AbbVie discussion in my books

I have discussed the company AbbVie (ticker: ABBV), relative industry or topics, in my latest two books; including:

In my book “The Rules of Super Growth Stocks Investing“:

- Section 2-3, page 103, discussion on patents

In my book “The Rules of 10 Baggers“:

- Sections 3-4, pp. 143-154, discussion on the healthcare and pharma

Company profile

AbbVie’s (ticker: ABBV) parent company, Abbott (ticker: ABT), was founded in 1888 by Wallace C. Abbott(I discussed Abbott in my previous post”Abbott, the world’s most important medical device and nutritional food supplier, how does it make money?“). Then in 2013, Abbott’s pharmaceutical division was spun off and became an independent listed company AbbVie. So far, Abbott and AbbVie, the two publicly traded companies, have been very successful, and each is considered one of the top leaders in the medical device and pharmaceutical fields.

Business Overview

Bad news

The better-known bad news about AbbVie is that revenue from its most important immune drug, Humira, is declining year over year. Biosimilar competition is taking its share of the market in Europe, and to make matters worse, biosimilars will enter the US market next year.

Good news

But the good news: AbbVie has other drug products that could make up its revenue. AbbVie said it expects combined sales of two other immunotherapy drugs, Skyrizi and Rinvoq, to surpass Humira’s top revenue. Both drugs could eventually be used for Humira’s indications. In the first quarter of 2022, Skyrizi’s sales increased by more than 63%, and Rinvoq’s sales increased by more than 53%.

The Acquisition of Allergan

AbbVie’s beauty line is also strengthening, thanks to AbbVie’s $63 billion acquisition of Allergan, known for its beauty products, in 2019. Allergan manufactures and sells the well-known anti-wrinkle product Botox and Juvederm, a filler for injectable gels. Shows beauty-related revenue growth of more than 20% in the first quarter of 2022 to $1.3 billion.

How is the performance vs. peers?

business performance comparison

In 2021, Johnson’s and Johnson’s, Abbvie, Merck and Pfizer’s business performance are shown in below table, respectively.

| Index | JNJ | PFE | ABBV | MRK |

| 2021 total revenue ($ billion) | 93.775 +13.55% | 81.288 +95% | 56.197 +22.69% | 48.704 +17.31% |

| Pharmaceuticals | 52.08 +14.28% | 79.557+95% | 56.197 +22.69% | 48.704 +17.31% |

| Medical devices / Pfizer is CDMO | 27.06 +17.86% | 1.731 +87% | 0 | 0 |

| Nutrition | 14.645 +4.1% | 0 | Spin off as Abbott | Spin off as Organon |

| Gross margin | 68.27% | 62.28% | 69.65% | 72.81% |

| Operating margin | 26.92% | 33.02% | 35.29% | 32.56% |

| Net margin | 22.26% | 27.04% | 22% | 26.79% |

Stock price comparison

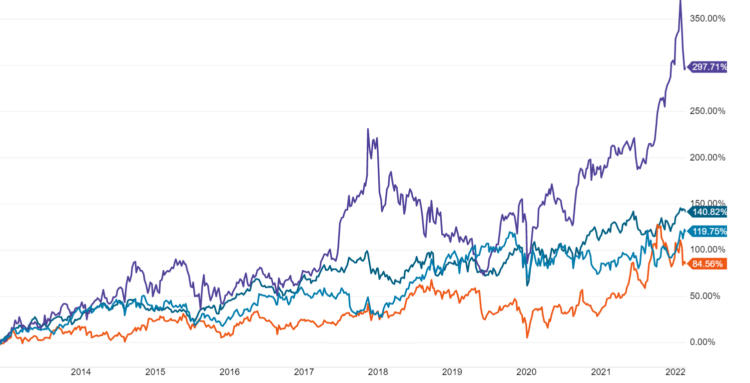

In the past 10 years, the stock prices of Johnson & Johnson, Pfizer, Merck, and AbbVie, as shown in the chart below, have risen by 119.75%, 46.11%, 84.56%, 140.82%, and 297.71%, respectively.

Stock performance comparision

| | JNJ | PFE | ABBV | MRK |

| Market captalization (billion) | 474.54 | 277.14 | 259.43 | 221.61 |

| Share price | 180.46 | 49.07 | 146.88 | 87.65 |

| P/E | 24.31 | 12.5 | 22.76 | 15.68 |

| P/S | 5.08 | 3.51 | 4.91 | 4.1 |

| Dividend yield | 2.5% | 3.26% | 3.84% | 3.15% |

Business outlook

Dividends

AbbVie is also the king of dividends, with a long-term dividend yield of nearly 4.1%, well above the market average of around 1.7%. Part of the reason why its long-term dividend yield is so high is that its top-selling drug Humira has seen revenue decline due to generic competition, leading to a depressed stock price.

Outlook for the next few years

The company has two alternative medicines that AbbVie believes should make up for expected lost revenue, so its future still looks bright. Its quarterly revenue has grown more than 49% over the past three years, and its quarterly free cash flow has grown 195% over the same period. In addition, it has the largest total number of drugs in development pipeline, and multiple of these drug under development have been submitted to the FDA for review at the same time.

Importantly, AbbVie is likely to continue to grow significantly even as Humira’s revenue declines. According to Statista, it is on track to become the No. 1 pharmaceutical company by global prescription drug market share by 2026.

AbbVie has released results to investors. It has risen more than 80% over the past three years. But given future growth, there could be better underlying performance going forward. That’s why holding for the next decade might be a good idea for long-term investors.

Related articles

- “Weight loss is the future golden goose of the drug market “

- “Gilead, lord of antiviral drug, reveals world’s first AIDS vaccine“

- “Viking is developing two future star new drugs at the same time“

- “FDA approved first ever MASH drug“

- “Alzheimer, the only major disease yet to be conquered, current progress and related companies“

- “Why Eli Lilly become global pharmaceutical market value king?“

- “Big pharma spin-offs, and advantages to invest them“

- “Eli Lilly, a big pharma with astonishing valuation“

- “Pfizer, the world’s largest pharmaceutical company“

- “Novo Nordisk’s new diabetes drug Semaglutide,Ozempic,Wegovy and Mounjaro found to have surprising weight-loss effects“

- “The next No. 1 pharmaceutical leader AbbVie“

- “Stable Dow Component Merck, how does it make money?“

- “The ex-largest pharma Merck“

- “Abbott, the world’s most important medical device and nutritional food supplier, how does it make money?“

- “Roche, the king of anti-cancer“

- “How the best AAA credit rating Johnson & Johnson makes money?“

- “How does dominated Intuitive Surgical make money?”

- “Eli Lilly, a big pharma with astonishing valuation“

Disclaimer

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.