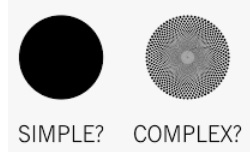

Simpler is better!

Buffett’s most philosophical quote

In my previous introduction to subsections 1-1 at the beginning of Chapter 1 of my book “The Rules of Super Growth Stocks Investing”, I used a famous quote from Buffett’s influential philosophy in the field of investing, “Investment is simple, but it’s not easy.” I personally think that all investors should think clearly about this sentence and understand the meaning behind this sentence; if you think clearly, it will definitely help you.

Keeping it simple is a masters’ consensus

Peter Lynch often cites one of his favorite adages: “If you don’t understand a company, if you can’t explain it to a 10-year-old in 2 minutes or less, don’t own it.” Richard Feynman said, “If we can’t explain it to a freshman we don’t really understand it.”

Most of the historically recognized great investors made decisions by themselves. This must be beyond the imagination of most retail investors. It is extremely important that almost all great investors make investment judgments and decisions “alone”. I mentioned before in my blog article “The advantages of stock investment, except money“. This is the biggest myth of many investors. Having more resources is not an advantage. This is the special feature of stock investment.

Complex and error-prone

Almost all of the most famous and great investors of all time have said that investing is not an exact science. Investing also has nothing to do with the IQ of the investor. To some extent, investing is an art. Overly complex financial models, formulas, and indicator calculations; all complicate investing; all complex things are error-prone, and stock investing is no exception.

Being too obsessed with numerical values will not only be easy to get into the horns, but it will also make people go crazy and enter a dead end, making you forget to think, but you will fall into the myth of seeing the trees but not the forest. It turned into a situation where “Everyone with a hammer in his hand sees anything and thinks it is a nail” in Munger’s words.

Buffett believes: “We like things that you don’t have to carry out to three decimal places. If you have to carry them out to three decimal places, they’re not good ideas.” As discussed in my blog post “I would rather be vaguely right than precisely wrong“, correctness is more important than precision. On the way of investing, correctness and simplicity always trump precision and complexity.

Buffett’s six investing principles

In Buffett’s 1986 letter to shareholders, Buffett laid out the different aspects he and Munger were looking for in new companies, including “simple businesses.” He even went so far as to say that “if there’s lots of technology, we won’t understand it.”

In Berkshire’s 2014 shareholder letter (tickers: BRK.A and BRK.B), Buffett announced that he has the following six requirements for investment and acquisition targets, which are very clear and easy to understand:

- Large purchases (at least $75 million of pre-tax earnings unless the business will fit into one of our existing units),

- Demonstrated consistent earning power (future projections are of no interest to us, nor are “turnaround” situations),

- Businesses earning good returns on equity while employing little or no debt,

- Management in place (we can’t supply it),

- Simple businesses (if there’s lots of technology, we won’t understand it),

- An offering price (we don’t want to waste our time or that of the seller by talking, even preliminarily, about a transaction

- when price is unknown).

Businesses with simple business models are better

Buffett himself has also said that many investments should be as simple as possible, and they are too complicated and prone to error. This is very consistent with his investment principles. For example, the business models of traditional industries are easy to understand. I have also cited it in my book. If a company has been operating the same business for decades, the possibility of error is very low, and the easier to predict. He even listed the simplicity of running a business as one of the six principles of Berkshire’s mergers and acquisitions, which I think he thought deeply about.

Businesses that survive a decade have solid foundations; if they keep doing the same things in the future, the chance of error is low. The reason is easy to understand:

- Because such companies can have enough time to correct all the mistakes they have faced and do all the work that the enterprise should do correctly.

- These types of companies generally have solid fundamentals and little chance of going wrong if they do the same in the future.

There are many reasons why once successful companies have lost their glory and most listed companies have gone downhill. But there is one thing that is bound to happen, and that is what I mentioned in my blog post “Institutional imperative – the good, bad, and ugly” Why? The main reason why big companies will inevitably become bureaucratic and contract the disease of big companies is that everyone wants to find something to do if they have nothing to do, so as to show their value and complicate a simple thing in a small company.

Investing simple and successful

Buffett specifically pointed out: “You only have to do a very few things right in your life so long as you don’t do too many things wrong.” In the book “Lessons for Corporate America”, Buffett mentioned: “Indeed, we’ll now settle for one good idea a year.”

The myth of most investors is that in their careers in stock market investment, they constantly buy and sell, and do everything possible to inquire about various touted stocks, buying high and selling low. Dumping stocks and fleeing the stock market during a crash, and desperately chasing highs and buying during a bull market make things too complicated; in the end, they can’t make money. This is also what I mentioned in my blog article “Great companies are rare, two or three will make you very rich“, a good investment target only needs two or three in a lifetime file is enough.

The easiest way for ordinary investors to accumulate wealth is to hold for the long term. There are no shortcuts for ordinary people to get rich. The easiest way to get rich is to get rich in two steps: (1) Buy assets that can increase the value in the long run (2) Don’t sell them.

Keep it simple in the long run

Buffett himself still can’t figure out: why people have an unhealthy mentality of trying to complicate simple things? Remember! In the world of investing, the simpler the better.

Buffett himself said the same thing in a 2008 Berkshire (tickers: BRK.A and BRK.B) shareholder letter, “Watch out for investment activity that draws applause; great moves are usually accompanied by a yawn.” He emphasized that “You don’t have to do extraordinary things to get extraordinary results.”

Munger’s interpretation

Charlie Munger once said, “Simplicity has a way of improving performance through enabling us to better understand what we are doing.” He believes that nothing is more important than understanding “why” and “how” to invest. As an investor, you must fully understand what financial goals you want to achieve, measure your risk appetite and investment horizon, and evaluate the balance available for investment. Keeping these factors in mind can make wealth creation simpler and more rewarding.

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.