If you want to enter the field of quantitative investment without having financial background, as long as you study hard and find someone to help you, you will be able to change your life. However, whether one is smart or not is not impossible to make up for through acquired learning.

Category: Quantitative investing

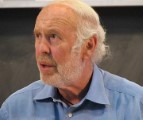

Jim Simons, the lord of quantitative investing

In 36 years, Jim Simons achieved an astonishing annualized return of nearly 40%. This is the best performance of any known investment guru today. For this part, please see my previous post: “The career annualized return on investment of top investment masters”.

The career annualized return on investment of top investment masters

The criteria for the investment masters selected in this article mainly include the following

How does JPMorgan Chase make money?

JPMorgan Chase is named after the founder of one of the companies in the group, which has long been inseparable from the banking industry. The merger of its businesses involved many of its major competitors in the past.

Retail investors’ wrong investment concept not worth trying at all

Investment concept not worth trying at all

Non-quantitative factors determine success or failure of an investment

Non-quantitative factors determine success or failure of an investment. People overemphasize the importance of science and numbers in investment, as I mentioned in the book “The Rules of Super Growth Stocks Investing”, section 1-1. Investment is a not a science but an art in the economic field under sociology, which is more related to humanities

Never borrow money, shorting, or derivative products

Don’t borrow money, shorting, or derivative products. In this blog and in my book “The Rules of Super Growth Stocks Investing”, I have repeatedly advised investors not to borrow money to invest, do not shorting, do not invest in derivative investment products such as options or futures