The history of venture capital and technology in the United States

What I want to talk about in this post is a just-published English book “The Power Law”. It is recommended that you should read this book if you want to have a deep understanding of the technology industry in the United States and the venture capital industry. This book can be said to be the most complete, clear, and easy-to-read book I ever read in this area.

This book reminds me of another book “Zero to One” written by Founders Fund co-founder and multiple venture capitalist Peter Thiel. Because Thiel also mentioned in his book that the return of the venture capital industry is the concept of the power law.

But I want to emphasize here that the breadth, depth and completeness of “The Power Law” are beyond the reach of “Zero to One“, You can even think of it as a complete history of venture capital or a very small encyclopedia, and Peter Thiel’s is mainly about his own philosophy and views, which are completely different.

The power laws

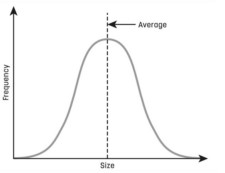

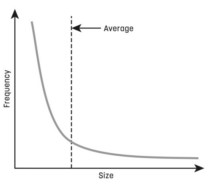

Once Bezos has made a fortune, his chances of getting richer multiply; the more citations a scientific paper is, the more famous it is and the more likely it will attract more citations. Whenever you have an outlier of success times success, you switch from the realm of the normal distribution to the realm governed by power laws.

Illustration of normal distribution

Illustration of power laws

Return on venture capital

The biggest feature of venture capital

The biggest feature of the venture capital industry’s investment is that the main return of the venture capital industry only comes from a small number of investments. Venture capitalist Peter Thiel said: “The biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund.” Benchmark Capital’s Bill Gurley once said: “Venture capital is not even a home-run business, It’s a grandslam business.”

The real numbers

- Horsley Bridge backed 7,000 startups between 1985 and 2014. A small subset of these deals, accounting for just 5 percent of the total capital deployed, generated fully 60 percent of all the Horsley Bridge returns during this period.

- Y Combinator, in 2012 that three-quarters of its gains came from just 2 of the 280 outfits it had bet on.

- To put that in context, in 2018 the top-performing 5 percent of subindustries in the S&P 500 accounted for only 9 percent of the index’s total performance.

Evolution in capitalism

In April 1946, the Rockefellers launched a parallel effort with the Whitneys to address what was widely recognized as a lack of capital for new companies. “What we want to do is go against the old system of blocking capital until a field or an idea is proven to be completely safe,”

1957, Shockley-Doriot made the bet that transformed his fortunes. He financed Digital Equipment Corporation (acquired by Compaq, ticker: HPE), a company founded by two MIT professors who had helped to develop the TX-0 computer at the military-backed Lincoln Laboratory. The TX-0’s achievement was to show how transistors (ancestor of modern semiconductors) could outperform vacuum tubes in equipment built for the military.

For Compaq, please refer to “How does HP make money? The pros and cons of investing in HP“

Semiconductor plays a key role

Semiconductor is important

Semiconductors are very important to American technology. It is not an exaggeration to say that the technology industry in the United States has flourished due to the invention of semiconductors.

Shockley, John Bardeen and Walter Bratton co-invented the transistor (the ancestor of the modern semiconductor) and won the 1956 Nobel Prize in Physics.

Important companies founded by semiconductor inventors

Shockley Laboratory

In early 1956, scientist William Shockley decided to establish “Shockley Laboratory”. In 1957, Noyce was dissatisfied with Shockley’s authoritarian management system, and resigned together with Moore and other 8 people.

Fairchild

With the financing of venture capitalists Arthur Rock and Sherman Fairchild, Noyce founded Fairchild (acquired by ON, ticker: ON) semiconductor company, called “traitorous eight” by Shockley.

It is worth mentioning that more than half of the original 70 or so Silicon Valley companies had a direct relationship with Fairchild Semiconductor. At the first Semiconductor Engineers Conference, only 24 of the 400 participants had never worked in Fairchild Semiconductor.

