My previous articles in 5-5 of the book “The Rules of Super Growth Stocks Investing” and my blog post of “Why stock split? the strong reasons and impacts” and “The valuation influence of stock liquidity and stock split on listed companies“, on the stock split of US stocks. This article will provide in-depth statistics, updates, introductions, views, and discussions on the rekindled trend of U.S. technology stock splits this year.

US stock splits

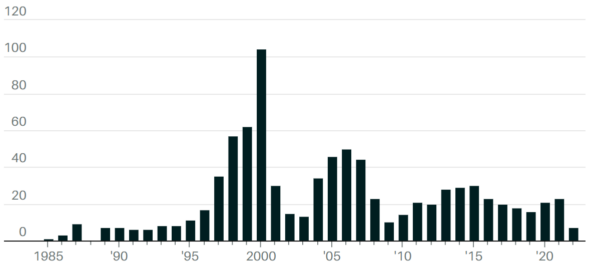

There were 12 S&P 500 constituents in 2011, and six in 2020 underwent stock splits. Over the past decade, U.S. stocks have had about 20 stock splits a year, according to Dow Jones Market data. The real heyday was during the tech bubble of the late 1990s. Between 1997 and 2000, an average of 65 U.S. companies underwent stock splits each year.

Figure 1: From 1985 to March 2022, the number of companies that have conducted stock splits in US stocks each year (Source: Dow Jones Market)

And Table 1 is a list of the most famous stocks for stock splits among the technology stocks in the US stock market from 2020 to April 2022.

| Year | Ticker | Split ratio |

| 2022 | AMZN | 20-for-1 |

| 2022 | GME | 4-for-1 |

| 2022 | ANET | 4-for-1 |

| 2022 | GOOGL | 20-for-1 |

| 2022 | GOOG | 20-for-1 |

| 2022 | SHOP | 10-for-1 |

| 2022 | NTDOY | 10-for-1 |

| 2022 | FTNT | 3-for-1 |

| 2022 | TSLA | 3-for-1 |

| 2021 | CSGP | 10-for-1 |

| 2021 | ISRG | 3-for-1 |

| 2021 | NVDA | 5-for-1 |

| 2020 | AAPL | 4-for-1 |

| 2020 | TSLA | 5-for-1 |

| 2020 | TTD | 10-for-1 |

Table 1: List of more famous stocks that will undergo stock splits in U.S. stocks from 2020 to 2022

Main business considerations

Stock splits lower the trading price of each share, making the stock more affordable for more people. Therefore, it can increase the liquidity of stocks and expand the number of shareholders, which will increase the coverage of the company in the social class, which is helpful to the image of the company, and of course, it will also increase the influence of the company on the society. The word Stakeholder in English means not only the holder of the company’s shares, but also a stakeholder).

The stock price is too high, and retail investors can only buy fractional shares. Unlike Taiwan’s, the fractional shares in the United States are designed like ETFs or stock funds containing high-priced stocks, allowing retail investors to buy their favorite high-priced stocks at any time with limited funds on hand.

Another reason why companies carry out stock splits is to join the Dow Jones Index, because the Dow Jones Index is not weighted by market capitalization but weighted by stock price. Failure to do a split will make the Dow Jones Index distortedly fall to high-priced stocks, so Apple (ticker: AAPL) and Visa (ticker: V) will join again. The Dow was previously required to conduct a stock split.

Generally speaking, companies hope that the stock price is relatively kept within a certain price range, which was between US$30 and 70 30 years ago, and will be split when it exceeds 80 or 100; the most typical example is Nike (ticker: NKE), Starbucks (ticker: SBUX), McDonald’s (ticker: MCD) all follow this rule. At that time, the common stock trading price was only IBM (ticker: IBM) that would remain above 100 for a long time. Now it’s $50 to $200 ($1 30 years ago equals $0.51 today because of inflationary currency depreciation).

However, the median price of a stock in the S&P 500 is about $118, with 8 companies’ stock price exceeds $1,000. A company’s stock split represents the management class of the company. In the long run, it is absolutely confident that the company’s stock price will rise in the long run with its long-term outlook.

