If the “Buffett indicator” is less than 50%, it means that the stock market is seriously undervalued, between 50% and 75% it is slightly undervalued, between 75% and 90% it is reasonably valued, between 90% and 115% it is slightly overvalued, and high At 115%, it is seriously overvalued.

Category: Economics

Fintech’s valuation plummeted and current dilemma

Fintech is no longer a super new blue ocean in the technology and financial circles ten years ago.

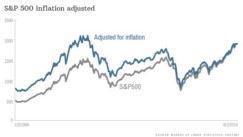

U.S. stocks have experienced zero returns twice in more than a decade due to inflation

U.S. stocks have experienced zero returns twice in more than a decade due to inflation – 1968 to 1982 and 1964 to 1981

Why are only US stocks the most valuable for long-term investment?

The factors that many investors worry about listed in this article will not cause too much harm to the long-term investment value of US stocks.

US credit rating downgrade by Fitch, the easons and implications

Fitch announced on August 2, 2023 that it would downgrade the US credit rating by one notch from the top AAA to AA+

Will Sino-US confrontation, de-globalization, and de-dollarization affect the long-term investment value of US stocks?

Sino-US confrontation will not hurt U.S. stocks too much.

The relationship between GDP and stock prices

GDP (gross domestic product) growth is positively correlated with stock market. Buffett Indicator a powerful and persuasive explanation for it.

Inflation-proof investments

Selecting companies that can stand out under inflation is an indispensable factor in Buffett’s investment technique

Investors should not trust forecasts

Buffett admits he has no ability to forecast In his 1966 letter to shareholders, Buffett set out his views on investor should care about company performance but not market performance. The following parts in italics are my complete excerpts: “I am not in the business of predicting general stock market or business fluctuations. If you … Continue reading “Investors should not trust forecasts”

Why do stock prices automatically rise with inflation?

The origin of this article A friend wrote to me, the original text is: “I read your blog article and mentioned that “stock prices will automatically rise with inflation”. After thinking about it for a long time, I still don’t understand it. Could you please give me a practical example to help me out? Let … Continue reading “Why do stock prices automatically rise with inflation?”