Introduction

The predecessor of IBM was ITR, which was founded in 1906. Later, the two companies merged and CTR (Computing Tabulating Recording) was established in 1911.

Company profile

International Business Machines (ticker: IBM) is the oldest and most well-known information company in the United States. Its main business is technology and consulting service, and its main customers are governments and enterprises. IBM has made great achievements in the fields of materials, chemistry, physics, materials and other sciences, finance, and software, and invented many products. The more famous ones include certain semiconductor process technologies, hard drives, Swaps in the financial world, magnetic stripes for credit/debit cards/ATM cards, ATMs, SQL language, relational databases management systems, DRAM, and early AI systems Watson.

Thirty or forty years ago, IBM’s position in the global technology world was unparalleled, even more so than today’s top five or top seven technology companies. And it was the position of domination and no rival. It was IBM’s invention of the personal computer in the 1980s that influenced IBM (which has since gone downhill) and the global technology world.

The company’s growth history

IBM is the most important technology company in the history of the United States. Although it has lost its glory, its growth history affects the entire technology industry. Here’s what I’ve put together, some of IBM’s most important achievements:

- In 1937, IBM’s tabulation machinery enabled it to process large volumes of data.

- In the late 1940s, the mechanical computer was changed to the vacuum tube and electronic computer used by the US Army.

- In 1964, the 360 series mainframe computers were developed, using the latest integrated circuit technology, which established IBM’s position as the dominant computer in the mainframe.

- In 1969, IBM invented the magnetic stripe card, which was later widely used in credit/debit/ATM cards everywhere.

- In 1974, IBM developed the Universal Product Code.

- Early 1980s. IBM’s mainframe computers and operating systems (such as OS/VS1 and MVS) that run on them, as well as software architectures and components such as CICS, have a near-monopoly market share of enterprise information systems, especially in the global financial industry and large corporations. It was almost standard equipment and became the system IBM is best known for.

- In the 1980s, IBM developed personal computers that used an open architecture so that other manufacturers could produce and sell compatible components and software to IBM.

- In June 1982, Columbia Data Products introduced the first IBM PC-compatible personal computer. In November 1982, Compaq Computer (ticker: HPQ) announced the development of the first IBM PC-compatible portable computer, the Compaq Portable (produced in March 1983).

- In 1981, IBM and the World Bank launched the idea of financial swaps, which have affected the global financial market so far.

- In 1991, IBM spun off the printer business Lexmark.

- In 2011, IBM gained global attention with the launch of its artificial intelligence system, Watson. Watson beat game show champions Ken Jennings and Brad Root.

- In the early 1990s, the strong competition from personal computers and workstations, decreased in sales of mainframe computers (System/360, z series), the company began to suffer losses.

How is the company doing?

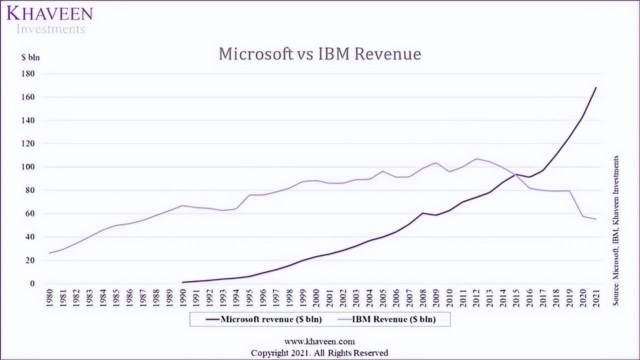

I use the following picture to illustrate how IBM has been doing in past 4 decads, all without words. The thin trend line is IBM and Microsoft is the thicker trend line.

Figure 1: IBM and Microsoft 1980 to 2021 revenue comparison chart (original image from Khaveen), note that Microsoft went public in 1986.

Ginni Rometty

Ginni Rometty, CEO of IBM, who is important in IBM’s corporate history:

- She is the only female CEO in IBM company history, and there are only ten CEOs in the history of this century-old enterprise.

- The nine years of her tenure in office from 2012 to 2020 were the watershed for IBM to get to where it is today. Revenue not only stagnated, but also decreased significantly, which is simply unbearable.

- During her tenure in power, Microsoft’s revenue began to significantly surpass IBM’s (see Figure 1). Microsoft has its current status by relying on the DOS operating system that IBM’s personal computer gave it in the 1980s.

- In the past nine years of mobile computing and cloud computing in the technology world, IBM has missed all of it.

- Buffett’s holdings coincided with Rometty’s reign, and I remember that Buffett had a lot of respect for her “in the beginning.”

