Block discussion in my books

I have discussed the company Block (ticker: SQ) in two recent books; including:

In my book “The Rules of Super Growth Stocks Investing“:

- Section 2-3, pp. 126-127

- Sections 3-5, pp. 208-215

- Section 4-1, pages 253-255

In my book “The Rules of 10 Baggers“:

- 5-7, pages 247-251, an entire subsection dedicated to this company

- Section 4-2, pp. 196-197

Company introduction

Company name changed to Block

In November 2021, the company name was changed to Block from Square, but the stock trading code was still SQ, and there was no change; the Square trademark will be used by the Seller department afterward.

Few people in Taiwan know about this company

Due to the long-term stagnation of technological innovations in Taiwan, coupled with the low international vision of the people, most people are indifferent to things outside of Taiwan and have a closed mind. Behind the world ─ ─ such as fintech. Instead of going abroad to play in a bunch of countries on vacation, taking pictures and punching in is called having an international outlook.

I once saw a local newspaper report that a Taiwanese girl complained to her long-time boyfriend that she was dissatisfied that her boyfriend had never been to travel or tour abroad. Unlike she herself arranges overseas trips every season, she think the man has no international outlook. I bet that most Taiwanese have never heard of Block (ticker: SQ), one of the most popular financial startup in the United States.

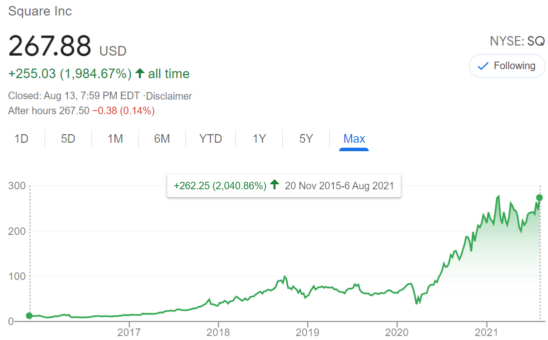

This company has repeatedly flipped and subverted all the scenarios of American consumer finance, its influence is getting bigger and bigger, and it oppresses almost all large and small companies in the US consumer finance sector. Even the new generation of financial giant PayPal does not dare to underestimate it. The following is its stock price chart (from Google Finance) since its listing. It has only been five and a half years since its listing, and it has risen by 2,040%, up to more than 20 times!

Founding of Block

I mentioned Block’s entrepreneurial story in section 4-1 of my book “The Rules of Super Growth Stocks Investing”. Interested readers can refer to the description in my book. I also have several special blog articles to introduce the founder of Block Jack Dorsey and Block company.

If you are deeply interested in the founding process of Block, you can refer to the only book on the market, “The Innovation Stack- Building an Unbeatable Business One Crazy Idea at a Time”. Founder Jack Dorsey is also the founder of Twitter (ticker: TWTR), and he concurrently serves as the CEO of these two important Silicon Valley companies. He resigned as CEO of Twitter in November 2021, and currently serves as CEO of Block.

Block company logo: from Block

Block founder Jack Dorsey

Regarding Dorsey, the founder of Block, please refer to other blog articles in my blog:

- For a brief introduction to Dorsey, please refer to “Introducting Jack Dorsey, the low-key Silicon Valley leader“.

- About Jack Dorsey and Bitcoin, please refer to “Incredible Bitcoin fanatical supporter, Jack Dorsey“.

Block main business

Block’s main financial landscape

| Block’s main financial landscape | Revenue and growth rate, Q2 2021 (in US$ billion) | Business |

| Cash app | 0.606B, +87% Y/Y | Super app for mobile finance |

| Square (Seller ecosystem) | 1.31B, +81% Y/Y | SMB merchants daily operation ecosystem |

| Spiral (CryptoCurrency) | 2.72B, +300% Y/Y | Bitcoin only, Spiral, TBD54566975 |

| Afterpay | 0.321B, +107.1% Y/Y (H2 2020) | BNPL |

| Digital bank | N/A, starting July 2021 | Digital bank |

Block’s main financial landscape: from Block

After reading the above table, you will suddenly realize why Block’s stock price is so expensive-P/E value is 234, P/S value is 7.5, please note that it is now a profitable company. Indeed, because of its four major sectors, the worst sector has revenue growth of 81%, and the other two sectors have annual growth of 300% and 107.1%; this is not easy, because the combined market value of Block and Afterpay is US$155 billion. It is not easy for most companies of this size to maintain annual revenue growth even if they have to maintain more than 30%.

You may hardly imagine that it was also substantially oversold more than a year ago in March 2020, and it fell by as much as 55% in less than a month (the Dow Jones index fell by 38% at most), and the stock price has fallen at the lowest point US$ 37.8; it can be seen that many investors do not know this gold mine (in September 2018, Block’s stock price was as high as US$ 100 when it was at its highest).

Cash App

Regarding the Cash app, please see my discussion in section 2-3 of my book “The Rules of Super Growth Stocks Investing”. It currently has 40 million user accounts. Basically it is a super financial program similar to Alipay, providing mobile payments, fund transfers, cryptocurrency transactions, debit card payments, salary transfers, buying and selling stocks, billing, utility rate transfer deductions, payment, etc.; plus all the services of digital banks. Block started to provide banking services in July 2021, and all services are basically integrated in this Cash app.

Block’s payment dongle (from Block)

Square- Seller Ecosystem

This is a business group gradually expanded from the payment card hardware invented when Block was first founded. This part has now become the company’s main source of revenue; it provides various services required by SME (small and medium enterprise) customers during their operations, including:

- It is suitable for payment hardware or POS machines of various sizes in different industries or different usage scenarios.

