The good times for banks are over

The glory days of the banks being on the top are over, at least in the world of consumer finance.

Citi abandons consumer business

Citigroup (ticker: C) announced on 4/15/2021 that it would withdraw from retail banking in 13 markets in Asia, Europe, the Middle East and North Africa, including Taiwan, but continue to provide institutional customer services; including private banking, cash management department, investment bank and transaction department, etc. Chief Executive Freiser stated that she will change four wealth centers in Singapore, Hong Kong, the United Arab Emirates and London to wealth management services.

Citi’s 2020 revenue is US$74.3 billion, with an annual growth rate of 0%. The consumer banking sector revenue 30 billion with an annual growth of minus 9.1% in 2020, and the growth in 2019 is 2.2%. Institutional customer sector is 44.3 billion with an annual growth of 12.8% in 2020, annual growth of 2.9% in 2019. The pre-tax profit of the Taiwan branch in 2020 fell below NT$ 10 billion, which was only NT$ 9.76 billion, which was a 33% drop from 2019, a record low in the past five years.

In December 2022, Citigroup announced its withdrawal from China’s retail banking business as well.

Global consumer banking has been going to slope

From the above financial report figures, we can understand why Citigroup made such a decision ─── the consumer finance sector has declined. In fact, the long-term sluggishness of the consumer finance sector of traditional banks is not unique to Citigroup or the large banks in the United States. Large European banks experienced the same problem four or five years ago and they abolished and sold them. Or reduce consumer finance departments or counter branches. Another phenomenon closer to the ordinary people is that the ATMs installed around the world have fallen sharply from the peak in history in recent years.

Statistics from Retail Banking Research show that at the end of 2018, the number of ATMs worldwide was approximately 3.24 million, a decrease of 1% from the end of the previous year, and it was the first time to decrease. The latest example is HSBC’s withdrawal from the US consumer gold market in May 2021 and plans to sell several branches. In recent years, Taiwan’s banking industry has also changed its past practice of vying to apply for new branches to expand its business. Instead, it has started to shrink branches and consumer finance departments.

However, in the past ten years, the global stock market has been a rare bull market, the economy has grown, all industries have continued to thrive, and consumers have been desperately borrowing and spending money; what factors have caused the traditional banks’ consumer finance sector shrink in the global banking industry? The answer is that in the past ten years, almost all businesses in the global consumer finance sector have been robbed by financial startups (FinTech) in most countries.

The culprit is new fintech

Fintechs have the advantages of convenience, speed, efficiency, flexibility, and fee rates that traditional banks cannot provide. These are fatal appeals to consumers. Compared with new financial entrepreneurs, traditional banks are the dinosaurs of the last century have absolutely no competitive advantage, and no ability to counterattack or contend.

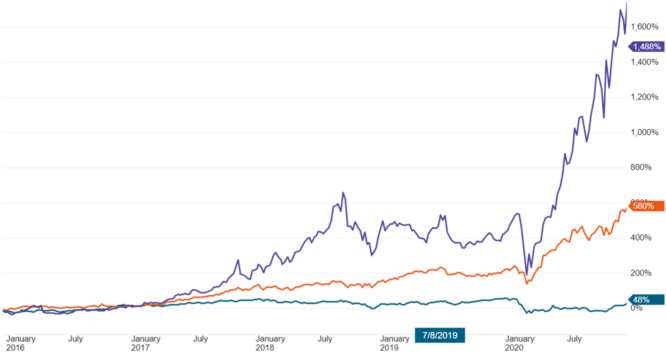

You only need to look at the business of Ant Group in Mainland China, N26, Revolut, Monzo and other challenger banks in Europe, PayPal (ticker: PYPL) and Block (ticker: XYZ) in the United States during the past period. The market value has repeatedly hit new highs. On the contrary, Citi’s stock price has almost stayed in place in the past five years (as shown in the figure below).

Stock price performance of fintechs and Citigroup

The three curves in the figure below are SQ (purple), PYPL (orange), and C (green) from top to bottom. The stock price charts from 2016 to 2020.

Related articles

- “Fannie Mae and Freddie Mac high possibility to relist soon“

- “Companies US has stake, and their stock performance“

- “How to invest in US stocks? sub-brokerage, and fintech“

- ““Too Big To Fall”-best to know 2008 financial crisis“

- “Inside Job”

- “The Big Short“

- “How is banking investment different from other industries? “

- “How did Silicon Valley Bank collapse? What is the impact?“

- “How does JPMorgan Chase make money?“

- “Morgan Stanley, the king of investment banks“

- “Bank of America, too big to fall“

- “Wells Fargo, a major holding once praised by Buffett and Munger“

- “Citigroup, a downward companies“

- “What caused Citi to abandon its retail banking business in 13 countries“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.