This history Bufett doesn’t want to mention again

On November 14, 2011, Buffett spent $10.7 billion. Invested in IBM, and continued to buy and increase its holdings for three years to become the largest shareholder, reaching 64 million shares. The acquisition cost was about US$167.19 per share, accounting for 5.4% of IBM’s outstanding shares and became the largest shareholder. But Buffett believes that “this is a failed investment”, because the stock price has fallen all the way after buying it, and it was only $150 per share when it was cleared in 2015.

Acquisitions, divestiture, and spin-offs

Acquisitions

Since the company is currently focusing on the development of cloud, consulting, and artificial intelligence businesses, in the past ten years, most of the major corporate mergers and acquisitions have been in these fields, and most of them are small companies. We omit these smaller acquisitions here and mention only the most important ones.

- In 2002, it acquired PwC Consulting, the consulting arm of PricewaterhouseCoopers Company, and merged it into its IBM Global Services division.

- In 2009, acquired SPSS.

- On October 28, 2015, the B2B data business of The Weather Company was acquired.

- On October 28, 2018, it acquired Red Hat, the world’s largest hybrid cloud service provider, for $190 per share in cash.

Divestiture

IBM has a tradition of regularly selling low-profit or loss-making divisions due to its large corporate organization. Here are some of the more famous examples:

- In December 2002, the desktop hard disk business was sold to Hitachi for $2.05 billion.

- In 2005, the company sold its PC business to Lenovo.

- In January 2014, the x86 server business was sold to Lenovo for $2.3 billion.

- In 2015, IBM decided to adopt a “fabless” model of semiconductor design, while transferring manufacturing operations to GlobalFoundries (ticker: GFS)

- In January 2022, sold Watson business.

Spin-offs

On October 8, 2020, due to the transformation of the business focus from traditional business to high-profit cloud computing business. IBM spun off its IT infrastructure services division into a separate publicly traded company called Kyndryl (ticker: KD).

Business and stock performance

Business focus

IBM’s current revenue share is concentrated because it is only distributed in 3 large areas:

| Revenue ($ million) | Percentage of total revenue | |

| Software | 24,141 | 42.09% |

| Consulting | 17,844 | 31.11% |

| Infrastructure | 14,188 | 24.74% |

| Finance | 774 | 1.25% |

| Other | 404 | 0.7% |

| Total revenue | 57,350 | 100% |

Business performance

| Year 2021 | IBM | Microsoft |

| Revenue ($ million) and growth rate | 56,571 +4.39% | 168,088 +17.53% |

| Gross income ($ million) and growth rate | 31,486 +2.02% | 115,856 +19.52% |

| Operating income ($ million) and growth rate | 5,772 +3.15% | 69,916 +31.56% |

| Net income ($ million) and growth rate | 5,743 +2.74% | 61,271 +38.37% |

| Gross margin | 55.66% | 68.93% |

| Operating margin | 10.20% | 41.59% |

| Net margin | 10.15% | 36.45% |

Stock valuation

| 6/29/2022 | IBM | Microsoft |

| Market capitalization ($ trillion) | 0.12338 | 1.95 |

| Share price | 137.18 | 261.01 |

| P/E | 22.54 | 27.23 |

| Dividend yield | 4.81% | 0.95% |

| Stock performance in past 5 years (S&P 500 was+57.54%) | -6.88% | +278.66% |

Investors’ reward

Other financial indicators

IBM’s net debt as a percentage of market capitalization is 79.7%. IBM’s debt/equity ratio is 5.94 times.

For IBM, except for gross margins, all margins are declining compared to the 5-year average.

ROE, ROTC and ROA ratios have deteriorated over the past 5 years due to declining profit margins. Also, asset turnover and cash from operations were poor.

Total returns

Total investment return over the past 5 years; total stock return plus dividend yield. Overall, the annualized total return is 3.88%.

Dividends

IBM’s dividend growth rate was 0.77%. But dividend growth has continued to slow from a 10-year CAGR of 8.17% to 3.6% (5 years) and 2.42% (3 years) over the past 10 years.

Related articles

- “How does IBM make money? What’s next?“

- “What kind of company is Accenture, the McKinsey of technology industry?“

- “How does the resurrected Dell make money?“

- “How does HP make money? The pros and cons of investing in HP“

- “Supermicro valuation is not justified and unsustanable, no worth for long-term holding at current level“

- “Is Buffett no longer hold for long haul? TSMC, HP, and US Bancorp cases study“”

- “How does database monopoly Oracle make money? What are the prospects?“

- “How Microsoft makes money? Where is the future?“

- “Microsoft, the dominant overlord of cloud computing“

- “How does Salesforce make money? Why is it so successful?“

- “What company is Snowflake owned by Buffett? Where is its value?“

- “Deep dive on Snowflake’s competitiveness“

- “Veeva, the king of industry systems in the lifescience industry“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.