Introduction

Company Profile

What I want to introduce today is a well-known company Procter & Gamble (ticker: PG) that I mentioned in the last section 5-6 of my book “The Rules of Super Growth Stocks Investing”. What? If you haven’t heard of this company, or have never used any product from this company, you may be a stowaways who just came from the moon!

Founded in 1837, the company name has almost become synonymous with household items such as soap and toothpaste. Another reason Procter & Gamble is famous is that it has a strong marketing organization and it is the first choice for graduates of top business schools who do not want to work for Wall Street but want to pursue a career in brand marketing.

A story

I remember that during the financial tsunami in 2008, when the U.S. stock market crashed for several consecutive days, an American reporter went to the New York Stock Exchange to interview a famous analyst and asked him what to do, what else is safe now? Is there a stock to buy? (slightly sarcastic). Unexpectedly, the analyst responded very appropriately: “Just buy Procter & Gamble!” This interview has left a deep impression on me to this day.

The stock can be safely held for a century

Please pay special attention to the word “century”.

Why is it better than the S&P 500 index?

As I blogged about, if there is one stock in the world that is worth “holding forever,” it has to be the S&P 500. (please see my post “S&P 500 index, the only stock worth holding forever“) But I’ll make a slight correction today. If you don’t buy ETFs, Procter & Gamble should be a stock worthy of your permanent holding. So why is it better than the S&P 500 index? The reasons are as follows:

- Unaffected by the economic situation, people still have to take a bath, wash their hair, and shave.

- The stock market crashed, corrected sharply, and entered a bear market with less impact on Procter & Gamble’s share price. You can take a look at all the historical stock price comparisons. Under these systemic factors, Procter & Gamble’s stock price will of course fall, but its decline should only be comparable to utility stocks.

- Some investors refuse to invest in ETFs that track the broader market for a variety of reasons, such as bias.

- All ETFs pay an annual custodial fee, which in the long run, is compounded and can eat up a lot of your returns. In terms of the lowest IVV and VOO among the ETFs tracking the S&P 500, there is still 0.03%!

- Past achievements: The S&P 500 has only existed for 53 years, but Procter & Gamble has existed for nearly 200 years (founded in 1837, listed in 1890, and listed companies in the US stock market older than it, there are, but very very very few)!

- Procter & Gamble’s share price volatility is much lower than that of the S&P 500 index. Its beta value is only 0.4, which means that Procter & Gamble’s share price volatility is only 40% of the broader market.

Stock price performance in past decads

Well, it looks good, but the stock price shouldn’t go up very much, just like the cowhide of the utility stocks, right? Then you are deadly wrong.

| Period | Procter & Gamble total return | S&P 500 Index total return |

| Past 40 years | 59,07% | 37,88.64% |

| Past 30 years | 14,46% | 10,42.67% |

| Past 20 years | 301% | 315.07% |

| Past 10 years | 145% | 278.64% |

| Past 5 years | 93% | 112.89% |

From the table above, strictly speaking, only the past ten years have underperformed the S&P 500. This is because the past decade has been the result of a major bull market rarely seen in U.S. stocks in the past three decades. For the rest years, no other year is worse than the S&P 500.

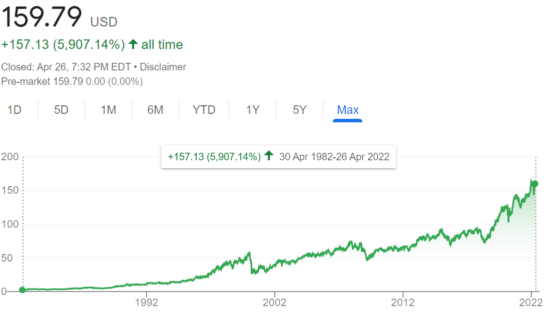

Here’s a chart of its stock price over the past 40 years:

Dividend hike for 65 consecutive years

Procter & Gamble has paid dividends for 132 consecutive years and Procter & Gamble has raised its dividend every year for the past 66 years. There are companies that the US stock market can compare with in this regard, but there are very, very, very few. There are only three, as I listed in 5-6 of my book “The Rules of Super Growth Stocks Investing”.

The most recent dividend hike was announced in April 2021, when the board approved a 10% increase in the quarterly payout to 86.98 cents per share. The current yield is 2.2%.

