Company Profile

JPMorgan Chase is named after the founder of one of the companies in the group, which has long been inseparable from the banking industry. The merger of its businesses involved many of its major competitors in the past. For example, Chemical Bank, Chase Bank, etc. were merged, and many subsidiaries of the same name were forced to give up their independence, and then merged into the JPMorgan Chase Group. JPMorgan Chase group remains a major provider of banking services to the high-net-worth group, despite in developed or emerging markets. JPMorgan Chase group has often taken advantage of every situation to enter emerging markets, where wealth is often concentrated in the hands of a few people.

How special is the status?

How important is the status of JPMorgan Chase & Co. (ticker: JPM), please see the following statistics:

- It is the world’s largest bank by market capitalization (the world’s fifth largest bank by total assets).

- America’s oldest bank.

- America’s largest credit card issuer.

- America’s most diversified bank.

- The rep of Wall Street.

An indicator role in the global financial world

Since JPMorgan Chase & Co. is not an ordinary bank, the moves are interesting. And the company is big enough to influence the government’s business or economic policies, and is a typical too big to fall business. Governments of various countries will also refer to the company’s practices when formulating financial policies. As for banks around the world, almost all of them use JPMorgan Chase as the main model for operation.

The most obvious of these is that JPMorgan Chase & Co. will hire outgoing political leaders (including the former Prime Minister of the United Kingdom) or government executives in charge of business, finance, or treasury (such as Li Xiaojia of the Hong Kong Stock Exchange) in various countries, and spending huge on policy lobbying shows the abundance of its political connections.

CEO

JPMorgan’s CEO is not a simple person enough. The current CEO, Jamie Dimon, was already a rising star in the U.S. banking industry before taking over as JPMorgan Chase & Co., and he is expected to succeed JPMorgan Chase’s CEO sooner or later. He is the protagonist behind the birth of the current Citibank (ticker: C), and later took over as the CEO of Bank One, became Chief Operating Officer of JPMorgan Chase in 2006.

Amazon (ticker: AMZN) founder Bezos (Note: Bezos was a senior executive at D. E. Shaw, a well-known quantitative investment firm on Wall Street before founding Amazon), once strongly praised JPMorgan Chase Bank Dimon. “If I were a big shareholder in JPMorgan Chase, I would just show up every Monday morning with like pastries and coffee for Jamie,” says the Amazon founder. “I think he’s a terrific executive in a very complicated company.”

From 2016 to 2018, Dimon was the highest-paid CEO of publicly traded U.S. companies. Dimon not only has a huge influence on Wall Street, but has even served as the chairman of the “Corporate Roundtable” for many times.

Major M&A History

The oldest predecessor institution of JPMorgan Chase & Co., The Bank of the Manhattan Company is the third oldest banking company in the United States and the 31st oldest bank in the world. The earliest known predecessor is The Bank of the Manhattan Company, founded by Aaron Burr, who transformed the company from a water carrier company into a bank.

The main body of the company, JP Morgan & Co., is a commercial and investment banking institution founded in 1871 by John Pierpont Morgan, a legendary celebrity in American business history. This company is the common predecessor of the world’s three largest banking institutions, JPMorgan Chase, Morgan Stanley (ticker: MS) and Deutsche Bank (ticker: DB).

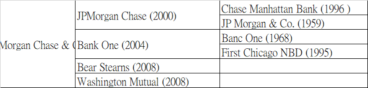

JPMorgan’s current structure is the result of the merger of several large U.S. banking companies since 1996. JPMorgan Chase & Co. has been able to achieve its current size and position mainly through years of uninterrupted mergers and acquisitions. The following are some of the most important large-scale mergers and acquisitions:

Main business

The revenue performance of each segment in 2021 is as follows:

| Group revenue | Number ($ million) |

| Investment banking | 13,216 +39.32% |

| Trading | 16,304 -9.53% |

| Deposit and lending | 7,032 +8% |

| Wealth managment | 21,029 +15.69% |

| Security investment | (345) vs 802 |

| Mortgage | 2,170 – 29.8% |

| Credit card | 5,102 +15.04% |

| Other income | 4,830 -0.72% |

| Non-interest revenue (all items above this line) | 69,338 +6.05% |

| Interest revenue | 52,311 -4.13% |

| Total revenue | 121,649 +1.42% |

2021 Financial Performance:

| Index | Number ($ million) |

| Revenue | 121,649 +1.42% |

| Pre-provision profit | 50,306 -5.61% |

| Provision for credit losses | (9,256) |

| Net income | 48,334 +65.92% |

| Market capitalization | 466,206 |

| Book value per share | 88.07 |

| ROE | 19% |

| ROA | 1.3 |

| Loans | 1,077,714 |

| Total asset | 3,743,567 |

| Deposit | 2,462,303 |

| Long-term debt | 301,005 |

| Allowance for loan losses to total retained loans | 1.62% |

Market valuation

| 2021 | JPMorgan Chase | Bank of America | Wells Fargo | Citigroup |

| Market capitalization ($ billion) | 361.68 | 299.15 | 167.88 | 98.82 |

| Share price | 123.03 | 37.13 | 44.16 | 50.1 |

| P/E | 9.13 | 10.58 | 9.18 | 5.91 |

| Dividend yield | 3.25% | 2.26% | 2.26% | 4.07% |

| Total asset ($ billion) | 3,743.567 | 3,169.495 | 1,948.068 | 2,291.413 |

| ROA | 1.3% | 0.9% | 0.9% | 0.9% |

| ROE | 19% | 11.6% | 10.4% | 11.9% |

Stock performance in past 10 years

The following is JPMorgan Chase (158.63%), Bank of America (203.35%), Wells Fargo (17.01%), Citibank (6.65%); compared to the stock price chart of the S&P 500 (158.64%):

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.