In recent years, cryptocurrencies (also known as virtual currencies) have been regarded as the most attractive and profitable new economic activity in the world. As of February 2021, there are 8,200 cryptocurrencies issued globally, 8,600 cryptocurrency exchanges, more than 100 million cryptocurrency users, and the total value of cryptocurrency assets is as high as 2 trillion US dollars.

Starting to affect the stock market

Cryptocurrencies will grow rapidly, not only because more and more merchants accept cryptocurrencies as transaction and payment tools, but also because of the rapid increase in companies and institutional investors start to invest in cryptocurrencies, such as Block (ticker: SQ) just bought 8,027 bitcoins, MicroStrategy (ticker: MSTR) bought 90,000 bitcoins, and Tesla (tickere: TSLA) bought $1.5 billion worth of bitcoins in 2020.

The college properties or retirement funds of prestigious schools such as Harvard, Yale, Brown, and the University of Michigan have also purchased cryptocurrencies as long-term alternative assets to increase the diversification of asset allocation. Even the most conservative American pension plan operators , such as ForUsAll have also begun to accept customers to include cryptocurrencies in pension plans.

These “snap-buying” actions have boosted the popularity of the overall cryptocurrency market transactions. Even since the second half of 2020, the price fluctuations of a small number of cryptocurrencies, such as Bitcoin, have also begun to affect the rise and fall of the stock market.

High price volatility

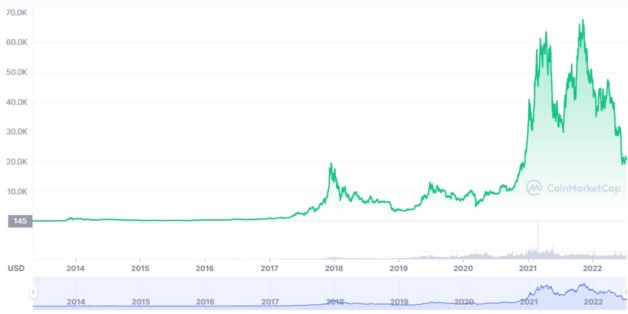

From an investment point of view, one of the reasons for the rapid rise of cryptocurrencies in the near future is the high price volatility, that is, the opportunity for high returns. Taking Bitcoin as an example, at the beginning of October 2020, the price was about 10,500 US dollars, and on April 14, 2021, the price soared to a maximum of 64,929 US dollars, a jump of 517% in just half a year; but then it plummeted to 34,877 on May 29. The dollar fell 38% in just one and a half months. Short-term price booms and busts have occurred twice in the past with Bitcoin and with other cryptocurrencies.

Figure 1. Bitcoin prices have the characteristics of short-term surges and crashes (Source: coinmarketcap.com)

Start attracting public investment

As a result, the investment charm of cryptocurrencies has quickly spread from enterprises and institutional investors to the general public. The American Financial Planning Association and the “Financial Planning Journal” released a survey report in June 2021. In the past six months, 49% of respondents’ clients have asked about cryptocurrency investments, much higher than 17% in the same period in 2020. Wall Street, the most sensitive to the capital market, actively develops various cryptocurrency-related derivative financial products, ETFs, or various funds in order to capture the early profit of this star asset.

How to invest in cryptocurrencies?

At present, there are two ways to participate in the growth of cryptocurrencies through investment: the first is to directly invest in cryptocurrencies, and the main types of investment platforms, such as Coinbase (ticker: COIN), can trade more than 50 cryptocurrencies. The other is like Block can only trade Bitcoin.

The second is to invest in the stocks related to cryptocurrency. I believes that the general investment public, due to the limited risk tolerance, should be a smarter and safer cryptocurrency participation strategy. You should choose currency-related stocks to invest.

For Coinbase, please see my post: “How do Coinbase and Binance make money? Advantages comparison“.

Companies related to cryptocurrencies

According to my research, there are five categories of companies that are more related to cryptocurrencies in the investment market: trust funds investing in cryptocurrencies, cryptocurrencies trading providers, professional platforms for cryptocurrency transactions, cryptocurrencies mining equipment manufacturers, and companies that already hold cryptocurrency assets (see table 1 for details).

| Company name | Ticker | Cryptocurrency related business | Note | Relevance score |

| Grayscale Bitcoin Trust | GBTC | Listed targets with the highest correlation with cryptocurrencies | ETF-like trust fund | 0.81 |

| Block | SQ | Has 8,027 bitcoins, mobile app to trade bitcoin, will launch bitcoin hardware wallet | A total of 3 million in 2020, and one million users will buy bitcoin for the first time through the Cash program in January 2021 | 0.58 |

| PayPal | PYPL | Mobile App to Trade Cryptocurrencies | 392 million digital wallet users can directly trade cryptocurrencies | 0.43 |

| Coinbase | COIN | The largest cryptocurrency professional trading platform in US | 11.1% of global crypto assets held in its custody | 0.32 |

| Kraken | Private | The fourth largest cryptocurrency professional trading platform | Coinbase’s competitor | |

| Nvidia | NVDA | CMP (Miner Chip), GPU (Graphics Chip) | Leaders in graphics chips, data centers, artificial intelligence, autonomous driving, etc. | 0.29 |

| Canaan | CAN | bitcoin mining machine | The world’s second largest bitcoin mining machine manufacturer | 0.4 |

| Ebang International | EBANG | Bitcoin mining machine, and cryptocurrency exchange Ebonex.io | The world’s third largest bitcoin mining machine manufacturer | 0.4 |

| Riot Blockchain | RIOT | Bitcoin mining with 1,565 bitcoins | Mining machine, cryptocurrency investment, related technology | 0.6 |

| Marathon Digital | MARA | Bitcoin mining with 5,292 bitcoins | Bitcoin mining | 0.6 |

| MicroStrategy | MSTR | Owns 92,079 Bitcoins | Company’s main business is cloud data analysis | 0.73 |

| Silvergate | SI | Digital currency service | Innovative financial infrastructure solutions and services | |

| Overstock | OSTK | Pioneer in accepting bitcoin payments with $175 million worth of bitcoin and blockchain assets | Company’s main is online furniture retail | 0.57 |

| Tesla | TSLA | Buy $1.5 billion worth of Bitcoin in 2020 | Will accept bitcoin for car purchases | 0.55 |

Table 1. Representative companies of the 5 major categories of cryptocurrency concept stocks, data source: The relevance score is quoted from MarketWatch.

People should not invest directly

Although there is no doubt about the future of cryptocurrencies, due to the high knowledge threshold, and the price fluctuations are too violent and easy to be hyped, the risks are far greater than the well-known derivative financial products or financial leverage. It is not advisable to invest directly. Instead, you can invest in companies related to cryptocurrencies, and you can also participate in their high-growth business opportunities.

I am the author of the original text, the abridged version of this article was originally published in Smart monthly magazine.

Related articles

- “Cryptocurrency ETFs drive surge in related companies“

- “Bitcoin ETF spot trading approval has far-reaching impact“

- “Enlightenment of Bitcoin reaching new heights“

- “Investing in cryptocurrency is not as good as investing in related companies“

- “How do Coinbase and Binance make money? Advantages comparison“

- “Incredible Bitcoin fanatical supporter, Jack Dorsey“

- “PayPal to buy cryptocurrencies is it not a good idea“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.