and modern portfolio theory mean that the investment success of Buffett and Simmons is impossible. Because Buffett and Simmons amassed massive wealth to prove him right, they are not afraid of risk, or they both get rich by taking advantage of market volatility, rather than avoiding risk as suggested by the efficient market hypothesis and modern portfolio theory.

Closing words

Like the Efficient Markets hypothesis, modern portfolio theory can produce Nobel Prize winners and has many academic supporters. But academic theories are just theories after all. These two theories are actually based on many beautiful assumptions, which are actually not feasible at all. For example, the biggest premise of both is that “investors are rational.” Anyone with a little investment experience or common sense knows that investors and the market are not rational. The premise or assumption is wrong and it is impossible to obtain the correct result.

Related articles

- “Why is portfolio rebalancing unreasonable“

- “Efficient market“

- “Why Modern Portfolio Theory Unreasonable?“

- “Why concentrated Investment?“

- “Most investors should invest ETFs tracking broader market“

- “US issued ETFs tracking US market is your best bet“

- “Why long-term investment is better?“

- “Investors should pay attention to the annualized rate of return (IRR), How to calculate?“

- “Any strong reason to buy mutual fund?“

- “Thinking cannot be outsourced“

- “People believe successful investors are survivorship bias cannot succeed“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.