Note: Traitorous Eight refers to Robert Noyce, Gordon Moore, Julius Blank, Eugene Claire, Jean Hoerni, Jay Last, Sheldon Roberts and Victor Grinich.

For “Traitorous Eight”, please see my special post of “Traitorous Eight, the origin of the semiconductor and venture capital industries“

Texas Instruments

When Noyce invented the integrated circuit in 1959, Jack Kilby of Texas Instruments (ticker: TXN) had already made the integrated circuit. In 1969, the court ruled that the integrated circuit invented by Noyce and Kilby had no infringement problem, and both patents were valid. Please see article “How does Texas Instruments make money? Amazing long term capital reward and company net profit margin!“

Intel

In August 1968, Noyce, Gordon Gordon and Andy Grove resigned together to found Intel (ticker: INTC).

Arthur Rock

Arthur Rock, one of the first and most successful venture capitalists in the United States, funded Teledyne Technologies (ticker: TDY), a startup, with a $450,000 investment. At various times, Teledyne has owned more than 150 companies in areas such as insurance, dental devices, specialty metals and avionics, but many of these companies were spun off before merging with Allegheny. The new Teledyne initially consists of 19 early Teledyne companies. By 2011, Teledyne had grown to include nearly 100 companies.

Arthur Rock is an early investor in well-known technology companies such as Fairchild, SDS (Scientific Data Systems, which has been incorporated into Xerox, ticker: XRX), Teledyne, Intel, and Apple (ticker: AAPL).

Venture capital firms mentioned

Kleiner Perkins Caufield & Byers

Founder introduction

Eugene Kleiner, one of the founders of Kleiner Perkins Caufield & Byers(KPCB), was the founder of Fairchild, and Kleiner Perkins was an early executive at HP, where his director was Georges Doriot. In 1973, Perkins founded Kleiner Perkins with Kleiner, raising $1 million from Rockefeller University. Perkins agreed to Treybig to incorporate his new company, which he called Tandem Computers (later acquired by Compaq, ticker: HPE).

investment cases

Together with Tandem, the Genentech bonanza turned the first Kleiner

Perkins fund into a legend, and a dramatic illustration of the power law. Successful investments in the two gold mines of Genentech and Tandem turned Kleiner Perkins into a legend. By 1984, Kleiner Perkins First Fund’s 14 investments had a combined profit of $208 million; 95% of it came from Tandem and Genentech. Roche (ticker: RHHBY) acquired Genentech in 2009 for $46.8 billion. Including home runs, the payout multiplier is 42 times.

FAMOUS companies that have invested in

Kleiner Perkins has invested in 500 companies, and Kleiner Perkins global investment focuses on three areas: digital technology, clean technology, and life sciences.

The famous companies Kleiner Perkins has invested in include: AOL (ticker: T), Amazon (ticker: AMZN), Tandem Computers (acquired by Compaq, ticker: HPE), Lotus (ticker: IBM), Compaq Computer (ticker: HPE), Mosaic (later renamed Netscape), Electronic Arts (ticker: EA), JD.com (ticker: JD), Square (renamed to Block, ticker: SQ), Genentech(acquired by Roche, ticker: RHHBY), Google, Netscape, Sun Computer (acquired by Oracle, ticker: ORCL), Nest (acquired by Google, ticker: GOOGL and GOOG), Palo Alto Networks (ticker: PANW), Synack, Snap (ticker: SNAP), AppDynamics, and Twitter (ticker: TWTR), Navigenics, Citrix Systems (ticker: CTX), Genomic Health, Geron Corporation, Intuit (ticker: INTU), Juniper Networks (ticker: JNPR), Nebula, Netscape (acquired by American Online), Norton (ticker: NLOK), Verisign (ticker: VRSN), WebMD and Zynga (acquired by Take Two, ticker: TTWO).