As I’ve said time and time again, “Past performance is no guarantee of future results.” But when it comes to paying dividends, a decades-long track record can be very reassuring.

How are operations and valuations?

The following table shows Procter & Gamble’s 2021 operating performance and current valuation data:

| Index | Number |

| 2021 annual revenue | $76.118 billion +7.28% |

| 2021 annual net income | $14.352 billion +9.53% |

| Market Capital | $383.38 billion |

| Share price | 159.79 |

| P/E | 27.92 |

| P/S | 4.88 |

| Dividend Yield | 2.29% |

Products and moats

Strong band and product portfolio

It’s a testament to its entrenched position in the consumer staples market. It carries a range of trusted brands such as Bounty tissues, Crest toothpaste, Gillette razors, Tide cleansers. Its popular brands of hair care, personal care, and baby care products such as Head & Shoulders, Pantene, Oral-B, and Pampers are sold in more than 170 countries.

These are products that households buy on a regular basis, regardless of economic situation. Therefore, companies can boldly issue reliable dividends for a long time regardless of the economic situation.

Procter & Gamble has an impressive 37,000 active patents, and invests $2 billion in research and development every year. These numbers demonstrate its commitment to innovation and its ability to continuously improve its products, which are fundamental reasons for its status as the world’s top company.

Competitiveness

100 years later, people still have to bathe, wash their hair, and shave; the best-selling products in the hypermarket are its products. Do you think you disdain these things? Well, didn’t the U.S. inflation break a 40-year high recently? All these items have been raised. These items are the main livelihood products that will be investigated by the inflation rates of various countries.

The power to raise prices is the moat.

Suitable for everyone

Please note that it is “everyone” stock. In the stock market, there are very few individual stocks suitable for everyone to hold, but Procter & Gamble is definitely one of them.

In everyone’s circle of competence

I have written the following two articles on this blog, readers can search:

- “Circle of competence“: Procter & Gamble’s products, Bounty tissue, Crest toothpaste, Gillette razor, and Tide cleaner, have been used by everyone.

- “Discover the possibility of super growth stocks in the civilian production industry“: It is difficult for non-tech stocks to find super growth stocks, isn’t it Procter & Gamble?

Buffett’s favorite

Buffett once said: “The best companies are those that can use a large amount of incremental capital at a very high rate of return over a long period of time.” This means that investors should directly choose companies with a higher return on invested capital (ROIC)., such as Procter & Gamble 13.5%, Apple 28%.

Because Gillette razors, the relationship between Buffett and Procter & Gamble is complicated. It was one of his biggest holdings until 2016, when he sold most of it in exchange for its subsidiary, Duracell battery. Buffett’s current remaining position, though small, is still a vote of confidence that Procter & Gamble fits his investment model.

As of September 30, 2021, Berkshire held 315,400 shares of Procter & Gamble, valued at approximately $50.8 million.

Related articles

- “Possibility of long-term holdings, Deep dive on Buffett’s case“

- “Cintas makes a lot of money from selling uniforms“

- “Global stock markets performance comparision over the past 30 years in a table“

- “How does Nike make money? The role model of growth stocks in non-tech industry“

- “Discover the possibility of super growth stocks in the civilian production“

- “Circle of competence“

- “S&P 500 index next year performance, based on last century record“

- “Return rate comparison among Buffett portfolio, Berkshire stock price, S&P 500 over the years“

- “2022 S&P 500 Constitutent Stocks Performance“

- “Stocks Better than the S&P 500, Procter & Gamble (P&G)

- “S&P 500 vs. Nasdaq 100 index, how to choose a market index?“

- “S&P 500 index, the only stock worth holding forever“

- “Querier to Annualized rate of return for S&P 500 Index“

- “S&P 500 P/E ratio has been rising in the past century, S&P 500 PE Ratio and Average Querier“

- “A table comparing S&P 500, Nasdaq, Dow Jones, Philadelphia Semiconductor Index over the years since its inception and annualized returns“

- “Most investors should invest ETFs tracking broader market“

- “Investors should care annualized rate of return (IRR), How to calculate?“

- “US issued ETFs tracking US market is your best bet“

- “Top 10 ETFs and important major US stock market index“

- “Disadvantages of ETF investment“

- “Any strong reason to buy mutual fund?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.