Because the three major U.S. exchanges have mandatory rules for automatic delisting of stock prices below $1 for a long time, companies will not do so unless they have confidence in their own stock prices. Moreover, the outstanding and successful listed companies in the US stock market will certainly continue to carry out stock splits, with almost no exceptions.

Some companies are reluctant to split

The main reason is that after the stock split makes the stock cheaper, it will attract too many shareholders, which may lead to an increase in the number of shareholders, and the increase in liquidity will encourage short-term operations, resulting in large fluctuations in stock prices. Moreover, it may also introduce active investors to interfere in the business direction of the enterprise, which is not conducive to the long-term operation and decision-making of the enterprise.

These are things that companies that insist on sustainable operation do not want to see, including Berkshire Hathaway (tickers: BRK.A and BRK.B) in the early days, and now many shareholders with a small number of shareholders. A typical examples are some financial holding companies similar to Berkshire Hathaway, their share price are generally a few thousand dollars. They are reluctant to conduct sotck split.

Common stock splits

In addition to the common split method of splitting one into multiple shares, U.S. stocks also have a reverse stock split mechanism. Twenty or thirty years ago, it was mostly a two-for-one split, but now because individual stock prices are getting higher and higher (especially many tech stocks), a 5-for-1 or a 10-for-10 is common.

Another type of split method is reverse stock split, which combines multiple shares into one share. The effect is that the stock price looks higher and can avoid the fate of being delisted. Therefore, companies that carry out reverse stock splits generally reveal negative signs of long-term operation.

Stock splits influence to stock prices

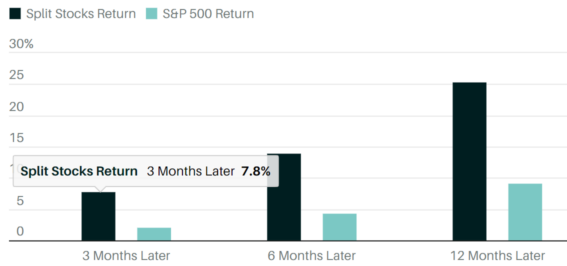

Stock splits have a huge short-term impact on stock prices, especially in the weeks before the effective day. Just before the effective days, due to the media or re-reports, investors’ memories will rise again for a few days. Figure 2, the numbers speak for themselves: Since 1980, S&P 500 stocks have risen an average of 7.8% in the three months following an announcement of a stock split, according to researchers at Bank of America Securities. Over a 12-month period, the stock has outperformed the index by an average of 16 percentage points.

Figure 2: Share price performance of S&P 500 constituents that have announced stock splits over the next 3 to 12 months since 1980 (Source: Bank of America)

However, in the medium and long term, the short-term bullish increase in stock splits will usually not be reflected, and even those with poor operating performance will fall back to the stock price before the company announced the split. Therefore, most of the retail investors or short-term investors who buy will see the actual split of the stock as a profit and sell it all because these people will not hold it for a long time.

There are fewer long-term institutional investors or retail investors who will choose to increase their holdings due to stock splits, because institutional investors and existing long term investors usually have a good understanding of individual stocks and have their own rhythm of adding and subtracting weights. Stock split is not materially helpful moves that change views on individual stocks.

That’s the main reason Buffett has repeatedly stated that stock splits are a pizza split effect that doesn’t make any real difference to a company’s stock. Although in the long run, the individual stocks undergoing stock splits are still mostly optimistic about the rise, but the company’s prospects and the actual stock price will rise, which has nothing to do with the stock split itself, and the actual rise and fall after the stock split is still depends on the performance of individual stocks. Ultimately, investors welcome stock splits because of the appearance of the stock’s success, not the result of a stock split plan.

Chapter 5, 5-5, of my book, “The Rules of Super Growth Stocks Investing”, which I published last year, has a detailed description of stock splits and dividends in U.S. stocks. Readers are welcome to refer to them.

I am the author of the original text, the abridged version of this article was originally published in Smart monthly magazine.

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.