Sequoia capital

Founder introduction

In 1972, Don Valentine founded the venture capital firm Sequoia capital. Valentine is a former Express, Raytheon employee and a network leader in industry and technology.

investment cases

Kleiner Perkins rejected Apple. Because of his marketing background, Valentine is an ideal investor in Apple. Kleiner and Perkins declined to meet with Steve Jobs because Kleiner Perkins preferred technical risks to business risks. Apple’s investment case is an important watershed, and it clearly shows the difference between Kleiner Perkins and Sequoia Capital, two of the most famous venture capital firms.

“Tell me what I have to do to have you finance me,” Jobs demanded.

“We have to have someone in the company who has some sense of

management and marketing and channels of distribution,” Valentine

countered.

“Fine,” said Jobs. “Send me three people.”

It was against this backdrop that Mike Markkula sent to Apple through Valentine’s introduction. He is not a venture capitalist. But he was arguably Silicon Valley’s first “angel investor.”

In December 1980, two months after Genentech’s IPO, Morgan Stanley (ticker: MS) helped Apple go public. Of the 237 IPOs that year, Apple was arguably the largest, raising more money than any public offering since Ford Motor (ticker: F)’s IPO 24 years ago. As of the end of December of that year, Apple’s market value was close to $1.8 billion.

FAMOUS companies that have invested in

The famous companies that Sequoia Capital has invested in include: Yahoo (currently acquired by Apollo), LSI Logic (acquired by Broadcom, ticker: AVGO), Oracle (ticker: ORCL), Cisco (ticker: CSCO) , Electronic Arts, Google (ticker: GOOG and GOOGL), Sun Microsystems (acquired by Oracle), Cypress (acquired by Infineon, ticker: IFNNY), BitClout, Bolt (ticker: BOLT), FTX, Wiz, 23andMe, Instacart, Klarna, Nubank (ticker: NU), Snowflake (ticker: SNOW), Stripe, WhatsApp (acquired by Meta, ticker: META), UiPath (ticker: PATH), Meituan (ticker: MPNGF), Pinduoduo (ticker: PDD), Dropbox (ticker: DBX), Airbnb (ticker: ABNB), Palo Alto Networks, ServiceNow (ticker: SNOW), Unity (ticker: U), YouTube (acquired by Google, U.S. stock code: GOOGL and GOOG), Apple, Nvidia (ticker: NVDA), Webvan, PayPal (ticker: PYPL), ByteDance, Xoom (acquired by PayPal, ticker : PYPL), MongoDB (ticker: MDB), Atari (ticker: ATAR), LinkedIn (acquired by Microsoft, ticker: MSFT), Kayak, Meebo, AdMob (acquired by Google, tickers: GOOGL and GOOG), and Zappos (acquired by Amazon, ticker: AMZN), etc.

Accel

Founder introduction

The two founders, Arthur Patterson and Jim Swartz, were already veterans of the business, and they were planners rather than improvisers, strategists rather than evangelists. Patterson, in particular, was self-consciously cerebral.

Note: The original text in the book is mainly to distinguish Accel from Kleiner Perkins’ consideration of technology, and Sequoia’s focus on marketing.

FAMOUS companies that have invested in

UUNET is Accel’s most successful early investment. UUNET (acquired by Verizon, ticker: VZ) illustrates the dominance of the power law, one of several unforeseen grand slams in Accel’s first dozen years of business.

Benchmark Capital

Founder introduction

Benchmark’s strength was local rather than global. Note: The original text in the book is mainly to distinguish the benchmark from Japan’s SoftBank (ticker: SFTBY), the biggest rival of the benchmark at the time, and the very difference between the two venture capital firms.

Some venture firms believed that selecting the right deal was ninetenths of the job; coaching entrepreneurs was an afterthought. Benchmark partners tended toward a more fifty-fifty attitude.