- Payment, loan, accounting, invoicing, salary, inventory, personnel management, customer management, marketing, schedule, and other solutions with common functions that all companies need.

- Industry software: The most common type of industry software for small and medium-sized enterprises, such as the catering industry, beauty industry, and retail industry.

- E-commerce: Provide customers with a convenient software platform, allowing customers to provide online transaction services, operation management; and even provide outbound services.

- Software market: dedicated to Block’s various software and solution integration, open system interface, or API.

CryptoCurrency

Please note that Block only supports Bitcoin trading, and the turnover of Bitcoin transactions accounts for a very large proportion of Block’s total turnover, but the profit is extremely low. Even so, Bitcoin trading is still very important to Block, because Block provides a platform that ordinary people can easily trade Bitcoin. You don’t have to deal with some professional cryptocurrency platforms such as Coinbase (ticker: COIN) or Binance. It can be completed by using the Cash mobile program provided by Block for general payment and transactions, no additional application required.

Block founder Jack Dorsey himself is a long-time fanatic of Bitcoin. I also have a special article on this blog to introduce Jack. For Dorsey’s thoughts and vision in this regard, you can refer to this article “Jack Dorsey, a fanatical supporter of Bitcoin“

BNPL Afterpay

On August 1, 2021, Block announced the acquisition of Afterpay at a sky-high price of US$ 29 billion. Obviously, the addition of Afterpay can enable Block to enter BNPL’s service, as well as many other important areas. Please refer to blog article I wrote about this matter, “Why is Block acquiring Afterpay so much?“

Digital banking

Block has obtained a U.S. banking license and began to provide digital banking (Neobank) business services in July 2021; it provides general banking services including deposits, checks, and loans. However, at the beginning, the Block banking service was not open to provide general public services. Currently, it is mainly provided to SME customers; however, it may be extended to general public in the future.

Revenue details and percentage estimation

Based on the 2021 earnings report, as well as analysts’ estimates of revenue details, the revenue, details, and percentages of Block’s two major divisions, Square and Cash, are as follows.

Square- Seller Ecosystem

| Business | Revenue srouce | 2021 revenue estimation ($ million) | Revenue percentage | |

| Transaction fee | Fee income charged by merchant’s payment amount | 4,383 | 84% | |

| Subscription and service fee | Finance and software service | 664 | ||

| Square Loan | Loan services to merchants | 259 | 5% | |

| Square Card | Merchant can withdraw the fund received through the Square Card | 68 | 1% | |

| Instantd Deosit) | Pay additional 1.5% fee to cut fund arrival time from 1-2 days to instant | 241 | 5% | |

| Other subscription service | Reservation management, inventory management, restaurant management, online store management, invoice management, customer relation management, business data analysis and other services | 97 | 2% | |

| Hardware | Reader, mobile POS, POS devices | 146 | 3% |

Cash App

| Business | Revenue source | 2021 revenue estimation ($ million) | Revenue percentage |

| Transaction Fees, Revenue Subscriptions, and Service Revenue | Users’ daily payment in Cash app at the supported merchant, company charges the merchant’s fee income | 410 | 18% |

| Cash Card | Ccompany charges a certain percentage of handling fee when the user consumes through the card | 790 | 34% |

| Instant fund transfer, card fund transfer, Cash for Business | When the user uses a credit card for P2P transfer, a certain fee is required | 964 | 42% |

| Others, except bitcoin | Cash loan, interest income from the user’s balance in the Cash app | 140 | 6% |

| Bitcoin transaction | The company acts as a market maker and records the total price of bitcoin sold to users as revenue | 10013 | 100% |

Huge Potential Ahead

As mentioned earlier, it has been less than six years since Block went public. Compared with PayPal or other financial technology companies, Block is still a kid, and there is a great possibility. And at present, almost all of its revenue is based on the United States, and it has not been vigorously spread to other countries at all (by comparison, PayPal is almost ubiquitous in the world).

Finally, Jack Dorsey, the founder of Block, is the most underestimated entrepreneur comparable to Steve Jobs and has a long-term vision beyond contemporary business people. This is why he founded and serve both Block and Twitter at the same time the reasons for the chief executives of two important listed companies (you read that right, it is Block and Twitter). He was also forced away by the Twitter he founded. When Twitter was about to fall to the ground five years ago, he was greeted as the chief executive of Twitter. Without him, Twitter may have fallen apart, or bankruptcy ceased to exist.

Regarding Dorsey, the founder of Block, please refer to other blog articles in my blog.

Related articles

- “You should know the company Square (rebraned to Block)“

- “What company is Nubank owned by Buffett? How it makes money and its advantages?“

- “Bitcoin ETF spot trading approval has far-reaching impact“

- “Enlightenment of Bitcoin reaching new heights“

- “Cryptocurrency ETFs drive surge in related companies“

- “How do Coinbase and Binance make money? Advantages comparison“

- “How to react when holdings are shorted by famous institutions?“

- “What is the metaverse? any related companies? Are there any related companies? “

- “What is a non-fungible token (NFT)? Any related stocks?“

- “What is Web 5?“

- “What is Web3? What are the related companies?“

- “Introducting Jack Dorsey, the low-key Silicon Valley leader“

- “Incredible Bitcoin fanatical supporter, Jack Dorsey“

- “Is Afterpay Worth Block (Square) $29 Billion M&A?“

- “The most popular news credit method BNPL“

- “PayPal’s current crisis and appeal“

- “Why PayPal plummeted sharply by 42% from its peak?“

- “PayPal buy bitcoin is it not a good idea“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.