Without Apple, there would be no Arm

Category: PE Ratio

PayPal’s current crisis and appeal

PayPal in my two books In my book “The Rules of Super Growth Stocks Investing“: In the book “The Rules of 10 Baggers“: How bad is it? The pandemic catalyst is no longer In the two or three years before 2021, PayPal’s stock price, like most technology stocks, has repeatedly hit new highs. Since the … Continue reading “PayPal’s current crisis and appeal”

Monster Beverage’s monster level stock returns

Monster Beverages with Monster Level Stock Returns In the 21st century alone, investing in Monster Beverages has returned over 110,000% in share price!

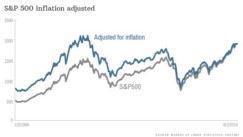

Why do stock prices automatically rise with inflation?

The origin of this article A friend wrote to me, the original text is: “I read your blog article and mentioned that “stock prices will automatically rise with inflation”. After thinking about it for a long time, I still don’t understand it. Could you please give me a practical example to help me out? Let … Continue reading “Why do stock prices automatically rise with inflation?”

For Taiwanese stock investors investing in U.S. stocks

Nine out of ten Taiwanese stock investors who invest in US stocks are experienced investors in Taiwan stocks, and they are investors who have only invested in US stocks in recent years.

S&P 500 P/E ratio has been rising in the past century, S&P 500 PE Ratio and Average Querier

S&P 500 P/E ratio has been rising in the past century, S&P 500 PE Ratio and Average Querier

Misunderstanding of price and value – Ge Ba’s wonderful views on the article

Misunderstanding of price and value – Ge Ba’s wonderful views on the article. This article was from Mr. Ge Ba’s feedback my blog post “Misunderstanding of price and value”.

Amazon vs. Alibaba

The businesses of Amazon and Alibaba are almost the same in all aspects, so the two are highly comparable. Just as Amazon’s stock price is not very good this year, and Alibaba has collapsed by more than 40% now, let us compare the two e-commerce giants in China and the United States.

Rule 40, perfect for SaaS companies

Rule 40. Investors are most concerned about the growth of the company and how much money it can make. In particular, the profitability conditions for companies listed on the US stock market are relatively loose, unlike Taiwan or China, which highlights corporate profitability as a necessary condition for listing.

Valuation methods significant different between US and Taiwan investors

Valuation methods significant different between US and Taiwan investors, P/S vs P/E ration