Some venture firms believed that selecting the right deal was ninetenths of the job; coaching entrepreneurs was an afterthought. Benchmark partners tended toward a more fifty-fifty attitude.

FAMOUS companies that have invested in

eBay’s growth was truly exponential.

Returning for a second visit, Benchmark partner noticed something else. Unlike other retailers, eBay did not hold inventory. It had no carrying costs, no shipping costs, no hassles with storage. As a result, its profit margins were formidable.

Important companies

Xerox

These are all invented by Xerox

The graphics user interface operating systems used by modern people, including Microsoft’s Windows and Apple’s macOS, are all derived from Xerox’s graphical desktop system. The mouse we use for our computers, and the network communication system in our office; it all comes from this company.

3Com

3Com (acquired by Hewlett-Packard, ticker: HPE) is a company created by extending the network of Xerox’s offices. At Xerox Palo Alto Research Center, Robert Metcalfe invented Ethernet and subsequently co-founded 3Com in 1979. 3Com Corporation began making Ethernet cards that were used in many computer systems in the early 1980s.

Adobe

Adobe (ticker: ADBE) was founded in December 1982 by John Warnock and Charles Geschke, who left Xerox to develop and sell PostScript to form Adobe, a major software company. Apple’s Jobs offered $5 million to buy Adobe, but was rejected by Adobe’s founders.

Startups that surprised Sequoia

When Larry Page, one of the founders of Google, first met Sequoia partner Moritz, he said he believed Google would have an annual runrate over of $10 billion in the future. Kleiner Perkins is technically and exponentially evaluating the business, realizing that this will be a potentially huge business of the size of Microsoft.

A unique case Kleiner Perkins and Sequoia invested at the same time

Moritz expected it would be dominated by brands.[30] Technical features such as search engines would exist as lowly plug-ins on popular websites that

commanded consumer loyalty (note: this is the original text, meaning that Google, the search engine, eventually succeed in the future, will be determined by how to market the brand. Please recall the previous paragraph, Kleiner Perkins rejected Apple’s story).

Benchmark and Accel, two venture capitalists, are willing to give Google a lower valuation. The chances of these big VC firms agreeing to co-invest in a startup are essentially nil. But Google wants its Kleiner Perkins and Sequoia each to own 12.5% of Google’s shares. If they refuse, Google will not sell any equity to either of them.

Bring in an external management team

Since the two Google founders are young people and have no experience in running a business, Kleiner Perkins suggested that Google be managed by Schmidt from Novell (which has been merged into Micro Focus, ticker: MFGP). What Page and Brin wanted was Apple’s Jobs.

Unique way to Go PUBLIC

Brin and Page insisted on maintaining control of the company even after going public, arguing that young founders would better protect the public’s best interests than outside shareholders. Democracy of shareholders actually undermines political democracy.

Moreover, Brin and Page do not want investment banks to make money when they go public, so its IPO case is to sell shares through a Dutch auction, which is completely different from the general listing of companies where Wall Street investment banks determine the stock price.

Dot-com crash

Destruct Venture Capital

In the first years of the twenty-first century, As of 2003, Sequoia was struggling to prop up a venture fund that had lost around 50 percent of its value; the partners felt honor-bound to plow their fees back into the pot to eke out a return of 1.3x. The equivalent Kleiner Perkins fund performed even worse, never making it into the black. Masayoshi Son, who had briefly become the

richest person in the world, lost more than 90 percent of his fortune.

Google saved Venture Capital

At the peak in 2000, new capital commitments to VC firms had hit $104 billion. By 2002, they were down to around $9 billion. Google’s public offering in the summer of 2004 marked the end of this dark period.

Peter Thiel

Peter Thiel in the venture capital world marked the beginning of another new era.

A not-typical venture capital company

Unlike traditional venture capital firms such as Kleiner Perkins or Sequoia before, Peter Thiel is a personal angel investor. He made his money mostly after PayPal went public, then set up his own Founders Fund and started his own venture capital path.

