The importance of the China market cannot be overemphasized. More than 10% of listed US companies, 14.98% of Taiwanese companies income come from China

Taiwan’s negative bias, ignore China‘s significant progress

Taiwan’s media reports on China have always adopted a negative stand or starting point; often the same thing is clearly an achievement of China, and the title (sometimes even the content) is also described as negative. This is actually a pity, because we understand Chinese and know China better than people in other countries in the world, so we should make good use of this advantage.

Taiwanese people’s international vision is inherently narrow, coupled with the fact that they have turned a blind eye to or deliberately downplayed the many amazing achievements of mainland China, causing many Taiwanese to still subjectively believe that mainland China is far behind Taiwan; it can only be said that this view is true.

It is a typical frog at the bottom of a well, showing the ignorance mentality. To be fair, in recent years, China’s rise and rapid economic growth have indeed benefited all countries around China. This is an indisputable fact. Few Taiwanese should know that the 2021 Fortune Global 500 list was released: China ranked first in the number of companies on the list for the second year in a row.

China’s influence on global corporations

In its 2021 research report, Bank of America (US stock code BAC) listed 303 listed companies (with a total market value of more than US$19 trillion), with at least 5% of their revenue coming from mainland China. In the past 20 years of global GDP growth, about 30% came from mainland China, which is higher than the 21% in the United States

Taiwan’s dependence on mainland China

According to the statistics of the Financial Regulatory Commission, as of the third quarter of 2021, 1,202 Taiwan listed companies have invested in the mainland, accounting for 73.52% of the total number of 1,635 listed companies. In 2020, Taiwan’s exports to China and Hong Kong accounted for 43.9% of Taiwan’s total exports, annual increase of 14.6%, setting a new record for the same period in the previous year.

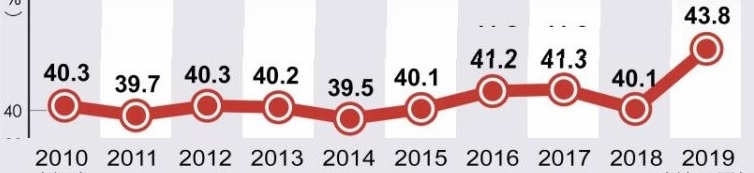

In the case of Taiwan, please take a look at the following information from the Ministry of Finance of Taiwan. In the past ten years, how much Taiwan’s economic dependence on mainland China is? However, there is even the ridiculous self-deception ignorance, who said without embarrassment, “This means that mainland China’s industry is heavily dependent on Taiwan.”

Figure 1: Taiwan exported to China and Hong Kong in 2020, x axis is US$ 100 millions, y axis is month, gray line is monthly increase v. previous year. (from Chinatimes.com)

Figure 2: Taiwan exported to China and Hong Kong, from 2010 to 2019, red line numbers is the percentage number of total Taiwan exports (from Chinatimes.com)

Not only that, in the first three quarters of 2020, Taiwan’s listed counters recognized China’s interest of NT$ 276.9 billion, which will exceed NT$ 548.1 billion in 2020, an annual increase of 11.72%, setting a new record high (information released by the FSC). In 2020, the interest of all listed companies in Taiwan is 3.66 trillion, which means that 14.98% are from mainland China (the actual number will only be higher than this). Everyone can think about the impact of the loss of mainland China’s revenue for Foxconn (Taiex code: 2317, ticker: HNHPF), a famous Taiwanese listed company with the top three market capitalizations.

Taiwanese companies’ earnings in China hitting new high every year

According to the comparison chart of the amount of Taiwan’s investment in mainland China in the past 10 years and the investment income recognized by listed companies provided by CRIF (China Credit Information Service). Due to the Sino-U.S. trade war and changes in the investment environment in China, the growth of Taiwan’s investment in the mainland has declined significantly in recent years. However, the income of Taiwan listed companies in mainland China has become more and more anomalous. This is similar to most People’s perceptions are completely different.

Most Taiwanese have a sense of superiority in the face of mainland China. They have been alive 20 years ago, believing that mainland Chinese manufacturers can only make low-priced or low-quality products. As an investor, if you still have such deep-rooted ideas in your heart, it will be a very dangerous thing. For how important China is to all listed companies in the world, please refer to my explanation on section 4-1 of the book “The Rules of Super Growth Stocks Investing”.

Without China, many multinational companies that you and I are familiar with may lose at least 1/5 of their market value, and may not even have their current status. Imagine that if Alphabet and Facebook can now operate in China, then the market value of these two companies can be increased by 20% in the worst case, and the best case can threaten Apple and Microsoft’s (both company’s 2 trillion US dollars in listed value) ability to operate in China.

