What is Discounted Cash Flow?

For DCF, see the detailed explanation on pages 330-337 of my book, “The Rules of Super Growth Stocks Investing“, and a step-by-step calculus for a practical example.

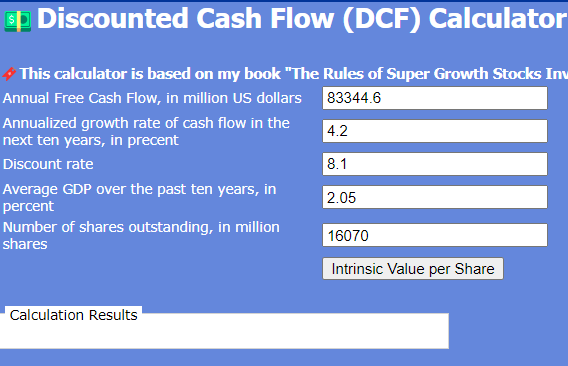

Features of this calculator

This calculator is used as a calculation template for user to adjust various parameters of the discounted cash flow model according to their own needs and the different company to be calculated, and finally calculate the reasonable intrinsic value of the company.

Please be noted:

- The default value of each field shown on the screen is based on Apple’s data at the end of the second quarter of 2022.

- Clicking on the words “Annual Free Cash Flow” on the screen will open Apple’s important statistics on the Yahoo Finance website, where you can find Apple’s annual free cash flow figures. You only need to change the U.S. stock code of the company on the website to find the statistics of the corresponding company.

- Clicking the words “annualized growth rate of cash flow in the next ten years” on the screen will open the important statistics of Apple on the Yahoo Finance website. You can find Apple’s revenue growth rate in the next few years. This calculates the annualized growth rate of cash flow. You only need to change the U.S. stock code of the company on the website to find the statistics of the corresponding company.

- For the discount rate figures, please refer to the detailed description on pages 330-337 of the book “Super Growth Stock Investing Rules”.

- Clicking on the words “average GDP over the past ten years” on the screen will allow you to query the average GDP and compound growth rate statistics of the United States in the past.

- Clicking on the word “Number of outstanding shares” on the screen will open the important statistics of Apple on the Yahoo Finance website, where you can find the number of outstanding shares of Apple. You only need to change the U.S. stock code of the company on the website to find the statistics of the corresponding company.

How to use this calculator?

Users simply click on this link to connect to the Querier to Annualized rate of return for Taiwan Stock Exchange and see the following screen:

Users only need to input the following fields on the screen:

- Annual Free Cash Flow

- Annualized growth rate of cash flow in the next ten years

- Discount Rate

- Average GDP over the past ten years

- Number of shares outstanding

The default values for the above fields will be based on Apple’s data at the end of the second quarter of 2022. You can change the value of each field of the corresponding company according to the company you want to calculate.

After the input is complete, click the “Intrinsic Value per Share” button on the screen, and you can see the calculation result of the intrinsic value per share in the “Calculation Results” area below.

Table for stock investment toolset

Here is a list of these must-have tools for investors:

Related articles

- “DCF (Discounted Cash Flow) Calculator“

- “What’s TSMC DCF intrinsic value?How to calculate it quickly with a free tool?“

- “Investors should care annualized rate of return (IRR), How to calculate?“

Disclaimer

- The content of this site is the author’s personal opinions and is for reference only. I am not responsible for the correctness, opinions, and immediacy of the content and information of the article. Readers must make their own judgments.

- I shall not be liable for any damages or other legal liabilities for the direct or indirect losses caused by the readers’ direct or indirect reliance on and reference to the information on this site, or all the responsibilities arising therefrom, as a result of any investment behavior.