For the first time, a mainstream Silicon Valley start-up dared to reject a mainstream venture capital firm. In June 2004, Thefacebook.com, the predecessor of Facebook (renamed to Meta, ticker: META), relocated its operating base to California. Shortly after the relocation, Thefacebook.com received its first major investment from Peter Thiel.

Famouse companies that have invested in

The company’s investments include Airbnb (ticker: ABNB), DeepMind (acquired by Google, tickers: GOOGL and GOOG), Lyft (ticker: LYFT), Facebook, Flexport, Palantir (ticker: PLTR), SpaceX, Spotify (ticker: SPOT), Stripe, Wish (ticker: WISH), Nubank (ticker: NU), and Twilio (ticker: TWLO).

The present and future of the venture capital

China

Masayoshi Son, founder of SoftBank, invested heavily in Alibaba (ticker: BABA) because of his position on Cisco’s board of directors, knowing that sales of routers to China had begun to take off. He bet huge on Alibaba. At the time of the Alibaba IPO, the stake was worth $58 billion. It was the most successful bet in venture capital history.

Sequoia Capital is very active in China, and its investments have been very successful as well; the most famous investment cases are Meituan (ticker: MPNGF) and TikTok parent company ByteDance.

Of course, Kleiner Perkins is reluctant to fall behind its biggest rival, Sequoia Capital. Kleiner Perkins also has an independent Chinese team and is very active in investing in Chinese startups.

The unwritten rules of venture capital

The unwritten rule in venture capital industry is that it is almost difficult to see any two super-large and well-known venture capitalists, especially Kleiner Perkins and Sequoia, investing in a start-up company at the same time. The Google mentioned above is one of exceptions.

There will also be a similar situation in China. I mentioned it in section 5-1 of my book “The Rules of Super Growth Stocks Investing”; according to McKinsey’s report, Alibaba (ticker: BABA) and Tencent (ticker: TCEHY) are the top 2 venture capital monopolizes 40% to 50% of the venture capital and startup projects in China. Tencent alone invested 35.3 billion yuan in 2019, while Alibaba invested 25.9 billion yuan. And the unwritten rule is that it is almost rare (there is, but very rare) that both Tencent and Alibaba are investing in a startup at the same time.

The background of venture capitalists

Early Silicon Valley venture capitalists, as profiled in this article, without exception, have deep tech and industry backgrounds. But with the founders of the earliest Silicon Valley venture capitalists no longer managing day-to-day operations at the company, leaving the front lines. The second generation of venture capitalists, in addition to many Wall Street investment banking backgrounds, members of the background is increasingly diverse.

When Moritz, the former head of Sequoia, first came to Sequoia, some of his colleagues were skeptical. Because he is an Oxford history graduate, a magazine reporter, and the author of two business books.

Another famous example is Founders Fund co-founder Peter Thiel. His background is philosophy and law.

The fall of venture capitals

If Internet 1.0 had been about selling stuff (Amazon, eBay), Internet 2.0 was about using the web as a communications medium. ‘2.0’ frenzy around social networking; Accel may have missed the boat,” in early 21 century.

Kleiner’s fall from grace is commonly ascribed to a spectacularly bad

investment call. Starting in 2004, the firm pursued so-called cleantech

startups—bets on technologies that help fight climate change, from solar

power to biofuels to electric vehicles. In 2008, Kleiner doubled down,

devoting a new $1 billion growth fund exclusively to this sector.

In 2021, when Kleiner partners had all but disappeared from the Forbes Midas list, Sequoia occupied the number one and number two slots, and three of the top ten, making it by far and away the top firm in the industry. It backed unicorns from Airbnb, WhatsApp, ByteDance, Meituan, Unity, Xoom, MongoDB, and Dropbox.

Conclusion

As I said at the beginning of this article, I suggest that you should read this book if you want to gain a deeper understanding of the technology industry, or the venture capital industry, in the United States. After reading patiently, you will get a lot.