The importance of Chinese market to U.S. companies

China has not only had a significant impact on the countries around China, even the United States. The following is what I know about the importance of the Chinese market to some well-known U.S. stock-listed companies (the figures come from the 2020 financial reports of various companies):

| Company (ticker:) | Chinese market to the companies |

| Apple (AAPL) | 14.68% of total revenue in 2020, the second largest market. But Apple’s App Store’s US$ 643 billion sales billing is 47% in China and only 27% in the United States. |

| Facebook (META) | 10% of total revenue in 2018, the fifth largest market (please note that Facebook is banned in China) |

| Amazon.com (AMZN) | The top 100,000 Chinese merchants account for 58% of the total, while US merchants account for only 36% |

| Tesla (TSLA) | 21.11% of total revenue in 2020, the second largest market |

| Nike (NKE) | 12.3% of total revenue in 2020, the second largest market |

| Starbucks (SBUX) | 10.98% of total revenue in 2020, the second largest market |

| Nvidia (NVDA) | It will account for 25% of the total revenue in 2023, the second largest market; if including the Chinese major customers in Singapore, the Chinese market actually accounts for 40% of the company’s total revenue. |

| Texas Instruments (TXN) | 55% of total revenue, No. 1 market |

| Qualcomm (QCOM) | 60% of total revenue, No. 1 market |

| Intel (INTC) | 26% of total revenue, No. 1 market |

| IPG Photonics (IPGP) | 42% of total revenue, No. 1 market |

| Las Vegas Sands (LVS) | 63% of total revenue, No. 1 market |

| Wynn Resorts (WYNN) | 70% of total revenue, No. 1 market |

According to a 2021 research report by Bank of America (BAC), at least 5% of the revenue of 79 S&P 500 companies come from mainland China. The correlation between the S&P 500’s earnings per share growth and the economic growth of mainland China soared from zero in 2010 to 90%, exceeding the importance of US gross domestic product (GDP) growth to US listed stocks.

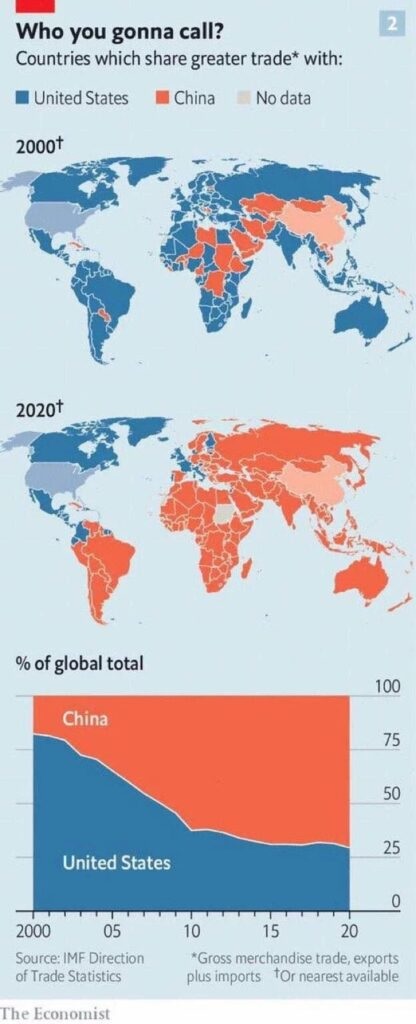

Total trade volume between China and the United States

The latest issue of The Economist published an article. First, please take a look at the figure attached to this article. The red part indicates countries whose total trade volume with China’s imports and exports exceeds that of the United States:

In just 20 years, these three sets of pictures are shocking. The conclusion is that in most countries, the total trade volume of imports and exports with China has surpassed that of the United States.

China’s GDP

Mainland China’s GDP in 2020 is RMB 101.5 trillion (US$14.72 trillion), an annual increase of 2.3% (don’t forget that there is an pandemic. This year, all major global economies in the world have negative growth, and only China has positive growth); the United States is US$ 20.935 trillion, an annual decrease of 2.3%.

China’s total economic output accounts for 17% of the world’s total. Mainland China plans to surpass the United States in GDP by 2030, and Japan expects that China’s GDP will surpass the United States in 2028, much ahead of the original forecast of 2036. The mainland’s contribution to the world economy is estimated by the mainland to maintain 25-30% in the next 5-10 years.

The figure below is a chart of the growth trend of the total GDP of China and the United States from 1985 to last year made by CNBC.

Remove bias and don’t dance with the media

The biggest devil of investors is prejudice, especially the fallacy and bigotry that scorn the facts. The capital market cares about facts, the stock market reflects the facts of business operations for a long time, and the intrinsic value of stocks comes from the performance of business operations, rather than media trends, mainstream opinions, or one’s own wishful thinking, nor is it political manipulation. As mentioned earlier, 14.98% of the income of Taiwan listed companies and at least 10% of the income of US listed companies come from the Chinese market (the larger the company, the higher the percentage).

The world is highly rely on China’s supply chain

Please note that this is only the money that companies make from the Chinese market; if the dependence on China’s manufacturing and supply chain is added, the degree of dependence on China of the world’s major companies is much larger than this and the percentage.

In February 2021, the American Chamber of Commerce in China conducted a poll survey. 94% of the interviewed companies were optimistic about the Chinese market, and none of the interviewed companies indicated that they would completely withdraw from China (because it is impossible, not because of money or government orders It can be done; the governments of the United States and Japan have shouted for several years, what about now? Isn’t this report the answer). Whether you like it or not, China will affect all investors in the world. China’s market, achievements, and influence on the world will only increase, and you cannot turn a blind eye or avoid it deliberately.

Never double standard

All investment methods, judgments, and rules must be consistent. This is the basic principle of investment principles. The standards for all companies must be consistent. Do not have double standards. Don’t discount or add points because of prejudice or any reason. The market will not turn around because of our personal expectations. Among the three reasons I listed on section 1-2 of the book “The Rules of Super Growth Stocks Investing”, the stock price will rise, bias is not there.

Related article

- “The gap between China Technology and US”

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.