Buffet’s view in shareholder letters Buffett is a big advocate of inaction. In his 1996 letter, he explains why: almost every investor in the markets is better served by buying a few reliable stocks and holding on to them long-term rather than trying to time their buying and selling with market cycles. “The art of investing in … Continue reading “Sloth is a great virtue in stock investment”

Category: Simplility

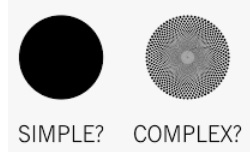

Simplicity and discipline, the invisible benefits of investing in ETFs

Simplicity and discipline, the invisible benefits of investing in ETFs, Less people noticed simplification and discipline are two great benefits of investing in ETFs that are invisible.

Creativity is worthless in investment

The consensus and practical practices of the above three investment masters are in conflict with seeking innovation and change or seeking creativity.

Do it right a few times in your lifetime is enough

Do it right a few times in your lifetime is enough, Good investments are very rare, I quoted Charlie Munger, “Good investments are very ‘rare’, and when this once-in-a-lifetime investment opportunity presents itself, you have to bet all your chips.” in my book “The Rules of Super Growth Stocks Investing”

Richer, Wiser, Happier

Richer, Wiser, Happier. You may have read a lot of reviews of this book “Richer, Wiser, Happier”, but I’m going to talk about this book in a different way and from a different perspective.

The simpler the investment, the better

The simpler the investment, the better, Buffett’s most philosophical quote, In my previous introduction to subsections 1-1 at the beginning of Chapter 1 of my book “The Rules of Super Growth Stocks Investing”, I used a famous quote from Buffett’s influential philosophy in the field of investing,