In addition to remdesivir, Gilead also holds other ace drugs of antiviral drugs, including the world’s first oral compound single-pill preparation and the first vaccine for a complete treatment regimen for HIV (AIDS) infection; the world’s first vaccine that can cure chronic type C Oral medications for hepatitis C (HCV); and several medications that can help effectively control chronic hepatitis B (HBV).

Category: Pharmaceutical

Viking is developing two future star new drugs at the same time

Viking is developing VK2735 for weight control and VK2809 for MASH

FDA approved first ever MASH drug

Madrigal’s Resmetirom was approved by the FDA on March 14, 2024, becoming the first new NASH hepatitis drug to be regulatory approved in history

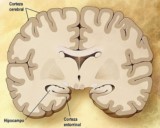

Alzheimer, the only major disease yet to be conquered, current progress and related companies

Alzheimer’s is the only major disease yet to be conquered, and is the leading cause of dementia, the seventh leading cause of death in the world.

Why Eli Lilly become global pharmaceutical market value king?

It is recommended that you also read my previous post related to Eli Lilly (ticker: LLY): Two future star drugs in hand Because it holds two future star drugs, Eli Lilly is very likely to become the world’s first listed pharmaceutical company with a market value of more than one trillion US dollars! With Alzheimer’s … Continue reading “Why Eli Lilly become global pharmaceutical market value king?”

The ex-largest pharma Merck

Merck, once the world’s largest pharmaceutical company, lost its throne due to a strategic error

Eli Lilly, the world latest largest pharma with astonishing valuation

Eli Lilly can be said to be the pioneer of insulin drugs, and weight loss drugs are its future hope

Weight loss is the future golden goose of the drug market

The blue ocean of weight loss is the future golden goose in the pharmaceutical market, and Monzaro is the future superstar

Pfizer, the world’s largest pharmaceutical company

Pfizer is the world’s largest pharmaceutical company by revenue. With operations in 129 countries around the world, Pfizer’s international sales account for nearly 50% of its total sales.

Novo Nordisk’s new diabetes drug Semaglutide,Ozempic,Wegovy and Incretin found to have surprising weight-loss effects

Novo Nordisk is one of the world’s major pharmaceutical companies supplying insulin for the treatment of diabetes, and insulin is its main business.