In addition to venture capital firms, accounting firms, law firms, consulting firms, private equity funds, investment banks, and wealth asset managers; these types of large companies are usually partnerships──unless they are companies To go public, it will be reorganized into a limited company.

Category: Wealth Management

Why is stock investment a better way to manage money?

This article will tell you from the most vernacular and ordinary people’s point of view, using the most concise reasons: why stock investment is the better way of financial management for modern people?

Bitcoin ETF spot trading approval has far-reaching impact

Bitcoin ETFs are listed on mainstream exchanges, which can reach more investors such as retirement funds, investment institutions, and retail investors, inject huge capital into the crypto market, expand trading volume, and accelerate the acceptance of ordinary people.

Bill Gates’ Investment Empire

What I’m interested in is why Bill Gates can “long-term” dominate the top few in the world’s wealth list; and often return to the top of the list, which is extremely rare, and he should be the only one in the world’s wealth list with this ability

How does Buffett manage Berkshire?

Buffett’s two managing principles for Berkshire

How does BlackRock, the world’s largest index and asset management company, make money?

BlackRock’s AUM like index trackers and ETFs top $9 trillion by mid-2023

How Does Private Equity Giant Blackstone Make Money?

Schwarzman and his mentor Peter Peterson left Lehman Brothers to co-found Blackstone with $400,000

The investment strategy of the Nobel Foundation

The investment strategy of the Nobel Foundation, Nobel Prize

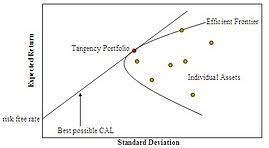

Why Modern Portfolio Theory Unreasonable?

Why Modern Portfolio Theory Unreasonable?

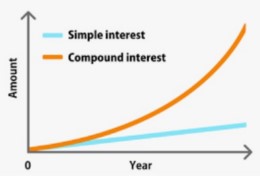

Simple and compound interest calculator

You can use simple and compound interest calculators to quickly calculate and compare the differences.