The S&P 500 index represents US stocks

Since the launch of the S&P 500 by Standard & Poor’s, it has gradually been accepteded globally as a representative of the market returns of U.S. stocks market. Therefore, not only in US stocks, the S&P 500 can be said to be the most important market index for the world’s financial market. Welcome to my two previous related articles “S&P 500 index, the only stock worth holding forever” and “A table comparing S&P 500, Nasdaq, Dow Jones, Philadelphia Semiconductor Index over the years since its inception and annualized returns“.

The famous SPY, IVV, and VOO ETFs track this index.

Features of this Querier

Querier to Annualized rate of return for S&P 500 Index provides two features:

- Enter two sets of years to query the annualized return of the S&P 500 between any two years

- If the two years entered are the same, you can query the annual return of the S&P 500 for that year

How to use this querier?

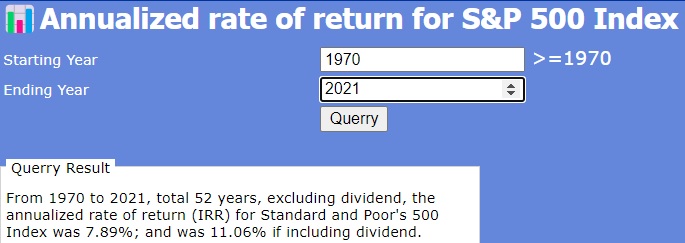

Users simply click on this link to connect to the Querier to Annualized rate of return for S&P 500 Index and see the following screen:

The user only needs to enter the following two fields on the screen:

- Starting Year: For example, in the example in the screen, we enter 1970

- Ending Year: For example, in the example in the screen, we enter 2021

After the input, click the “Query” button on the screen, and you can see the querry results in the “Query Results” area.

Table for US stock investment toolset

Special reminder

For all major market index annualized return query tools listed in the table; including Taiwan Stock Index, Dow Jones Index, S&P 500 Index, Nasdaq Index, Philadelphia Semiconductor Index, not only annualized return query , you can also query the index return rate in any year──just enter the year you want to query in both the start and end fields.

The following is a list of must-have US stock investment free tools developed by Andy Lin:

For the detail, please see “Free online US stock investment toolset".

Related articles

- “Stocks Better than the S&P 500, Procter & Gamble (P&G) “

- “Global stock markets performance comparision over the past 30 years in a table“

- “S&P 500 index next year performance, based on last century record“

- “Return rate comparison among Buffett portfolio, Berkshire stock price, S&P 500 over the years“

- “2022 S&P 500 Constitutent Stocks Performance“

- “Stocks Better than the S&P 500, Procter & Gamble (P&G)

- “S&P 500 vs. Nasdaq 100 index, how to choose a market index?“

- “S&P 500 index, the only stock worth holding forever“

- “Querier to Annualized rate of return for S&P 500 Index“

- “S&P 500 P/E ratio has been rising in the past century, S&P 500 PE Ratio and Average Querier“

- “A table comparing S&P 500, Nasdaq, Dow Jones, Philadelphia Semiconductor Index over the years since its inception and annualized returns“

- “Investors should care annualized rate of return (IRR), How to calculate?“

- “Most investors should invest ETFs tracking broader market“

- “US issued ETFs tracking US market is your best bet“

- “Top 10 ETFs and important major US stock market index“

- “Querier to Annualized rate of return for Taiwan Stock Exchange“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.