Related articles

- “Traitorous Eight, the origin of the semiconductor and venture capital industries“

- “Don Valentine, founder of Sequoia Capital, father of Silicon Valley Venture Capital“

- “Angel is an excellent venture capital book for ordinary people“

- “The Power Law“

- “Zero to One“

- “Venture capital and unicorns introduction“

- “Global Venture Capital and Unicorn Report“

- “How does Texas Instruments make money? Amazing long term capital reward and company net profit margin!“

Related books

If you want to know more about and Peter Thiel, his companies and startups, you can refer to the following three other books by PayPal Mafia members that are influential in Silicon Valley and the venture capital community:

- “Zero to One“

- “The Hard Thing About Hard Things” by A16Z co-founder Ben Horowitz.

- “PayPal Wars” by former PayPal executive Eric Jackson

- “The Alliance” by former deputy general manager of PayPal and founder of LinkedIn Reid Hoffman

Note:

After Reid Hoffman sold LinkedIn, which he founded, to Microsoft, he founded a well-known artificial intelligence startup, Inflection.ai, and is currently focusing on running this company.

Related articles

- “Traitorous Eight, the origin of the semiconductor and venture capital industries“

- “Two famous essays by Marc Anderson on software and artificial intelligence“

- “The Power Law“

- “Zero to One“

- “Venture capital and unicorns introduction“

- “Global Venture Capital and Unicorn Report“

- “How does HP make money? The pros and cons of investing in HP“

- “Investing in turnaround stocks is hard”

- “The Power Law“

- “TSMC negative corp culture and management style are detrimental to its future and growth“

- “Four chip companies account for one-third of S&P 500 gains so far this year

- “Top five lucrative artificial lucrative intelligence listed companies“

- “What’s TSMC DCF intrinsic value?How to calculate it quickly with a free tool?“

- “How many fabs and houses does TSMC have currently and in the future?“

- “Comparison of TSMC, Samsung, Intel’s Yield and Advanced Process“

- “The TSMC cost, sell price, and R&D cost of chip foundry“

- “ASML, who dominate TSMC’s fate“

- “Comparison of TSMC, Intel, and Samsung’s new process roadmaps for future chips“

- “Two long-term threats to TSMC: US and SMIC“

- “Why is TSMC’s profit margin much greater than competitors?“

- “How does TSMC make money?“

- “Zyvex and sub-nanometer semiconductor processes, will Zyvex threat TSMC?“

- “TSMC gets emerging and serious challenges“

- “How does nVidia make money, Nvidia is changing the gaming rules“

- “The reasons for Nvidia’s monopoly and the challenges it faces“

- “Why nVidia failed to acquire ARM?“

- “Revisiting Nvidia: The Absolute Leader in Artificial Intelligence, Data Center, and Graphics“

- “Will Intel go bankrupt?“

- “How does Intel make money? and the benefits to invest in it“

- “Intel’s current difficult dilemma“

- “How does Texas Instruments make money? Amazing long term capital reward and company net profit margin!“

- “How AMD makes money? A rare case of turning defeat into victory“

- “Why is AMD’s performance so jaw-dropping?“

- “Qualcomm diversifies success, no nonger highly dependend on phone“

- “How does the ubiquitous Arm make money?“

- “Significant changes in Broadcom’s business approach“

- “Data center, a rapidly growing semiconductor field“

- “How does Applied Materials, lord of semiconductor equipment, make money?“

- “The lucrative semiconductor supply chain“

- “Global semiconductor chip market in detail, big dominators and markets“

- “6 common wrong semiconductor investment myths“

- “Gen 3 semiconductor“

- “Three EDA oligopoly vendors: Synopsys, Cadence, and Mentor Graphics“

- “How does, the EDA oligopoly, Cadence make money?“

- “How does Synopsis, the EDA oligopoly, make money?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.