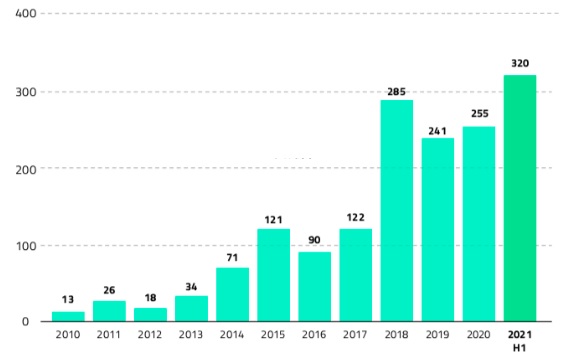

Number of unicorns

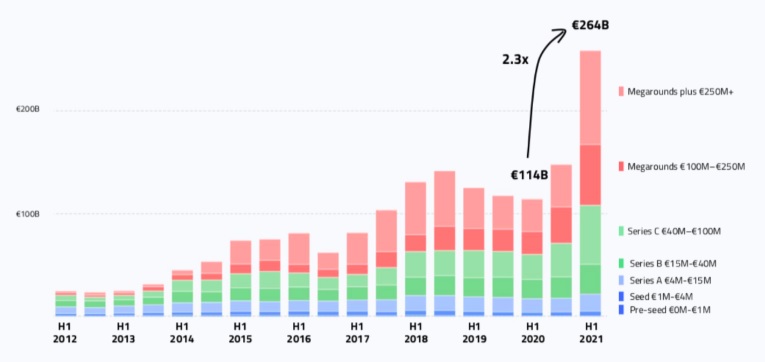

According to the Dealroom report, there have been 1,601 technology companies around the world that have crossed the $1 billion milestone since 1990. In the first half of 2021, unicorn companies have grown fiercely, with more than two unicorns being born every day. In 2021, global venture capital broke the previous record, reaching a total of 264 billion euros, a year-on-year increase of 2.3 times.

From 2010 to 2021, the number of unicorns in the world is counted.

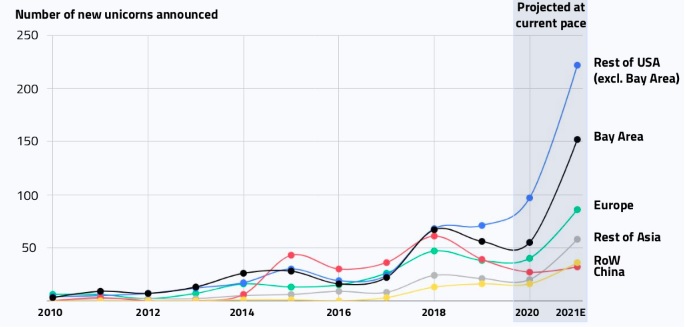

The origin of the unicorn

The below table is the distribution map of unicorns:

- The United States (the blue part in the picture below) accounted for 53%

- China (shown in red below) accounted for 17%

- Europe (the green part of the figure below) accounts for 17%

- Asia except China (the gray part in the figure below) accounts for 8%

- Other regions (the yellow part in the picture below) 4%

Unicorn’s annual birth chart

The following chart shows the status of unicorns in each major region from 2010 to the present more clearly:

- The blue line represents the United States

- The red line represents China

- The green line represents Europe

- The gray line represents Asia excluding China

- The yellow line indicates China and other regions

The city where unicorns live

The figure below shows the number of cities with at least one unicorn:

Global Venture Capital Investment Trend

The following picture shows the trend of global venture capital investment in development capital from 2012 to the present. Blue represents early capital investment, green represents mid-term capital investment, and red represents later capital investment.

The total value of the technology company

At present, the total value of global technology companies has reached 35 trillion U.S. dollars, of which technology companies established after 1990 are worth 27 trillion U.S. dollars, and technology companies established after 2010 are worth 10 trillion U.S. dollars. To give you a comparative concept, IBM was founded in 1896, and it took 45 years to reach 1 billion US dollars in revenue in 2020.

It is particularly worth mentioning that US technology companies are worth 24 trillion U.S. dollars (the entire S&P 500 index is 32 trillion U.S. dollars). They contribute 50% of domestic R&D and about 70% of artificial intelligence experts.

Related articles

The following is an overview of the development of new innovative technologies in some important countries in my blog, or brief articles:

- “Traitorous Eight, the origin of the semiconductor and venture capital industries“

- “The Power Law“

- “Zero to One“

- “Venture capital and unicorns introduction“

- “Global Venture Capital and Unicorn Report“

- “Let’s talk about TikTok “

- “Failed Taiwan Software Industry Policy“

- “The hardware and software gap between China and US, is all China-made software and hardware possible?“

- “Japan is already a country of mediocrity, not as advanced as you think“

- “South Korea’s emerging technology giant“

- “Beyond your imagination of Israel’s strong venture capital and tech strength“

- “Reasons of the success Israel’s technology nation“

- “Israel stock market and tech giants“

- “Booming India stock market and the emerging Indian tech giants“

- “Indians do well in the US, India’s weak and uncompetitive industries

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.